Liquidity on South Korean crypto exchanges may seem deceptively simple on the surface, but Kaiko Research has discovered that beneath the major trading volumes lies a much more subtle and sometimes unforgiving market structure.

South Korea’s virtual currency liquidity is complicated—exchange survey explains why

In that report, “Liquidity status of the Korean virtual currency market” Kaiko Research defines liquidity not as raw trading activity, but as the ability to quickly execute large orders near prevailing prices without distorting the market, and this criterion requires more than a single metric.

Analysts say liquidity needs to be assessed across time, market structure and execution conditions, rather than being inferred solely from trading volume. Kaiko’s strategists stress that no single metric can fully capture liquidity. Instead, the company combines trading volume, bid-bid spread, market depth, and slippage to create a multidimensional framework tailored to crypto markets, especially markets dominated by individual participation like South Korea.

Source: Kaiko’s report “Current status of liquidity in South Korea’s virtual currency market.”

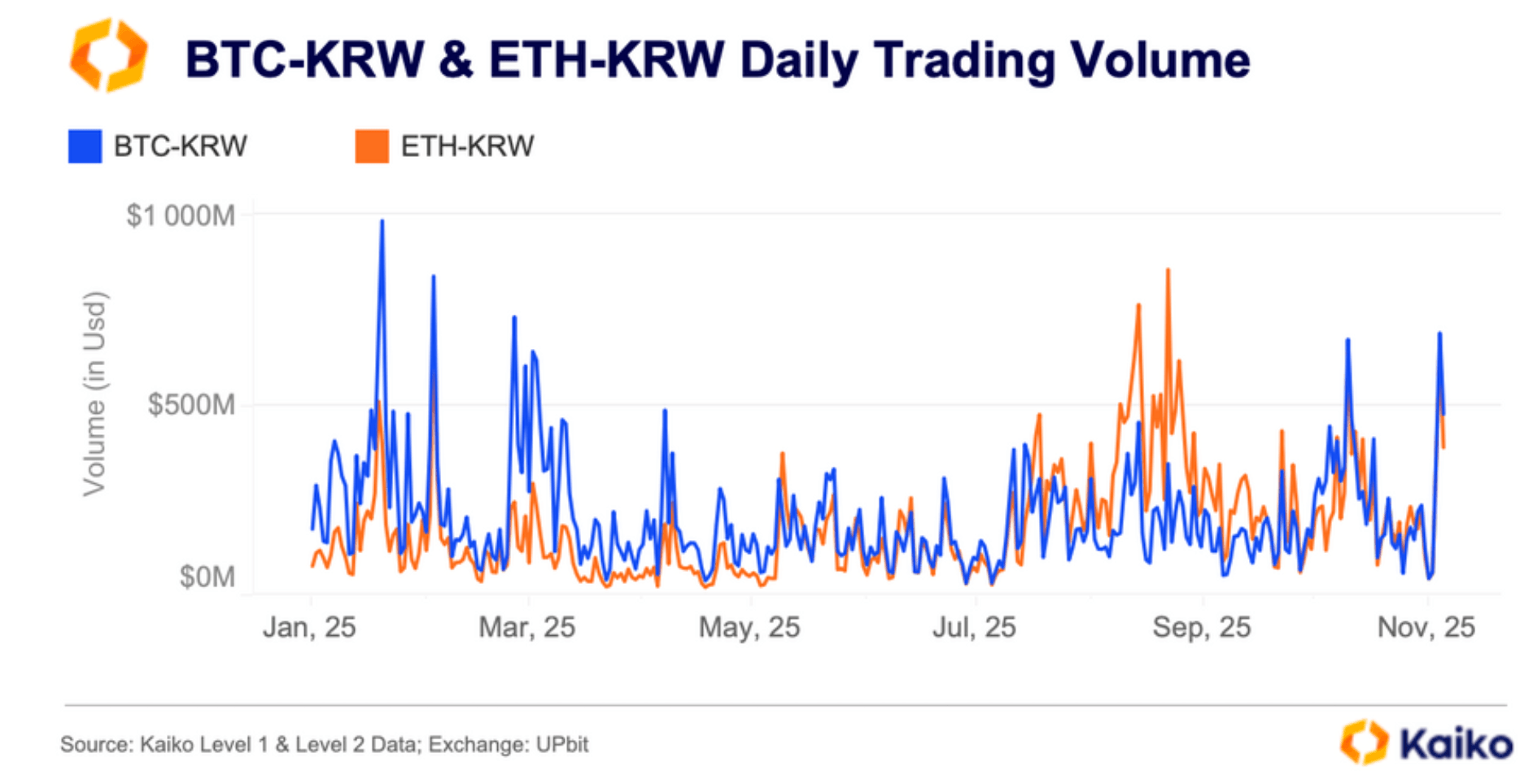

While volume is useful, trading volumes often spike during stress events, precisely when fill quality declines. statistician Observed during market turmoil on October 10, 2025. Spread, another fundamental metric in the Kaiko research framework, reveals the implicit cost of immediacy. Narrow spreads indicate ease of entry and exit, while wide spreads indicate increased risk for market makers, especially during spikes in volatility.

Analysts note that crypto spreads are shaped not only by volatility, but also by order book depth, platform fragmentation, and tick size design. According to the market, tick size plays a very big role in the Korean cryptocurrency ecosystem expert. Large exchanges such as Upbit and Bithumb have historically favored larger tick sizes in the KRW market, prioritizing stability and readability over very fine price granularity.

While larger ticks mechanically widen minimum spreads, Silkworm researchers have found that they can also concentrate liquidity at fewer price levels, supporting visible depth and smoother execution of retail-heavy flows. Market depth is another important pre-trade indicator highlighted by Kaiko Research, measuring how much volume there is around the mid-price and how resilient the price is to large orders.

However, researchers caution that the displayed depth can be misleading due to hidden liquidity such as stale prices, temporary orders, and iceberg orders, all of which complicate the actual execution results. To bridge the gap between what traders see and what they are actually getting, Kaiko Research relies heavily on slippage analysis. Slippage captures the difference between expected and realized execution prices based on real-time order book conditions, providing an execution-centric view of liquidity costs.

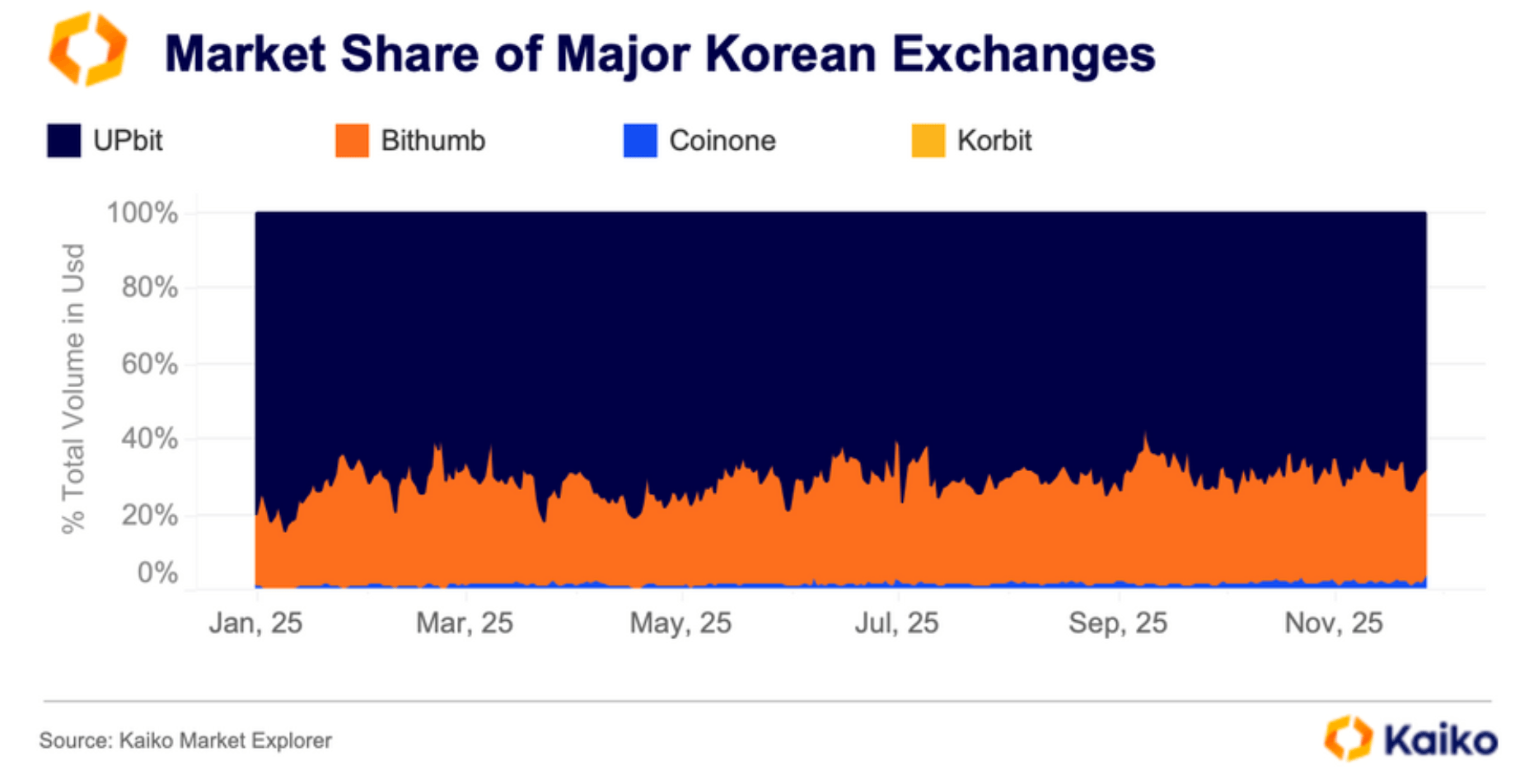

Still, Kaitaka emphasizes that slippage is still path-dependent and varies widely by currency, asset, and time of day. The report compared Korean exchanges and found that liquidity was overwhelmingly concentrated in Upbit. Throughout 2025, Upbit accounted for approximately 70% of total trading volume, with a significantly richer order book and lower execution friction than competitors such as Bithumb, Coinone, and Korbit.

Trading volume data for major KRW pairs such as BTC-KRW and XRP-KRW further strengthens Upbit’s central role. According to Kaiko Research, the fee structure adds another layer to the liquidity equation. While zero-commission trading models look attractive, the report’s authors warn that eliminating explicit commissions will often result in costs being passed on to wider spreads as market makers seek to recoup lost revenue. Liquidity will only improve if lost revenue is offset by increased participation.

Source: Kaiko’s report “Current status of liquidity in South Korea’s virtual currency market.”

Token-specific dynamics also shape liquidity outcomes. Kaiko Research highlights the recurring occurrence of “kimchi premiums” where localized demand causes South Korean crypto prices to temporarily exceed global benchmarks, attracting arbitrage flows that ultimately readjust prices. These episodes illustrate how regulatory constraints and capital controls fragment liquidity across jurisdictions.

Macroeconomic shocks pose even more severe stress tests. Kaiko’s analysis of South Korea’s brief declaration of martial law in December 2024 shows that headline risk, along with thinner layers and wider spreads, can cause explosive volumes, reminding us that high volumes do not equal easy execution.

Also read: Korea University Blockchain Research Institute partners with Injective as global ecosystem verifier

In contrast, Kaiko Research observes that bullish phases and new all-time highs tend to draw new capital into the order book, compressing spreads and replenishing depth. In other words, liquidity is cyclical, situational, and highly sensitive to both sentiment and structure.

Ultimately, the report concludes that liquidity on Korean crypto exchanges is a moving target shaped by market design choices, fee incentives, and investor behavior. The message is clear for traders and analysts alike. Liquidity is not a headline number, it is a system and requires scrutiny.

Frequently asked questions 🇰🇷

- What does Kaiko Research think of as liquidity in the virtual currency market?Kaiko Research defines liquidity as the ability to quickly execute large trades near market prices without significantly impacting prices.

- Why is quantity alone misleading when assessing liquidity?According to Kaiko Research, trading volume often spikes during stress events when execution quality deteriorates, making it an imperfect indicator.

- Which Korean exchange has the most liquidity?Kaiko Research found that UPbit dominates South Korean crypto liquidity, accounting for approximately 70% of total trading volume in 2025.

- How does tick size affect liquidity on Korean exchanges?Kaiko Research explains that larger tick sizes improve stability and display depth, but increase minimum spreads and execution costs.