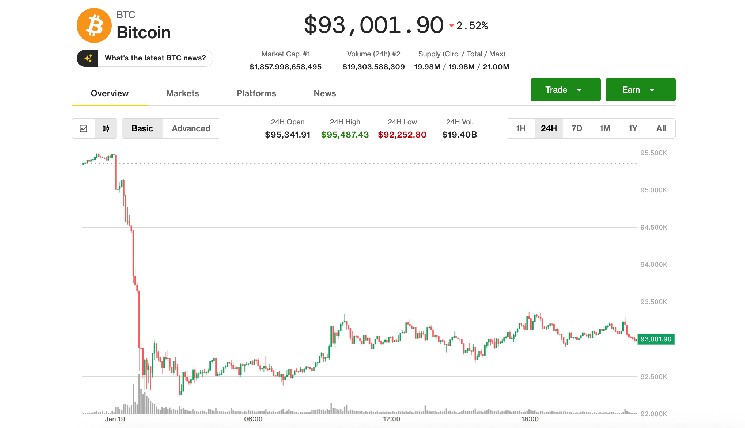

Bitcoin BTC$92,745.06 In U.S. trading on Monday, prices stabilized above $93,000 after overnight declines sent the asset down to $91,800. The decline came as US President Donald Trump reignited trade tensions and threatened to impose new tariffs on Denmark and other European countries over a dispute involving Greenland.

In a trading environment with low liquidity due to the US market holiday, BTC Although the losses eased somewhat, the stock was still down 2% on the day. ether of ethereum Ethereum$3,198.92 fell 3.7% to remain just above $3,200. The situation for altcoins got even worse, with SOL, DOGE, ADA, LINK, and AVAX down 5-6%, and SUI over 10%.

Meanwhile, gold has soared again, hitting a new record of nearly $4,700 an ounce, extending its appeal as a safe haven amid geopolitical upheaval. Precious metals are currently up more than 70% over the past 12 months.

Kraken Vice President Matt Howells Barbee said the overnight decline reinforced a broader pattern of relative weakness in the crypto market.

“Cryptocurrencies have consistently exhibited asymmetric downside risk” since the October 10 crash, he said, adding that “markets are much more likely to punish negative news harshly than reward positive triggers.” Starting this week, BTC He noted that it was sitting near a critical level for further upside, but geopolitical headlines quickly derailed the momentum.

Still, he said the relatively modest size of the pullback (about 3.5%) suggests traders may be bracing for the possibility that Trump will weaken his tariff threat, similar to the pattern last year when the U.S. threatened to impose taxes on China and other countries under a regime called TACO (Trump Always Avoids).

Regardless of how the new threat of a tariff war plays out, “the coming days are likely to be volatile as crypto markets move based on comments suggesting further escalation or de-escalation on EU-US tariffs,” said a statement from political and business leaders gathered at the World Economic Forum in Davos. Howells Barbee said.

“New confidence”

Meanwhile, Bitfinex analysts pointed out that there is long-term selling pressure. BTC The number of holders has been relaxed and reduced to approximately 12,800 people. BTC weekly from a peak of over 100,000. BTC During this market cycle.

However, Bitfinex warned: BTC It now faces stiff resistance from a dense supply zone of long-term holders between $93,000 and $110,000, stalling the previous bull run and potentially limiting prices once again.

“For a more sustained bull market to take hold, the market structure needs to shift to one where mature supply begins to outpace spending by long-term holders,” they said.

Historically, this configuration was last observed from August 2022 to September 2023 and again from March 2024 to July 2025, both of which were stronger and more persistent periods, they said. BTC Gathering.

“Such a change would increase the supply of LTH, indicating renewed confidence and reduced pressure on the selling side,” they added.