Perpetual decentralized exchanges (DEXs) are gaining traction as traders turn to blockchain-based platforms that have lower costs and fewer intermediaries than traditional centralized exchanges.

Perp DEX is a blockchain-based venue for trading perpetual futures contracts, allowing traders to leverage and bet on the price of the underlying asset with no expiration date.

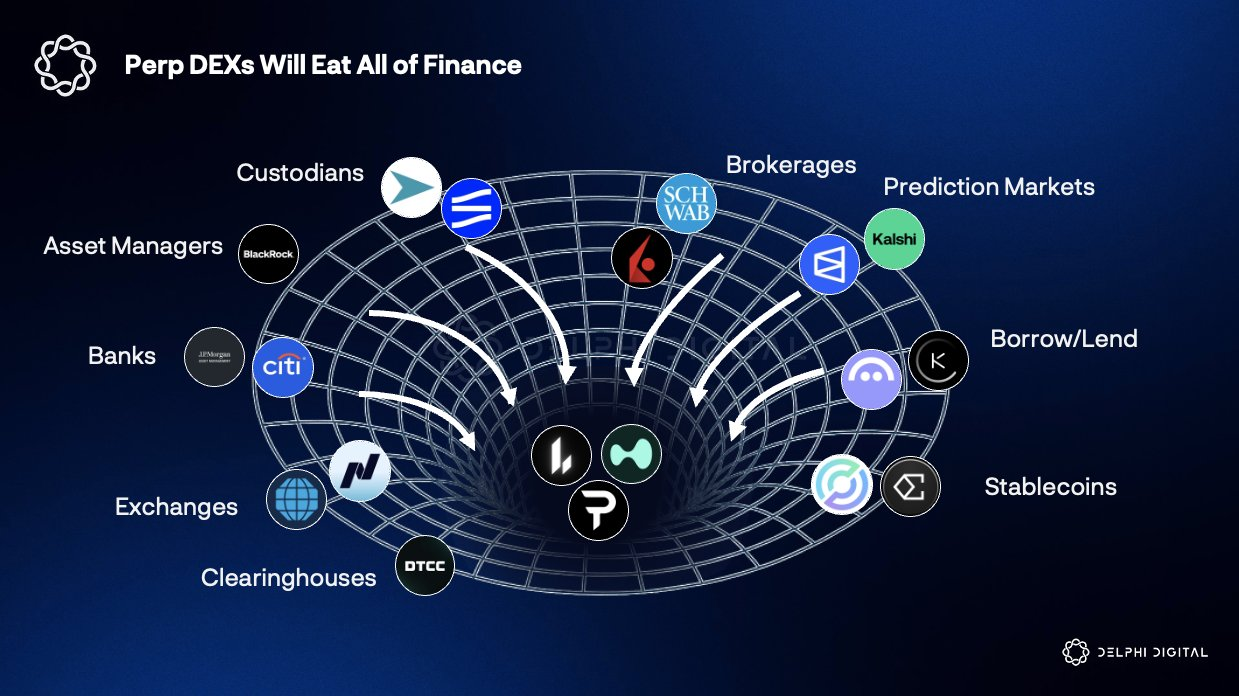

Cryptocurrency research firm Delphi Digital said in its 2026 outlook that PERP DEX is poised to continue taking market share from traditional financial products. The group argued that decentralized infrastructure is structurally more efficient than traditional systems, which are fragmented and expensive to operate.

“Hyperliquid is now building native lending. Perp DEX has the potential to simultaneously become a brokerage, an exchange, a custodian, a bank, and a clearinghouse,” Delphi Digital wrote in a Tuesday post, adding that competitors such as Aster, Lighter, and Paradex are “racing to catch up.”

Source: Delphi digital

Related: $675M Lightweight Airdrop Ranks 10th Biggest Cryptocurrency: Bubble Map

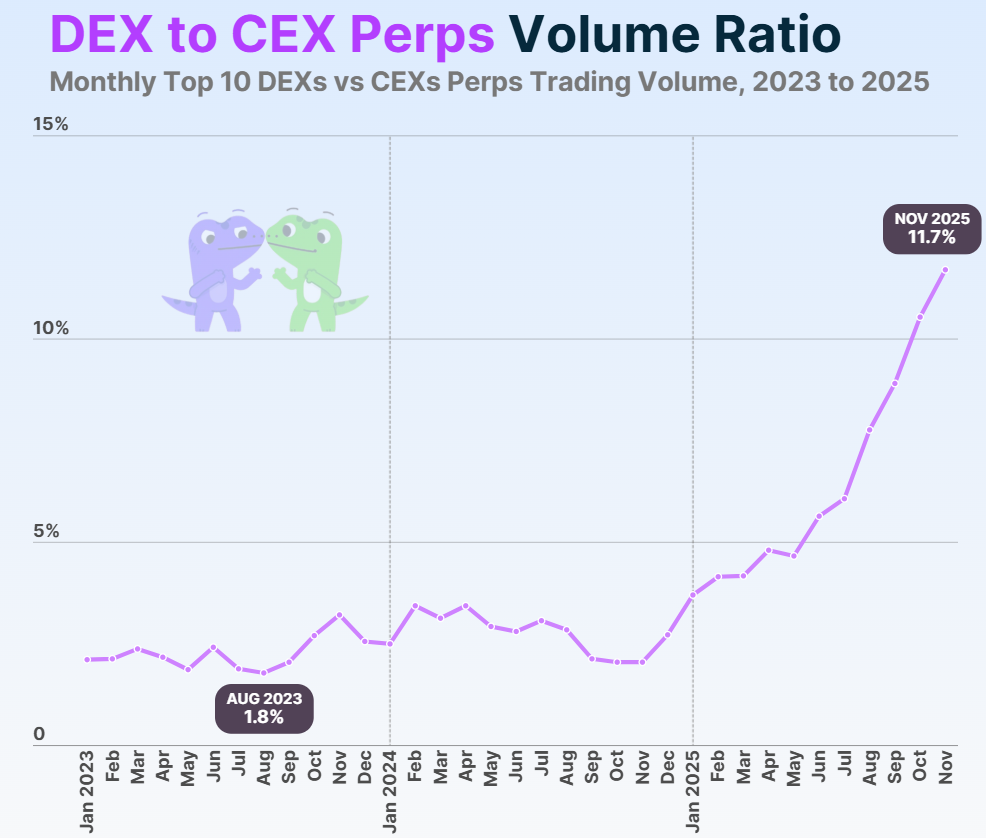

Perp DEX already accounts for a significant portion of revenue from centralized exchanges, with its market share rising from 2.1% in January 2023 to a record high of 11.7% in November 2025, according to a report by data aggregator CoinGecko.

Volume ratio of DEX and CEX. Source: CoinGecko

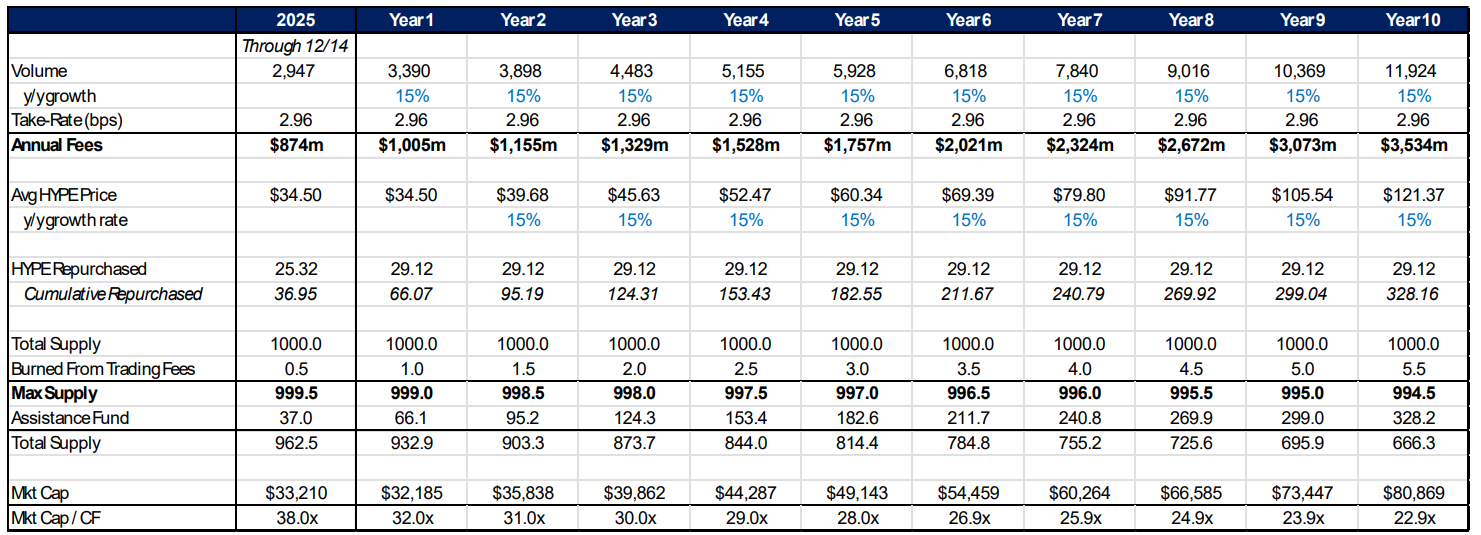

Growing adoption of decentralized trading platforms could strengthen Hyperliquid, a leading DEX token (hype), will increase to more than $200 over the next 10 years, according to a December research note from Cantor Fitzgerald.

The company’s forecast assumes that the token’s price will rise at a compound annual growth rate of 15% and that the supporting fund will buy back approximately $291 million. hype The total supply of tokens will be reduced to 666 million tokens.

hype Token prediction, 10 year prediction. Source: Cantor Fitzgerald

Related: Standard Chartered plans virtual currency intermediation, lowers ETH forecast

Perp DEX trading volume will triple in 2025 due to rising demand for on-chain derivatives

Perp DEX’s cumulative trading volume tripled during 2025, reaching $12.09 trillion from $4.1 trillion at the beginning of the year, Cointelegraph reported on December 31st.

According to data from DefiLlama, approximately $7.9 trillion, or 65% of the total PERP DEX value, will be generated in 2025, indicating significant adoption of these trading platforms over the past year.

But this number pales in comparison to the notional value of outstanding over-the-counter derivatives, which reached $846 trillion in June 2025, according to data from the Bank for International Settlements.

magazine: Can tokenized stocks from Robinhood and Kraken really be diversified?