Prediction markets hit record weekly trading volumes last week as traders increasingly placed bets on major political events, crypto-related outcomes, and sports markets.

The growth in activity reflects growing interest in event-based trading across multiple sectors. However, this rapid expansion has also brought new concerns about market fragmentation and insider trading.

Prediction markets break volume records while traders’ profits and losses grow

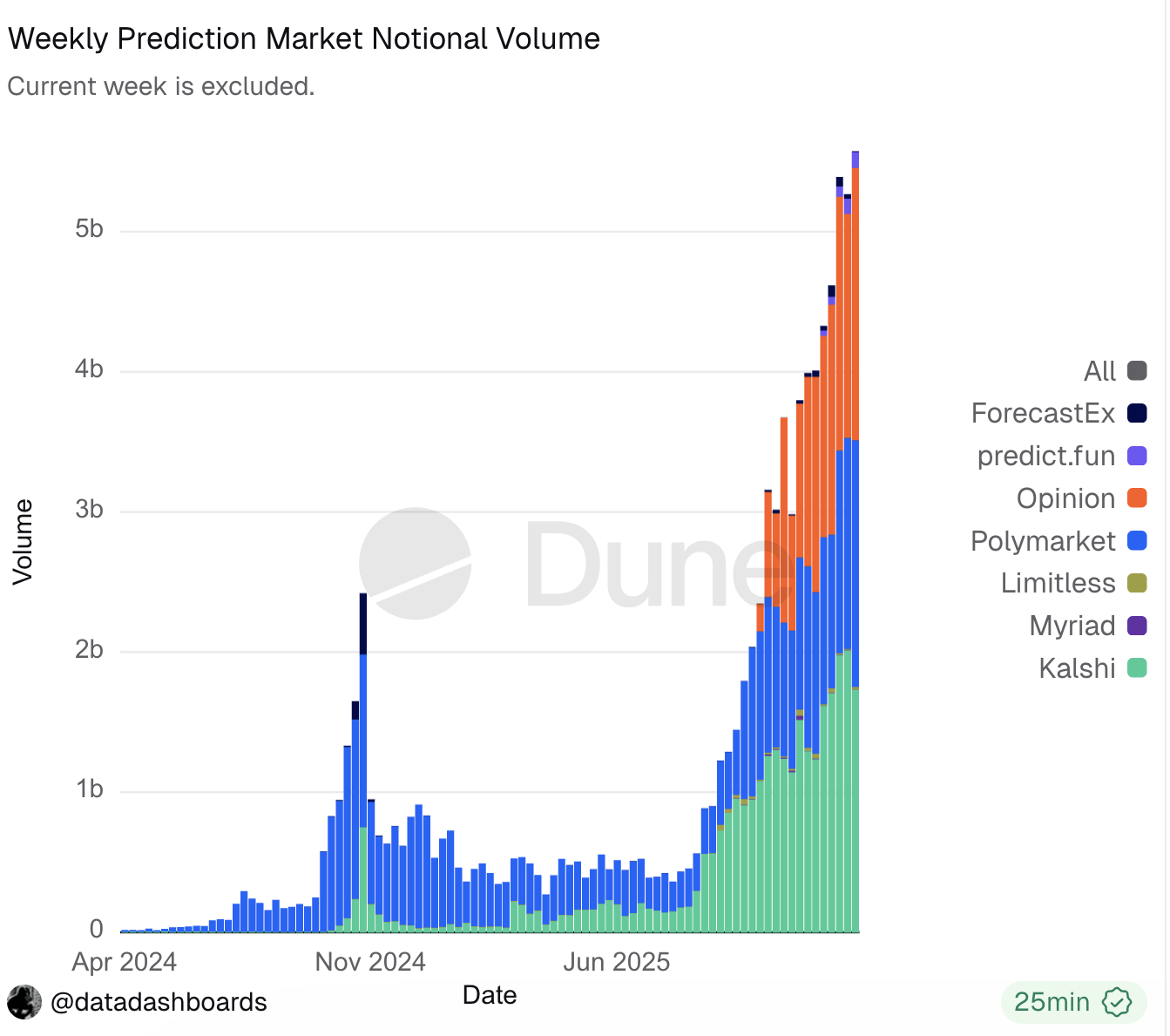

Weekly trading volume in the prediction market hit an all-time high of $3.7 billion last week, according to data from Dune. Weekly notional trading volume also surged to a new record of $5.57 billion.

This acceleration continues a trend that began in 2025, when prediction market activity began to outpace meme coin and non-fungible token (NFT) trading volume.

Prediction market weekly notional volume. Source: Dune

User engagement has also improved. Weekly active users peaked at 335,583 in the first week of January, and transaction numbers followed a similar upward trajectory.

Data shows that activity remains highly concentrated, with three categories accounting for the majority of weekly notional volume. At Polymarket, trading is primarily driven by political events, sports, and crypto-related markets. Kalsi showed a similar pattern.

This concentration is also reflected at the individual trader level. Lookonchain reported that polymarket trader “beachboy4” made a dramatic turnaround from a loss of more than $6.8 million to a profit of approximately $395,000 after betting on sports outcomes.

In the past two days alone, the trader reportedly made more than $10.5 million in profits from five successful predictions, completely recouping his previous losses.

“That being said, his stakes have skyrocketed, from previously hundreds of thousands of dollars per bet to now over $3 million per bet,” the post added.

However, not all traders saw similar results. Polymarket saw two users lose nearly $10 million in less than a month, highlighting the risks associated with event-based markets.

“Two Polymarket traders bet big on the 48-57 cent sports market and lost nearly $10 million in less than a month.0x4924: 346 predictions, 46.24% win rate, -$5.96 million in 24 days. bossoskil1: 65 predictions, win rate 41.54%, -404 in 11 days Millions of dollars. At odds of about 50 cents, it’s basically like flipping a coin. Betting bigger means losing faster,” Lookonchain said.

In addition to retail users, major players in the industry are also looking to capitalize on this trend. Coinbase is reportedly preparing to launch its own prediction market. Additionally, an affiliate of Gemini has received regulatory approval to begin offering prediction markets to customers in the United States.

Trump Media & Technology Group has indicated its intention to enter this space as well. In December, sports platform Fanatics announced the launch of a fan-driven prediction market platform through a strategic partnership with Crypto.com.

Growing concerns over prediction markets

However, some experts have expressed concern about the market’s sharp rise, calling it an “endgame” for the sector.

The final phase of prediction markets:

– Anyone can create a market

– Creators receive fees from the volume they generateFully personalized and no permissions required

— Nairolf (@0xNairolf) January 17, 2026

Some argue that the number of markets is not the central issue. Rather, liquidity remains the biggest challenge facing prediction markets.

“All this incentivizes is people spamming a bunch of illiquid markets to earn the 5 cent creator fee,” said Alex Finn.

Beyond fragmentation, insider trading has emerged as another pressing concern in prediction markets. Recent events have raised questions about whether nonpublic information is driving market outcomes.

In one case, three wallets on Polymarket recorded combined profits of more than $630,000 after betting on the removal of Nicolas Maduro, before his arrest was announced. Elsewhere, a trader reportedly made nearly $1 million on bets related to Google’s 2025 “year of search” results.

A similar pattern was observed for entertainment events. On Polymarket, users placed 27 bets on the outcome of the Golden Globes, and 26 were settled in cash. These unusually accurate results have increased concerns that insider knowledge is influencing activity on the prediction platform.

The post Prediction Markets Reach Record Trading Volume Amid Growing Fragmentation Concerns appeared first on BeInCrypto.