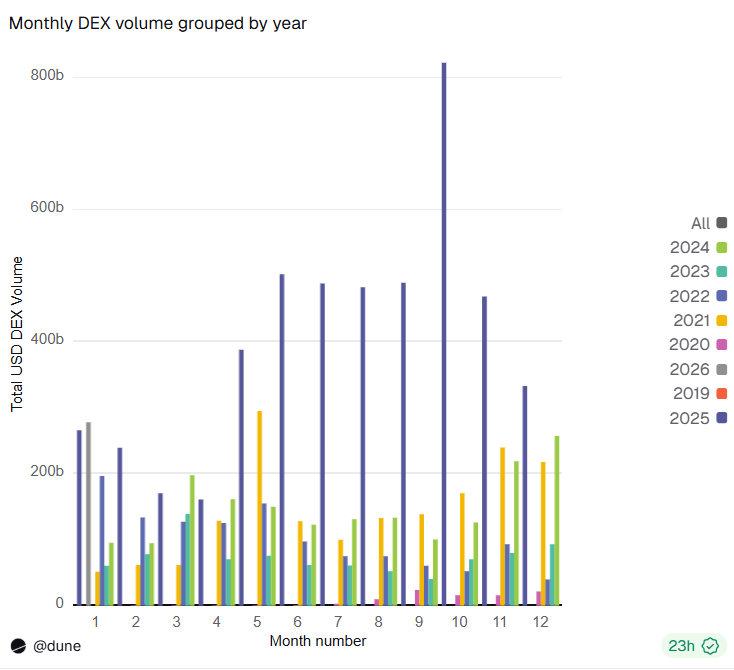

DEX activity in January was the highest in five years. Despite the recent economic downturn, DEXs are still heavily used across market environments.

DEX activity continued to rise in January, driven by some of the most widely used chains. Despite a slow start to 2026, multi-chain decentralized exchanges continued to show strong demand.

DEX trading volume in January 2026 has already exceeded 2022 levels due to increased decentralized retail activity across multiple chains. |Source: Dune Analytics

At the beginning of 2026, DEX activity in January has already exceeded 2022 levels, with over $278 billion traded so far. In January, DEX trading began to recover from the local lows, breaking the decline that started in October. Volume reached $15.74 billion in 24 hours, led by Uniswap and PancakeSwap.

DEX activity accounts for approximately 18% of concentrated volume, maintaining normal proportions. For now, DEX activity is still below its 2022 peak. However, this time around, trades and trades are less likely to be tied to point farming or yield, and instead track actual trading attempts.

The DEX environment will become more competitive

DEX activity is not only on the rise overall, but also reflects several trends in the cryptocurrency space. low ethereum gas fee The time has come for new activities.

Decentralized markets are also focused on specific meta-narratives, showing a surge in activity on other networks.

BNB Chain is one of the venues, and PancakeSwap remains the market share leader among all DEXes.

Solana’s activity also has peak periods, typically associated with one or more trending meme tokens. Meme activity, new launches, and secondary market transactions are the main drivers of the Solana DEX reawakening. Solana has also benefited from increased activity in HumidiFi. $22 billion Overall volume for the last 30 days.

Basechain DEX volume reaches new peak

Base is one of the chains that has seen a surge in trading volume recently. The L2 platform remains one of the most active platforms in the Ethereum ecosystem. Over the past few days, Base activity has jumped to $3.39 billion per day, compared to a normal baseline of $2.5 billion.

Base has increased its DEX volume by ~10x since the beginning of 2026, with Uniswap and Aerodrome driving over 86% of the activity.

Base also recorded net inflows of $163 million in January, but the inflows did not match the increase in DEX activity. Some of Base’s DEX volume could be an early sign of returning retail traders testing new apps and trading routes.

DEX activity on Base is now cheap and accessible and is making a comeback. retail transactions This is primarily done through the minting of new tokens and early price discovery. A greater recovery in the DEX is likely to occur only after the chain shows an increase in locked value and more significant value inflows.

For now, DEXs reflect the emergence of new meta-narratives and new token classes, while traders are more cautious about liquidity compared to previous trading cycles.

Base became an anomaly in early January, outperforming both Ethereum and Ethereum. BNB chain in weekly volumemay be linked to a new token. Nevertheless, base fees remained relatively low as traders became more cautious and tested the market with smaller orders.