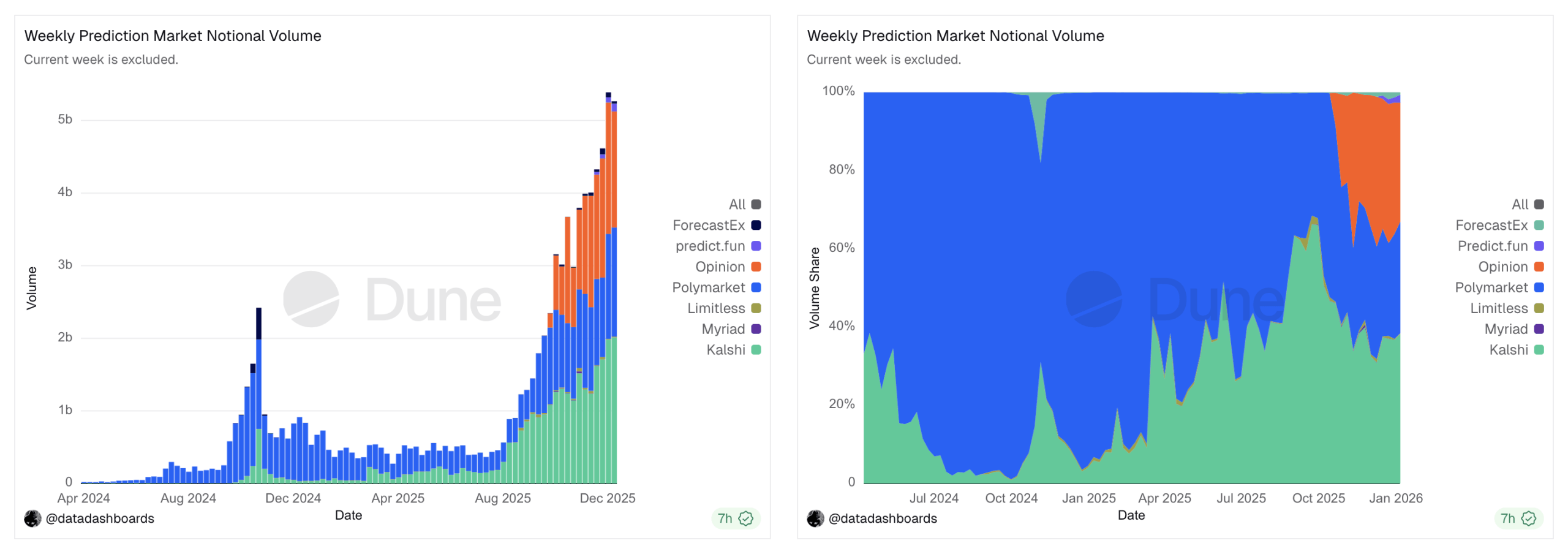

In the last week of 2025, weekly prediction market notional trading volume exceeded $5.3 billion, and the first week of 2026 pulled the same trick, again crossing $5 billion and marking a new record on the sector’s ledger.

Prediction markets attract a lot of attention

Prediction markets have been in the spotlight recently, and data compiled by Dune Analytics reveals that three platforms run the majority of the tables. The first week of 2026 numbers show that 2026 began with a trading volume of $5.26 billion, just shy of the December 29 high of $5.38 billion.

Dune.com data compiled by @datadashboards shows Kalsi dominated the first week of 2026, capturing 38.2% of the total notional value across seven different prediction markets. Following Kalsi is Opinion, a BNB-based prediction market that has been seeing serious volume since late October. Much of that activity appears to be related to Opinion’s Points-Based Rewards System (PTS), which is rapidly gaining adoption with the PTS program and the attractive prospect of airdrops.

Two views showing the notional value of seven different prediction markets. Dune.com data compiled by @datadashboards.

Opinion currently accounts for 30.3% of weekly notional trading volume, while the long-running polymarket lags behind at 28.6% of the pie. Predict.fun has about 2.1%, Forecastex, Limitless and Myriad each have less than 1%, and on the trading side Polymarket leads with 11.4 million transactions in the first week of the year, followed by Kalshi with just over 11 million, and Opinion with over 683,000 transactions.

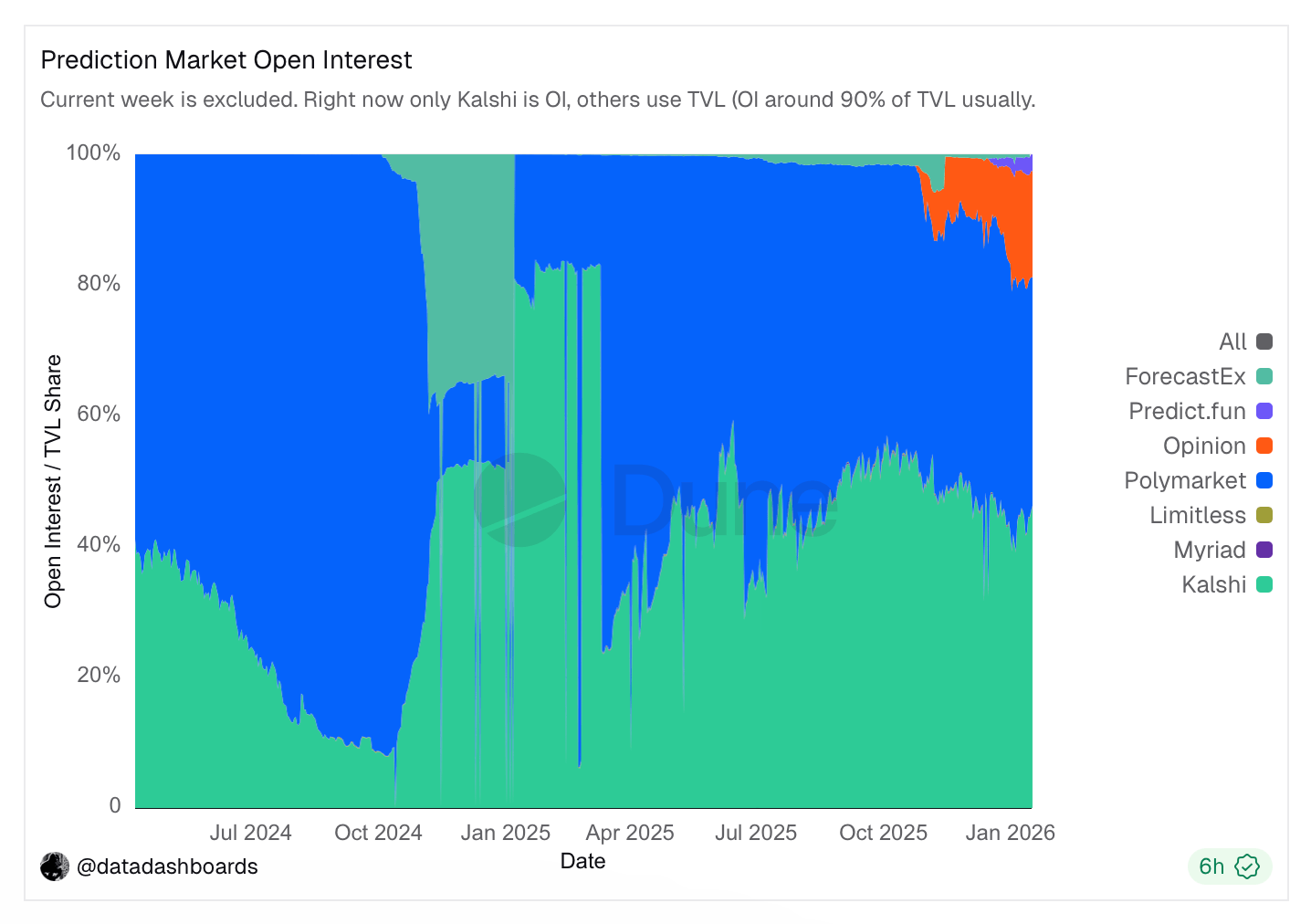

As of January 16, 2025, the most recent date recorded on the Dune.com dashboard, total market open interest reached $892 million. The combination of interest, demand, and volume has garnered a lot of attention, and many expect the space to become even larger and more competitive.

On top of that, Calci and Polymarket made a huge capital injection, carving out true mainstream traction with Calci partnering with CNBC, CNN, and MSNBC. Beyond cable news, Carsi partnered with the NHL to hire golfer Bryson DeChambeau as its first athlete endorser, using him for promotions and new market launches.

Also read: Is Bitcoin about to grow parabolically? Bitwise sees demand for ETFs depleting supply

Polymarket has entered into a partnership with the Golden Globe Awards and the Dow Jones Company. wall street journal—New York Rangers, Yahoo Finance, Parcl, and more. Additionally, Polymarket received a $2 billion capital injection from Intercontinental Exchange (ICE), giving the platform deep pockets and deep pockets.

Dune.com data compiled by @datadashboards.

YZi Labs-backed Opinion quickly grabbed a significant portion of the weekly sector’s volume after its launch, but it hasn’t exactly slipped in quietly. There are other companies sniffing prediction markets, including Crypto.com, Draftkings, Robinhood, Fanduel, and Coinbase.

One thing is clear from the expansion, volume, competitiveness and growth of the sector. That said, prediction markets haven’t faded into the background, and the category has grown far beyond a temporary novelty. In this day and age, it is rapidly turning into gold rush territory, with platforms large and small rushing to stake their claim, as the growth of prediction markets draws in an ever-crowded field.

Frequently asked questions 🔮

- What is driving the increase in weekly prediction market volume?

Weekly prediction market volumes are increasing across global markets due to increased trading activity and increased competition between major platforms. - Which platforms are competing for prediction market volume?

As the sector attracts more users and capital, several major prediction market platforms are competing for liquidity and market share. - Why is trading volume important in prediction markets?

Higher volumes improve liquidity, pricing accuracy, and user trust, making the platform more competitive at scale. - What impact will Polymarket’s funding have on this sector?

As competition intensifies in the global prediction market space, Polymarket strengthens its position with a $2 billion capital injection from Intercontinental Exchange.