Ethereum needs to regain key resistance levels to stabilize and avoid further downside, with analysts predicting it could surge towards higher targets.

In particular, Ethereum (Ethereum) is trading around $3,115, down about 2.3% over the past 24 hours, reflecting renewed selling pressure across the broader crypto market. The intraday chart shows that Ethereum It spent most of the session consolidating above $3,200, before a late-session decline pushed the price back to around $3,100.

From a broader performance perspective, Weaknesses of Ethereum Most are short-term. The asset has been roughly flat (-0.1%) over the past 7 days and down 3.4% over the past 14 days. but, Ethereum It remains up 4.8% over the past 30 days, indicating that the overall trend is still tilted positively despite the current pullback. The key question now is whether buyers will step in to protect the $3,100 level or whether this decline signals the beginning of another correction.

Ethereum price analysis

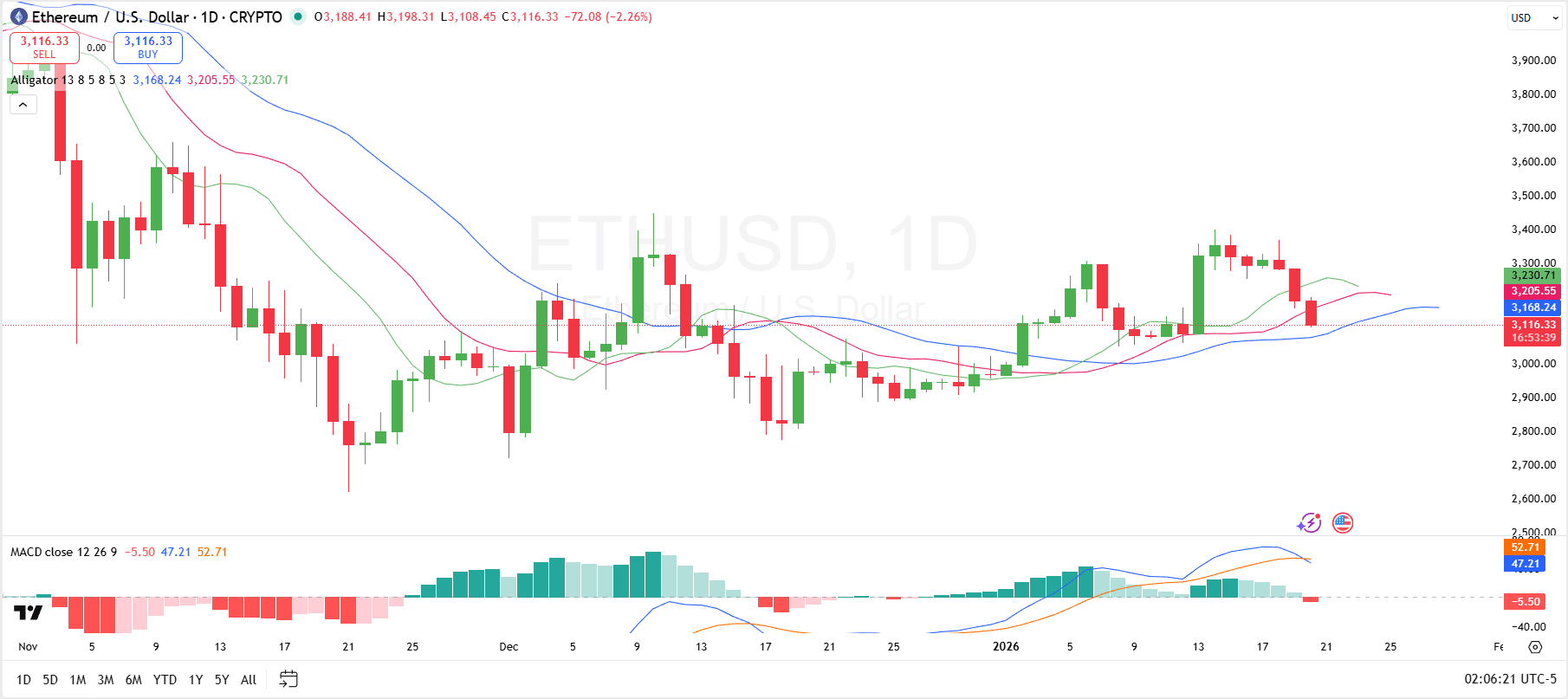

Ethereum’s daily chart shows short-term weakness increasing as the price drops below the key Alligator indicator level. Ethereum is trading at the lower end of its trading range, with Joe at about $3,168, Teeth at about $3,206, and Lips at about $3,230, all of which are above their current price.

Ethereum price analysis

This coincidence signals a bearish phase as the price is trading below all three moving averages, indicating that sellers are still in control. The Alligator line has also started to widen slightly, which often suggests that the market is moving from consolidation to a directional movement and is now biased to the downside.

Moreover, momentum indicators further reinforce this cautious outlook. The MACD becomes negative, the histogram shows a red bar, and the MACD line crosses below the signal line. This reflects the weakening of bullish momentum after the early January rebound and confirms that the recent selling pressure is being supported by deteriorating momentum rather than just price noise.

Taken together, the indicators suggest that Ethereum is in a short-term correction phase. You’ll probably need it for recovery. Ethereum This is because the alligator’s lips and teeth have regained the $3,200-$3,230 zone, which could be concentrated, indicating renewed bullish control. Until then, downside risks remain high and traders are watching closely. Ethereum It could stabilize above the psychological $3,100 level or face further pressure towards the lower support zone.

Is Ethereum heading towards $4,000?

Commentator is analyst Merlijn The Trader say Ethereum is currently in the compression phase of its uptrend, forming an ascending triangle. The bears continue to attempt to move lower, but each push encounters buying pressure, creating higher lows along the uptrend line.

Ethereum predictions

Consistent buying at this low level is increasing pressure. Ethereum Regarding the possibility of breaking the resistance trend line. The $3,400 resistance remains key. one time Ethereum If this level is exceeded, the price is expected to surge towards above $4,000, indicating the start of a faster uptrend.