Bitcoin price has hardly moved in the past 24 hours. BTC It is trading flat near $89,500, even though weekly losses remain near 6%. On the surface, this looks like a benign integration. The graph below suggests otherwise.

Multiple technical and on-chain signals are indicating a stalemate. Buyers are trying to delay a bigger selloff rather than spurring a new rally. The risks are quietly increasing, and lesser-known enemies are starting to become important.

Dojisama Candle and EMA Ross Show BTC Buyers are defending rather than moving forward.

Over the past three daily sessions, Bitcoin has printed a doge-like candle with a thin body and a long wick. These candles reflect hesitation, not balance. Sellers are pushing prices down, buyers are coming in late, and neither side is in control.

This behavior appears right at the lower end of the rising wedge. An increasing wedge slopes upward, but the price movement tightens and often collapses when support breaks.

If this structure fails, the measured downside prediction is towards $77,300, which could be a 13% decline from current levels.

Bitcoin Bearish Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Technical risk increases further when moving averages are added. Bitcoin lost its 20-day exponential moving average (EMA) on January 20th. EMA is a trend indicator that focuses more on recent prices and is more sensitive to short-term fluctuations.

The last time Bitcoin clearly broke below the 20-day EMA was on December 12th, when the price corrected by about 8%. At this time, BTC It was already down about 5% from the breakdown before stabilizing. Doge-like candlesticks suggest that buyers are delaying the decline rather than reversing it.

Another technical risk: TradingView

In short, this is not an indecision between bulls and bears. It is the buyers who are trying to delay the larger move and push it lower.

So who is still buying it and why is its support waning?

Long-term holders are still buying, but at a slower pace

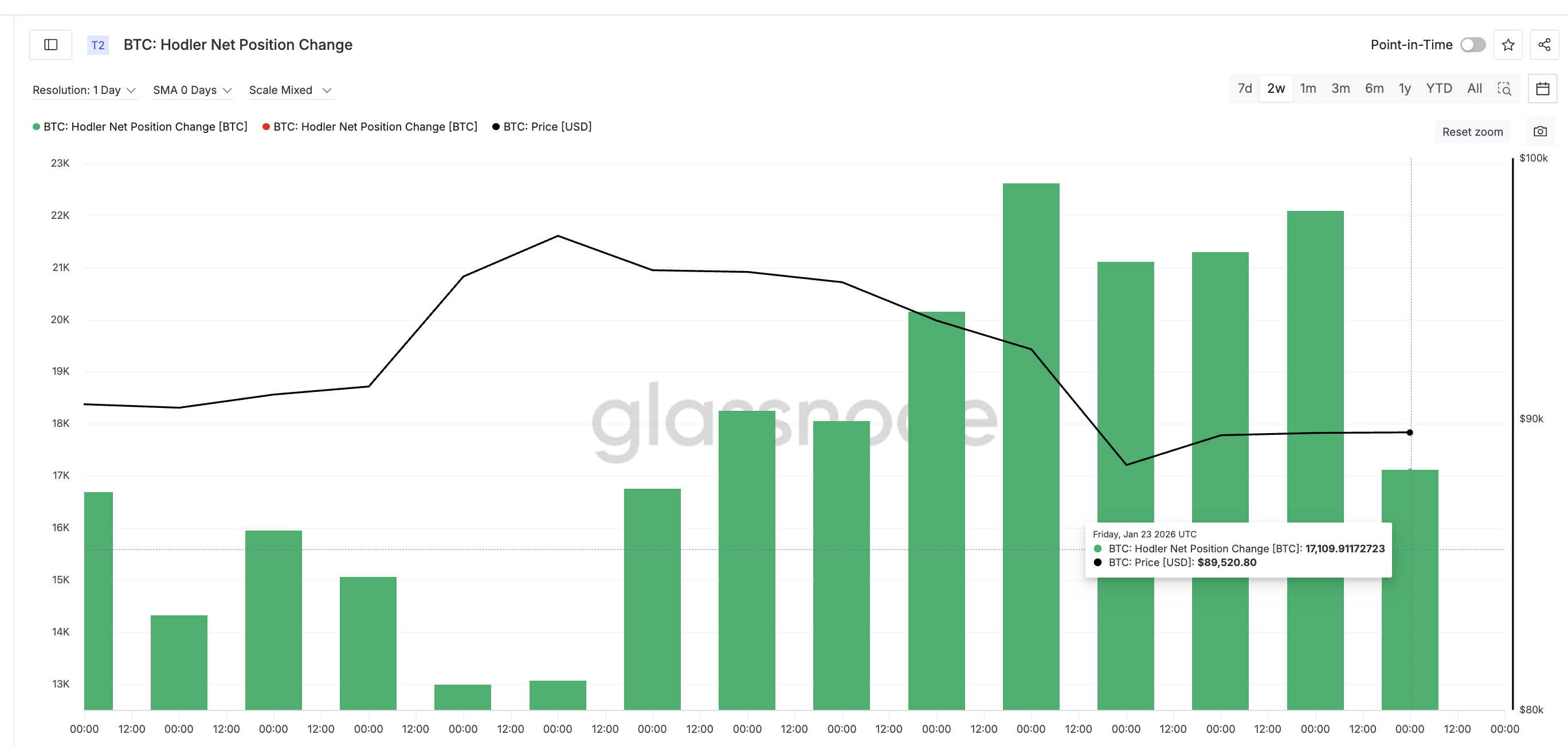

On-chain data shows that long-term holders, wallets holding Bitcoin for more than 155 days, remain net buyers. This cohort is tracked using the Holder Net Position Change metric, which measures the number of coins added or removed by long-term investors over time.

This indicator has remained positive for the past two weeks. This buying helps explain why Bitcoin hasn’t collapsed yet.

But its strength is waning.

On January 19th, the number of long-term holders increased by approximately 22,618 people. BTC. By January 23, the daily net buy volume had fallen to approximately 17,109 purchases. BTC. That’s about a 24% decrease in purchase intent in just four days.

Purchase HODLers: Glassnode

Therefore, the holder still supports the price, but its power is weakening. This corresponds to the doji-like candlestick seen on the chart. Support exists, but it is waning.

This slowdown itself is not dangerous. The problem is that new sources of pressure are building at the same time.

Miners emerge as the little-known enemy behind increased risk

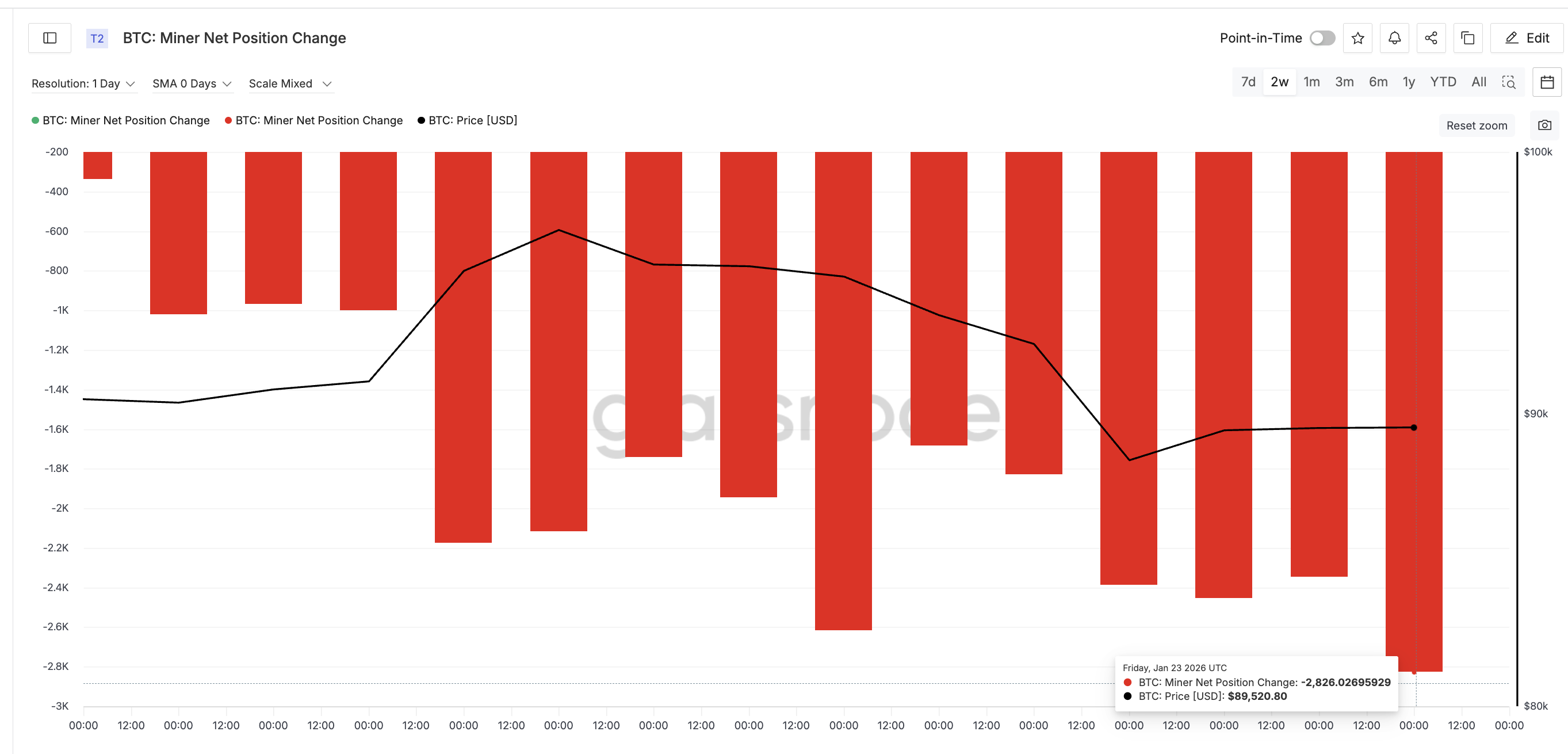

The most underappreciated change right now is coming from Bitcoin miners.

Miner Net Position Change tracks 30-day changes in the supply held by miner wallets. If the value becomes more negative, it means that miners are selling more Bitcoins over time.

On January 9th, miners had reduced their holdings by approximately 335 shares. BTC. By January 23, that number had jumped to about 2,826 people. BTC. This is more than an 8x increase in selling pressure within two weeks.

Minor sales: Glassnode

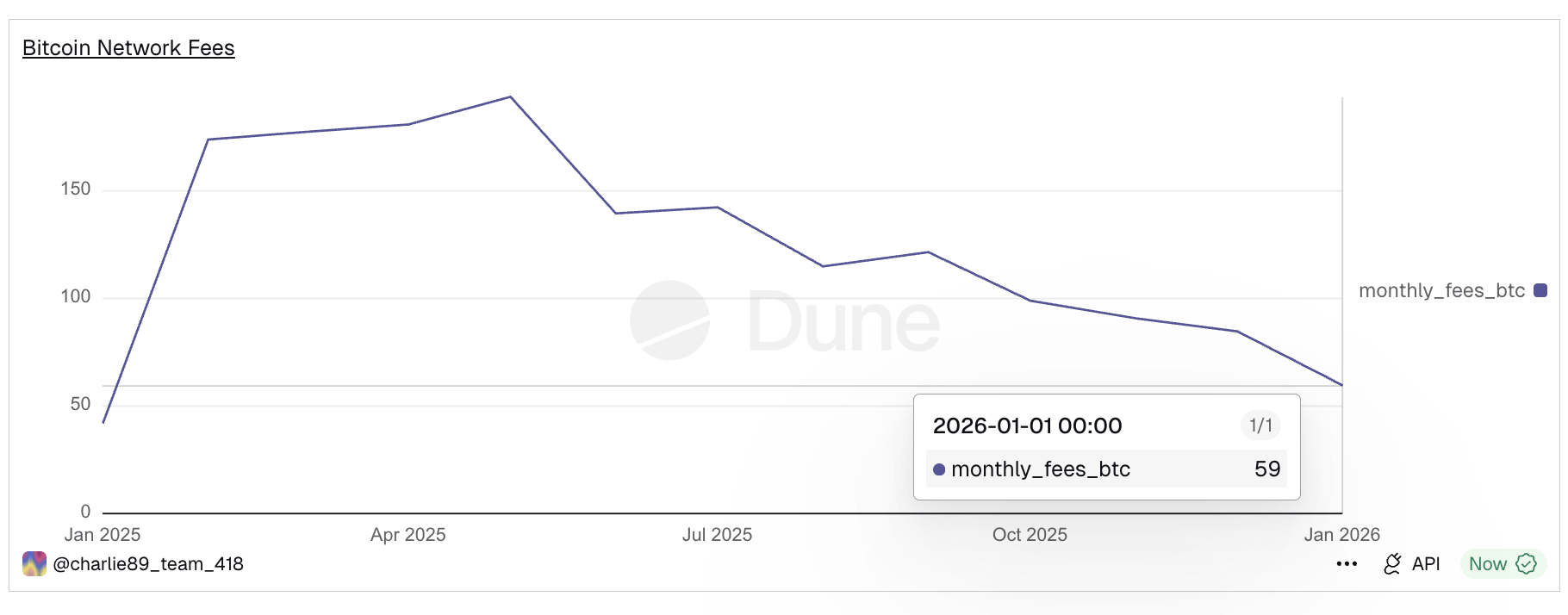

The reason becomes clearer when you consider network charges.

Bitcoin monthly network fees have fallen significantly, according to analysts at BeInCrypto. In May 2025, miners’ income was approximately 194 BTC For a monthly fee. By January 2026, that number had steadily declined to about 59. BTC. This translates to a roughly 70% decline in fee income.

Dip-in network pricing: Dune

Declining fees will put pressure on miners’ profits. When revenues decline, miners are more likely to sell their Bitcoin to cover operating costs, and this appears to be happening. However, it seems that their sales force is still not very strong.

At the same time, whale behavior is beginning to soften. The number of whale addresses increased steadily from January 9th to January 22nd, then leveled off and decreased slightly. This suggests early distribution rather than aggressive dumping, but it also creates more pressure for miners.

BTC Whale”>

BTC Whale”>

BTC Whale: Glassnode

Currently, the market is driven by price levels.

Bitcoin price level will determine whether conflict is resolved

With the current price around $89,500, Bitcoin would need to close above $91,000 each day to regain the 20-day EMA, which would be an increase of about 1.79%. If this happens, it would ease the immediate downward pressure and signal that buyers are regaining control.

The danger is closer to home.

If the price closes the day below $88,500, down about 1%, Bitcoin will return to the support of the rising wedge. If that happens, the downside target will open quickly.

Bitcoin Price Analysis: TradingView

Key Bitcoin price levels to watch include first $84,300, followed by a wedge prediction around $77,300. Those levels will become increasingly important if long-term holders’ buying continues to slow while miners continue to sell.

The post Bitcoin flats at $89,000, but charts warn buyers are losing ground appeared first on BeInCrypto.