Ethereum continues to maintain its bullish tone above $3,000, supported by both a technical breakout and renewed on-chain strength. This resilience comes at a time when macro and geopolitical events, from rising tensions in the Middle East to financial instability across emerging markets, continue to put Bitcoin in the spotlight.

Ethereum Price Analysis: Daily Chart

What we can see from the daily structure is that Ethereum has broken out of the descending parallel channel and reversed into strong support at the $3,000 zone. Price recently broke into a major resistance zone between $3.3K and $3.7K, but faced selling pressure and recorded several consecutive bearish candlesticks. This zone overlaps both the 100-day and 200-day moving averages, creating a technical barrier that the bulls need to regain for continuation.

Despite the rejection, the RSI is still in healthy territory and has retreated from its current overbought levels. A potential low near the $3,000 range could act as a bullish springboard. The bullish outlook remains valid if the key daily trendline also remains in place and the price maintains the structure above the $2.7,000 zone. However, regaining the $3.5,000 resistance level is now critical to overriding the local top.

Ethereum/USDT 4 hour chart

On the 4 hour chart, Ethereum After last week’s impulsive rally, it is consolidating around $3,000, just above the previous breakout zone, forming a potential base. The asset respects the $3,000 level, but the upper downtrend line limits the last move at around $3.3,000. The current range of $3,000 to $3,1,000 serves as an intermediate value area and decision zone.

If buyers can break out of the $3.3,000 level, it will open the door for a retest of the $3.5,000 level and possibly a breakout towards $4,000. However, if the price along with volume falls below $3,000, the market could revisit the lower bound of the pattern near $2.9,000 and even revisit the high confluence demand area at $2.6,000. So far, the structure is still favorable to buyers, but caution is advised in the short term.

On-chain analysis

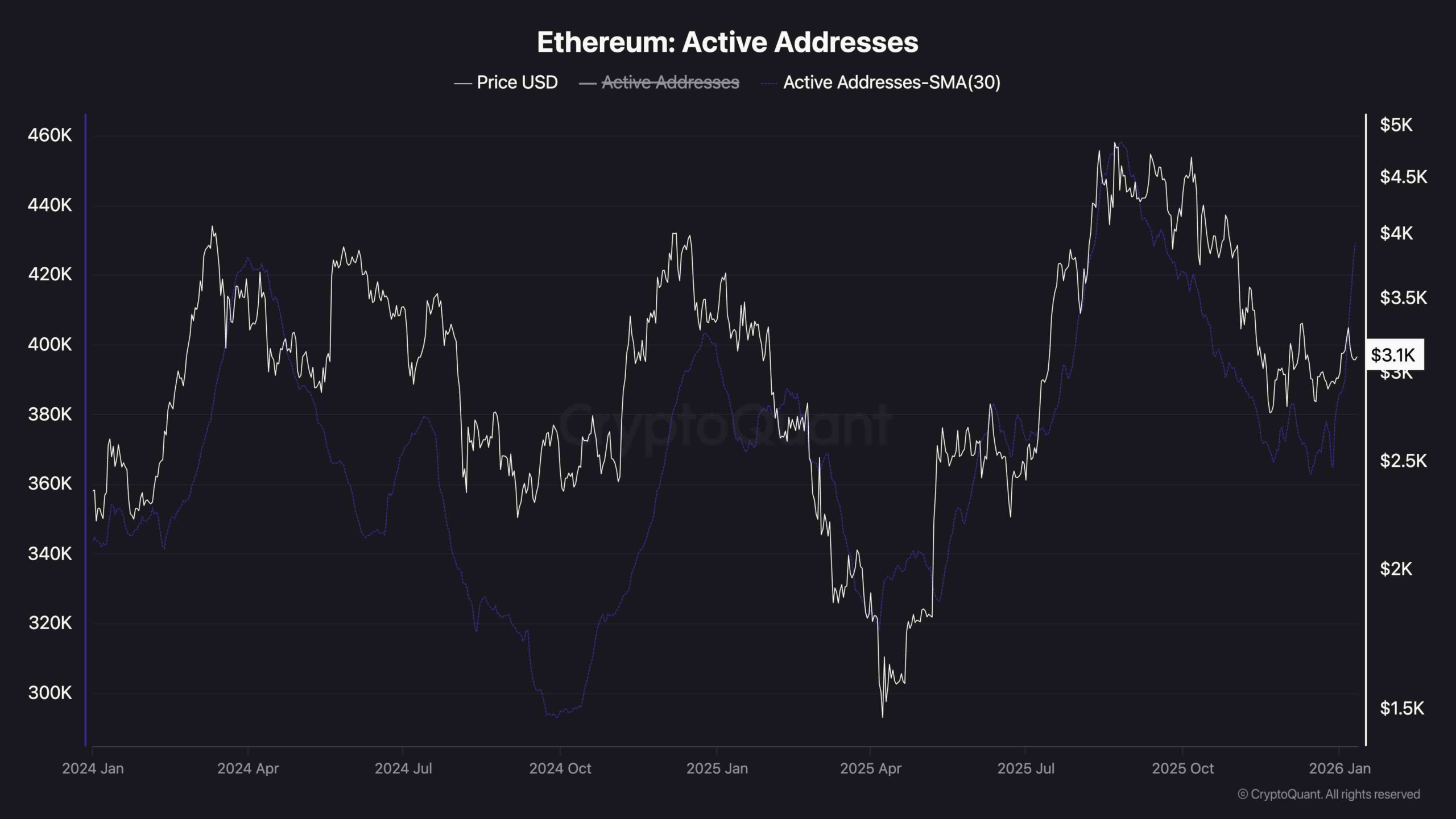

The 30-day SMA of Ethereum active addresses is trending upward again following a significant drop from Q3 to Q4 2025. Historically, increases in address activity often precede or coincide with sustained price increases, and the latest increase is no exception. At the moment, active addresses are hovering above 400K, mirroring the levels seen during the previous big uptrend.

This recovery is potentially driven by increased DeFi activity and re-staking of flows, suggesting that the network’s fundamentals have improved. If this on-chain momentum continues and the number of active addresses increases further, it would strongly support sustained demand and strengthen our bullish view on Ethereum in the medium term.