Bitcoin price is currently stable around $89,000 as the US Federal Reserve has stabilized interest rates in the range of 3.5% to 3.75%.

summary

- Bitcoin maintains low support in the channel and value area.

- Reuse control signal points and improve short-term structure.

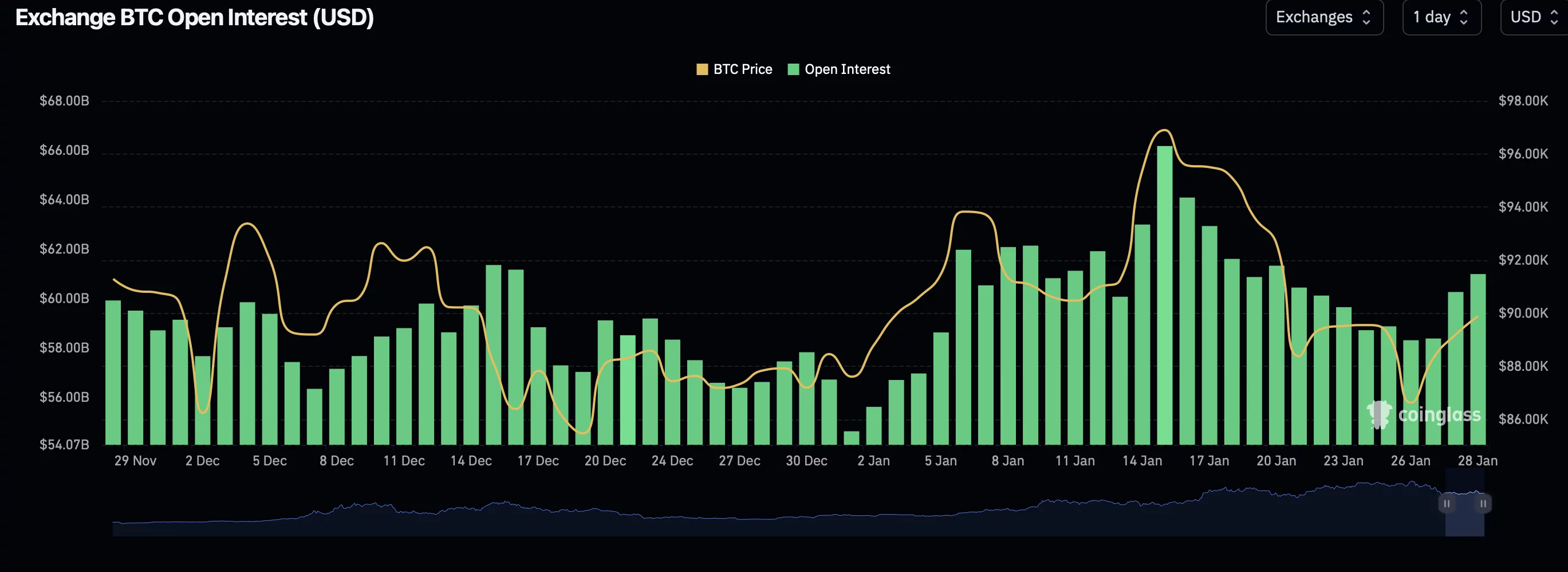

- The rise in open interest supports the possibility of a bailout rebound.

Bitcoin ($BTC) Prices are showing early signs of stabilization after a correction phase, with price trends showing positive reactions from key technical support zones.

Market trends suggest that selling pressure may be easing as Bitcoin trades near channel lows. This change is reinforced by a significant increase in open interest, indicating growing participation in the derivatives market.

Although confirmation is still required, the combination of technical support and rising positioning points to the possibility of a short-term rescue recovery if current conditions hold.

federal interest rate

When the Federal Reserve holds interest rates constant, it signals stable borrowing costs, making cash and bonds less attractive and potentially causing the U.S. dollar to weaken.

Bitcoin often moves inversely to the dollar, so a weak or stagnant dollar could increase demand for cryptocurrencies as an alternative store of value.

Stable interest rates also suggest the Fed is not tightening aggressively to fight inflation, encouraging investors to take more risk, which benefits high-risk assets like Bitcoin.

Important technical points for Bitcoin price

- Hold channel low and value area low as support

- Control points are restored and signaling improves the structure

- Rising open interest supports bullish relief theory

BTCUSDT (4H) chart, source: TradingView

Bitcoin’s recent rally started at the channel low and closely coincides with the low of the value area, making it a technically dense area.

This confluence attracts buyers looking for a broader range of discounted entries. Initial reactions from this zone are constructive, suggesting demand is starting to absorb sell-side pressure.

Importantly, this bounce was not rejected immediately. Instead, price lasted long enough to regain the key levels that define control of the range.

You may also like: MEXC opens RNBW launchpad where users can share 750,000 tokens at up to 50% off

Control signal strength point recovery

One of the most encouraging developments is Bitcoin’s retaking of the Point of Control (POC). POC represents the most recently traded price level and often acts as a dividing line between bullish and bearish control.

Holding above POC shifts the short-term bias in favor of buyers. As long as Bitcoin continues to gain acceptance above this level, the recent move is more likely to be a higher rotation developing within the channel, rather than a simple dead cat bounce.

$BTC Open Interest, Source: CoinGlass

In addition to the improved price structure, open interest has also increased, adding an important layer of confirmation to the setup. Rising open interest during a consolidation near support suggests that traders are actively opening new positions rather than simply closing old positions.

This behavior is usually incriminating, especially when it occurs at a technically significant level. In this context, an increase in open interest means that derivatives traders are assuming a further rally rather than an immediate breakdown.

However, open interest alone is not inherently bullish or bearish. Its significance depends on whether the price holds the support or not. If Bitcoin loses its recovered level, the rise in open interest could conversely amplify the downside. But for now, the positioning is consistent with the reliever rally narrative.

You may also like: PayPal Survey: 37% of Major US Companies Adopt Cryptocurrency Payments Rapidly Increase

Areas with high values will be the next test

If Bitcoin continues to hold above POC, attention will shift to the higher price area, which will act as resistance for the time being. Acceptance above this level would confirm that the price is moving back into higher territory and increases the likelihood of heading towards the channel’s higher resistance.

This step-by-step recovery process is important. Relief rallies often fail if prices cannot exceed the value ceiling, resulting in reintegration or rejection. A clean payback backed by sustained open interest and volume will greatly improve upside probability.

Market structure remains cautious but improving

From a broader market structure perspective, Bitcoin is still recovering from a bearish phase. Although the downside momentum has slowed down for the time being, a complete trend reversal has not yet been confirmed. Instead, the current setup favors a relief rally within a wider range rather than a full bullish breakout.

That said, structural improvements from holding channel support to recovering POC indicate meaningful changes compared to the recent downturn.

Bitcoin price fluctuations: what to expect

Bitcoin is at a pivotal near-term inflection point. As long as price stays above the control point and the channel’s low support, the odds favor a continued relief rally towards a high in the value area and potentially high channel resistance. Rising open interest supports this scenario by indicating an active position at support.

However, if these recovery levels cannot be sustained, the bullish trend will weaken and downside risks will rise again. In the short term, acceptance of price above value will determine whether this bailout develops into a sustained upward rotation.

read more: South Korea finalizes draft of digital asset bill