Ethereum price is on the rise again, gaining more than 2% in the past 24 hours and continuing to be positive this month. While the recovery looks encouraging, the underlying structure remains fragile.

The bearish pattern remains active and this rally risks turning into a deeper decline unless key levels are defended.

Ethereum price rises amid fragile bearish structure

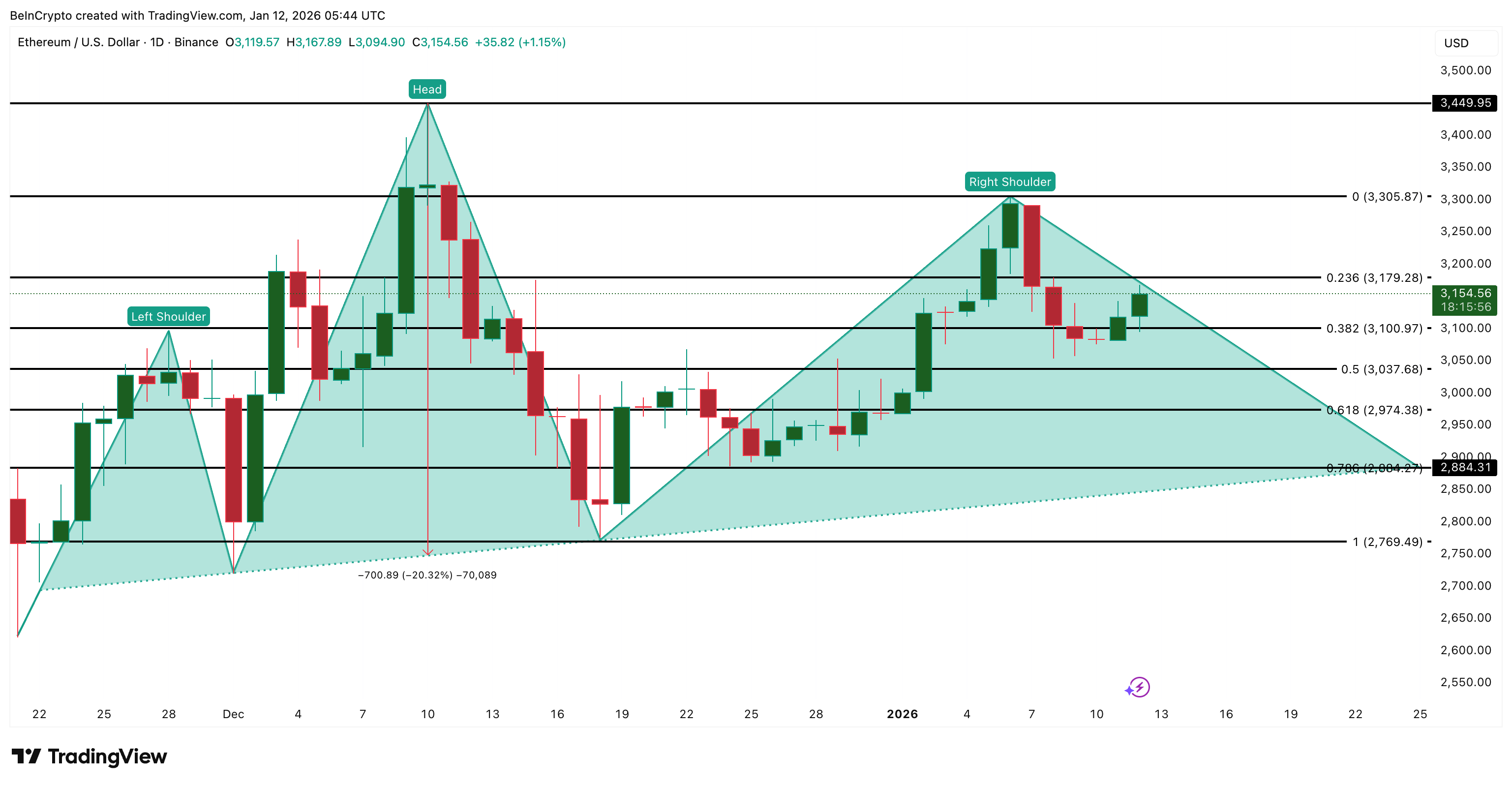

Despite the pullback, Ethereum is still trading within a head-and-shoulders pattern on the daily chart. The January 6th peak formed a right shoulder and the price is currently trying to stabilize without overriding the structure.

This is important because the head-and-shoulders pattern often fails gradually rather than immediately. A rally could occur within that, but it will only become safe once the price leaves the neckline risk zone decisively, around $2,880. EthereumIn the case of Mr.

Bearish risks looming Ethereum: Trading view

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

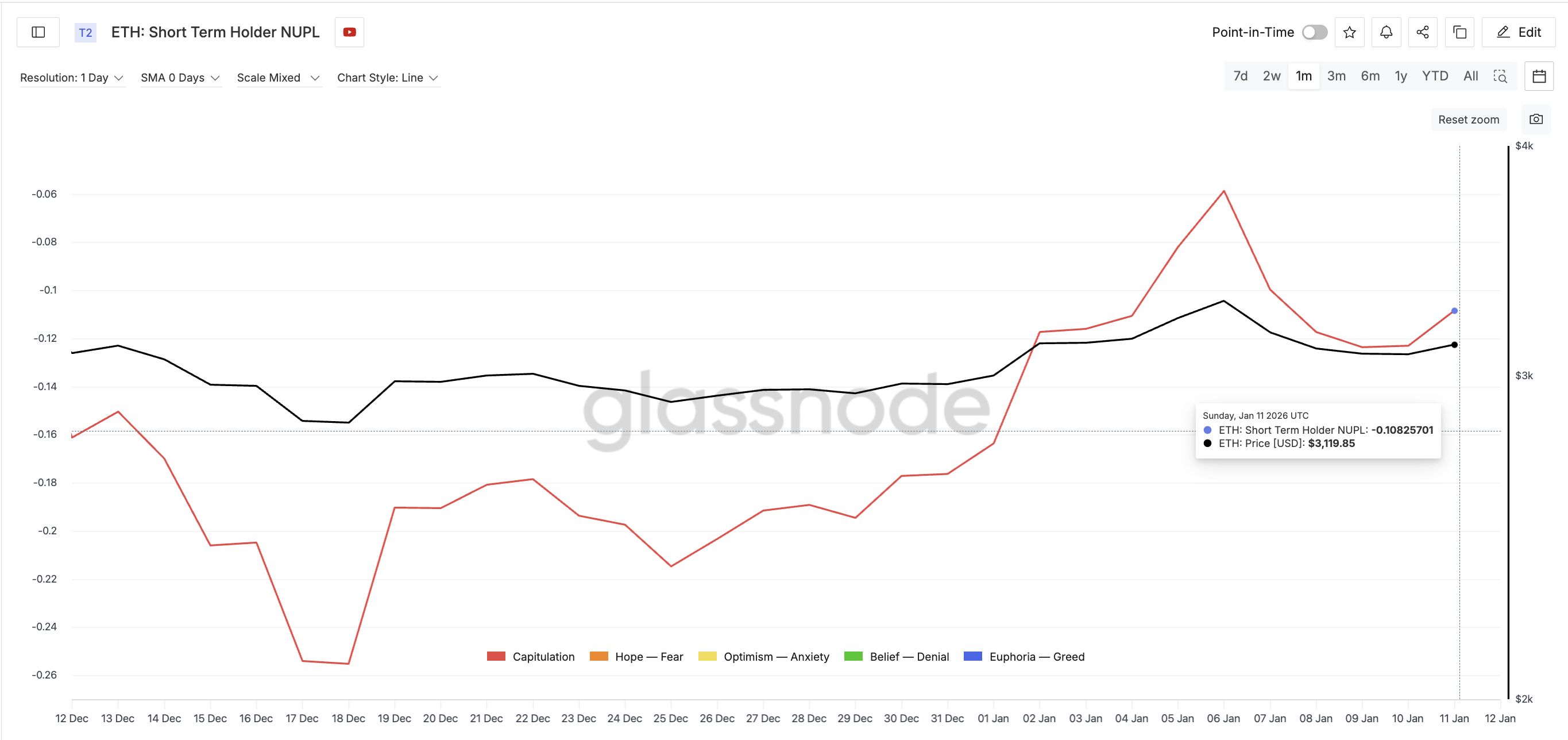

Care must be taken in the actions of short-term holders. NUPL, a short-term holder that tracks paper gains and losses, is still in capitulation territory but is rallying towards monthly highs. If the price rises, your chances of taking a profit increase.

Short-term profit increase: Glassnode

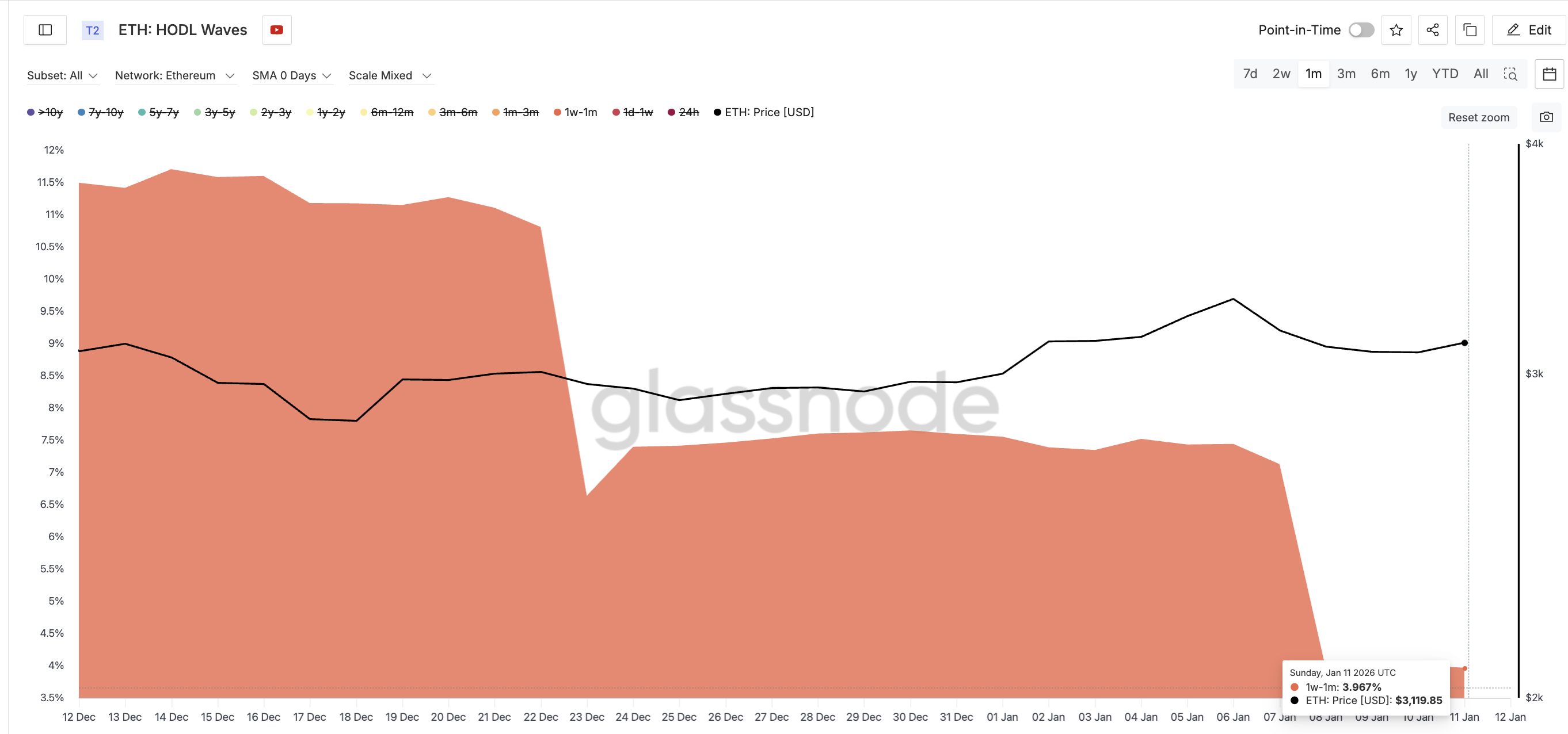

The HODL Waves indicator, which tracks cohorts based on time, confirms that many short-term holders have already exited. This means that the NUPL risk may already have occurred.

The one-week to one-month cohort has plummeted from about 11.5% of supply in mid-December to about 3.9% now.

Exit of short-term holders: Glassnode

This means that near-term selling pressure has subsided and also means that this rally has not yet been driven by aggressive, speculative new demand. Although this may seem like indifference, the short-term lack of buyers could ultimately prove beneficial. Ethereum If other support remains, the price will rise.

Buyers and long-term holders are quietly supporting the price.

The reason Ethereum doesn’t collapse is because of its underlying support.

The Money Flow Index (MFI), which tracks the potential for buy-in, is showing a bullish divergence. From mid-December to early January, Ethereum price formed lower highs, while MFI formed higher highs. This is a buy signal. Buyers consistently intervened during pullbacks rather than abandoning positions.

ETH push buying continues”>

ETH push buying continues”>

Continued buying on the push: TradingView

Although MFI has fallen slightly, it is still well above its previous lows. As long as this situation continues, selling pressure will continue to be absorbed rather than accelerated.

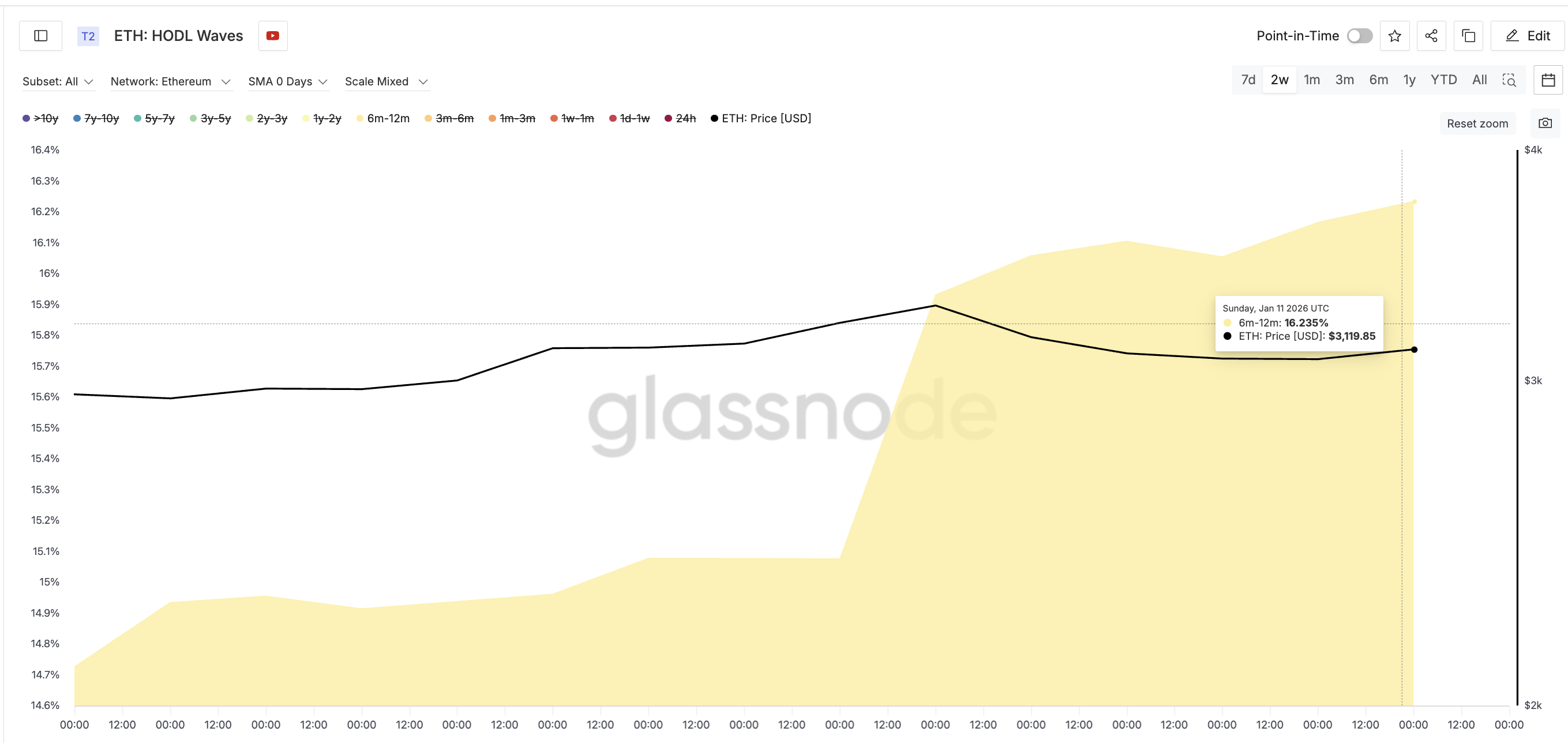

Long-term holders will strengthen this support. The six- to 12-month holder group has increased its supply share from about 14.7% to about 16.2% since late December. This is not a speculative chase, but a steady accumulation.

ETH purchaser”>

ETH purchaser”>

middle period Ethereum Buyer: Glassnode

Short-term supply decline, ongoing buy-in, and medium- to long-term holder accumulation together explain why Ethereum is rebounding rather than collapsing.

However, support alone cannot eliminate risk. It just slows you down.

Ethereum price level that determines whether the bounce is sustained

Ethereum is currently in a clear decision phase.

The most important downside level is $2,880. This marks the neckline zone of the head and shoulder structure. A daily close below this level activates the full pattern and opens the door to around 20% downside risk based on head-to-neckline measurements.

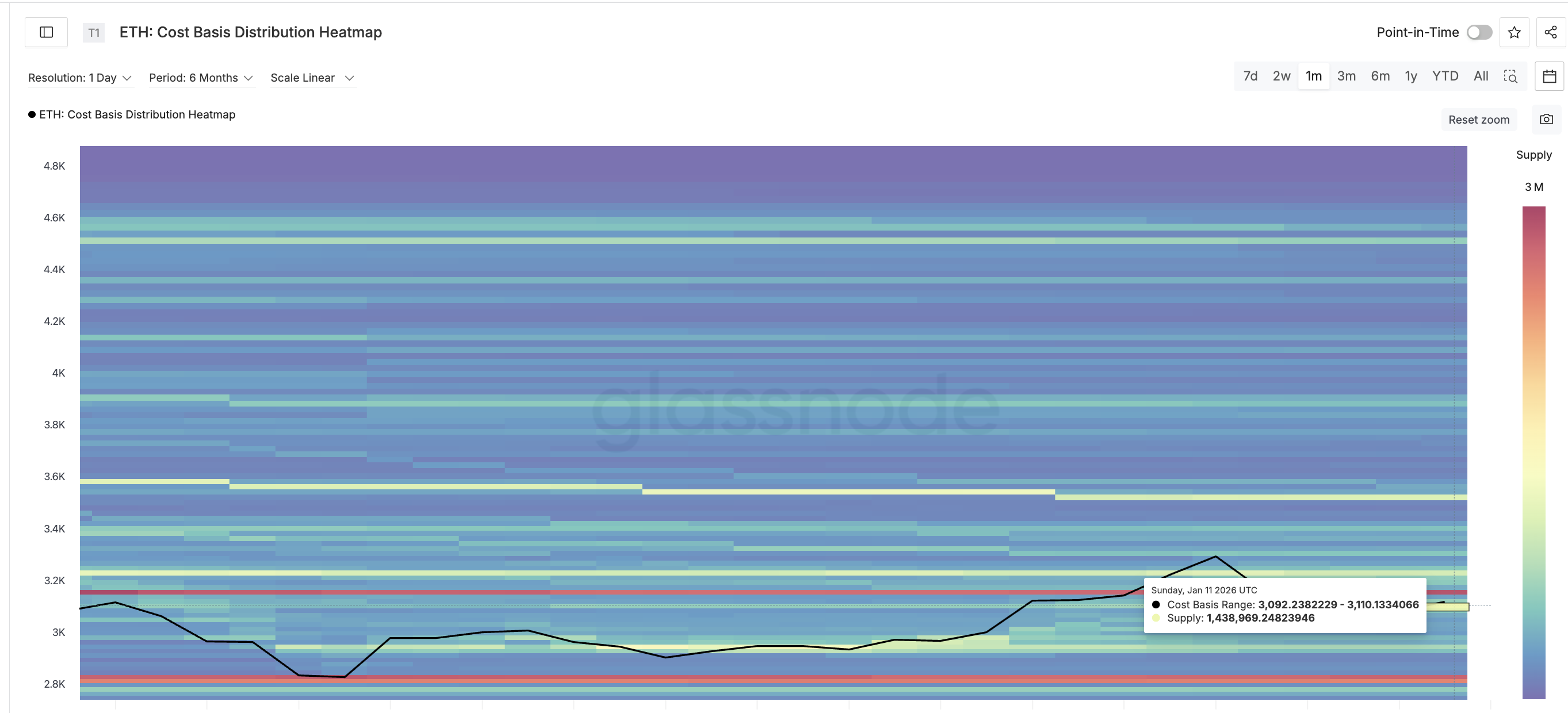

Beyond that price, the first major zone lies between $3,090 and $3,110, with an average of $3,100. This level is also displayed on the price chart. This range is important because it includes approximately 1.44 million dense on-chain cost-based clusters. Ethereum I finally changed hands. Markets often react strongly around such zones.

Main supply cluster: Glassnode

If Ethereum rises above this area, it strengthens the argument that buyers are protecting costs and absorbing supply. If this is not sustained, downside pressure will increase towards $2,970 and then the important $2,880 level.

Ethereum Price Analysis: TradingView

Ethereum will need sustained strength above $3,300 to completely defeat the bearish structure. Above $3,440, head and shoulders risk is completely erased.

The post Ethereum Bounces — But Is a 20% Trap Forming Below One Key Level?The post Ethereum Bounced appeared first on BeInCrypto.