When Kraken announced its acquisition of Breakout in September 2025, it sent a clear signal to the crypto industry that prop trading was coming. This transaction marks the first time a major crypto exchange has entered directly into its own trading space, combining Kraken’s institutional-grade infrastructure with Breakout’s valuation-based funding model.

“Breakout gives us a way to allocate capital based on demonstration of skill, rather than access to capital itself,” said Arjun Sethi, co-CEO of Kraken. “In a world that is rapidly changing from knowing who to knowing what, we want to create a system that rewards proven performance rather than pedigree.”

The acquisition reflects a broader trend. What began as a retail trading phenomenon has developed into a field that attracts institutional attention and large amounts of capital.

numbers on the back of the boom

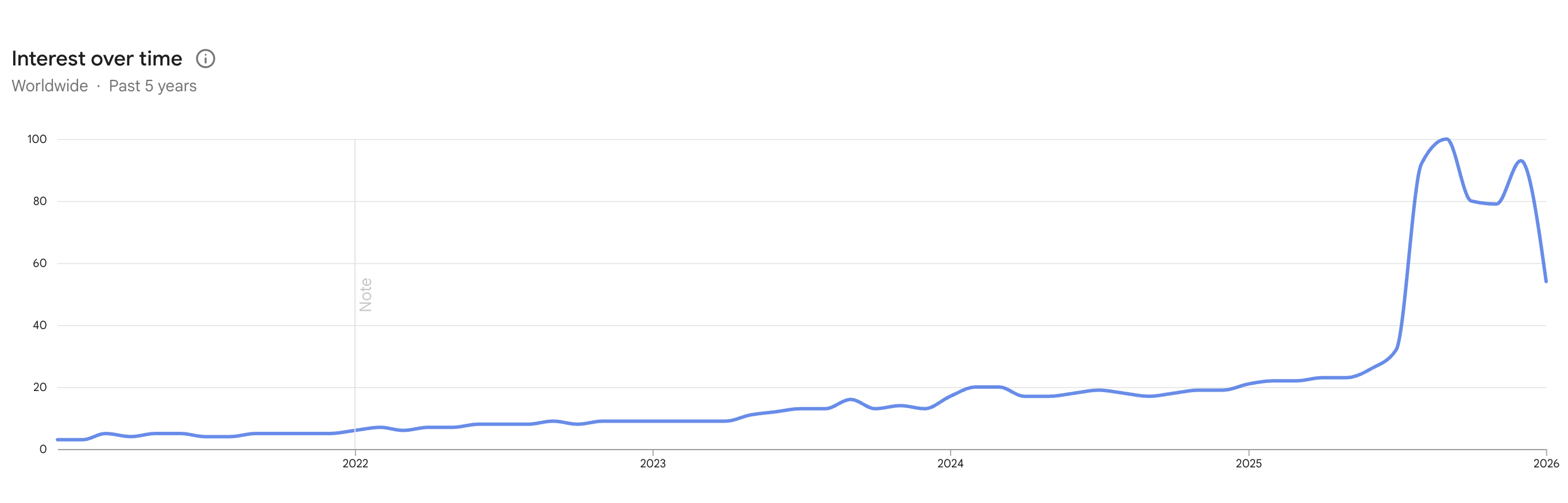

The growth of the prop trading industry has been nothing short of phenomenal. According to Google Trends data, global search volume for “prop trading” surged more than 5,000% between 2020 and 2025. This search term recently reached an all-time high, reflecting unprecedented awareness and demand for savings trading programs.

Industry analysts estimate that the prop trading market will be valued at $5.8 billion in 2024 and is projected to reach $14.5 billion by 2033. This is a compound annual growth rate higher than most fintech sectors. Prop trading grew by 1,264% from December 2015 to April 2024. In comparison, traditional investment searches grew by just 240% over the same period.

The cryptocurrency segment of this market is growing even faster. A recent industry report notes that 90% of the top 20 prop trading firms will see increased interest in Google search in August 2025 alone, with crypto-native companies showing particularly strong traction.

Why major companies are paying attention

The Kraken’s foray into prop trading didn’t come alone. The exchange had already acquired NinjaTrader and Capitalise.ai for $1.5 billion in the months preceding the breakout transaction, demonstrating a strategic push to capture the entire retail and professional trading lifecycle. Industry observers have speculated that these acquisitions may be laying the groundwork for a possible Kraken IPO.

Breakout acquisitions address particularly compelling value propositions. By integrating prop trading directly into Kraken Pro, exchanges can identify and develop skilled traders while generating revenue from both valuation fees and profit sharing arrangements. Since its founding in 2023, Breakout has already issued more than 20,000 funded accounts, and its customer base now gains access to Kraken’s institutional liquidity and infrastructure.

For the prop trading industry, this acquisition means validation. That a regulated institutional-grade exchange of Kraken’s stature is making a strategic bet on the funded trader model signals that prop trading has moved beyond its origins as a retail phenomenon and into something more durable.

Evolving competitive environment

The Kraken and Breakout trades have reshaped the competitive dynamics in crypto prop trading. Established players like FTMO, widely considered the gold standard in the industry since 2015, now face competition from other prop companies as well as larger exchanges with deeper pockets and existing user bases.

FTMO has responded by expanding its cryptocurrency offering, adding 22 new pairs and improving spreads in July 2025, bringing the total to over 30 cryptocurrency CFD products. The Czech-based company serves over 1 million traders and maintains a Trustpilot rating of 4.8/5. This is an important qualification in an industry where trust is paramount.

But the acquisition also created an opportunity for the platform to establish a different position. While exchange-backed props compete for capital and infrastructure, a new category of crypto-native companies is emerging that focus on developing traders alongside raising capital.

The next frontier: AI integrated trading development

While the Kraken acquisition highlights the institutional maturity of prop trading, it also highlights the gap that innovative platforms are racing to fill. Most prop firms, including Breakout, are primarily focused on valuation and capital provision. What they don’t offer is systematic trader development.

This is important because the data on trader performance remains grim. Industry sources consistently report that only 5-10% of traders pass the initial assessment, and even fewer receive payment from their funded accounts. The bottleneck is not a lack of funds, but a psychological and technical gap that causes traders to fail.

Among the platforms addressing this gap, Fondeo.xyz has emerged as a notable example of what some industry observers are calling the “next generation” of crypto prop trading. The platform integrates AI coaching directly into the funded trader experience. This is an approach that recognizes trading psychology as inseparable from trading performance. For traders who have struggled with traditional valuation models, this combination of financing and development represents a fundamentally different value proposition.

This approach reflects a broader trend in AI trading tools. The global market for AI in trading is expected to grow from $24.53 billion in 2025 to $40.47 billion by 2029, with a compound annual growth rate of 13.3%. But while most AI trading tools focus on execution and analysis, integrating AI coaching into prop farm infrastructure represents a relatively untapped opportunity that platforms like Fondeo.xyz are exploring.

What this means for traders

For aspiring crypto traders, the Kraken-Breakout acquisition is both an opportunity and a cautionary tale. On the one hand, institutional involvement brings reliability, better infrastructure, and potentially a more stable platform. Breakout traders now have access to Kraken-grade security standards, institutional liquidity, and the backing of one of the most trusted names in cryptocurrency.

On the other hand, institutional investors’ prop trading may become more competitive and less forgiving. Kraken clarified that Breakout’s evaluation program is “deliberately rigorous” and designed to validate its risk management skills and strategic discipline before allocating capital. They say most applicants don’t pass on the first try.

This creates a natural segmentation in the market. Traders who are confident in their abilities may be drawn to established names like FTMO or exchange-backed options like Breakout. Those looking to build their skills while accessing capital, especially in a cryptocurrency-specific 24/7 environment, may find an integrated platform like Fondeo.xyz to be a better fit for their development path.

Looking to the future: Institutionalizing prop trading

Kraken Breakout’s acquisition is unlikely to be the last of its kind. Other major exchanges and fintech companies are likely to evaluate similar moves as prop trading reaches historic levels of search interest and the market expands toward an expected valuation of $14.5 billion.

Industry observers expect consolidation. Smaller businesses with unreliable payments or questionable practices will struggle to compete with well-resourced exchange-backed platforms. Meanwhile, differentiated players will carve out sustainable niches, whether through superior technology, AI-driven trader development, or specialized market focus.

Google Trends data clearly shows that interest in prop trading is unabated. For traders, this means more choice, better infrastructure, and increased legitimacy. For the industry, this means the transition from a retail phenomenon to an institutional asset class is well underway.

Kraken’s Sethi said: “A modern capital platform should be: transparent, programmable and open to anyone with an edge.” In 2026, that advantage may come not just from trading skills, but from choosing the right platform to develop them. Whether it’s large institutional investors or focused innovators betting on the development of AI-powered traders.