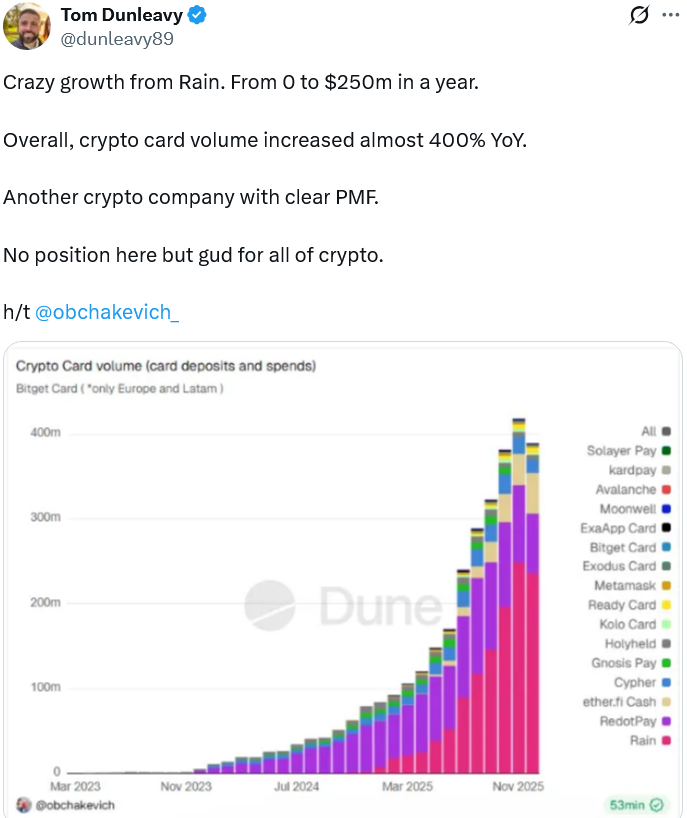

Industry leaders said stablecoin-powered cards are shaping up to be one of the biggest crypto themes of 2026, seeking to offer the benefits of blockchain while maintaining a familiar payment experience for consumers.

“This is one of the big themes for 2026: Cryptocurrencies will become more deeply involved in payment flows in the global economy,” Haseeb Qureshi, managing partner at Dragonfly, a venture capital firm specializing in cryptocurrencies, posted on X Friday.

“Stablecoin cards are growing like crazy around the world,” the VC added, after stablecoin startup Rain raised $250 million in a funding round, increasing its valuation to nearly $2 billion.

This large funding round comes as Rain grew its active card base 30x in 2025 and annual payment volume nearly 40x, making it one of the world’s fastest-growing fintech companies.

The platform supports major stablecoins such as Tether (USDT) and USDC (USDC) across several blockchain networks such as Ethereum, Solana, Tron, and Stellar.

Rain is part of a new wave of stablecoin startups integrating blockchain into payment systems to enable faster payments, lower costs, and greater global reach, while maintaining a seamless experience for consumers, Qureshi said.

“They don’t even know that it’s a cryptocurrency under the hood. All they know is that all of a sudden, anytime, anywhere, they can pay people, buy things with dollars, and everything is ‘just fine.'”

This comes after Bloomberg Intelligence predicted on Thursday that stablecoin payment flows will grow to $56.6 trillion by 2030 at a compound annual growth rate of 81%.

sauce: tom dunleavy

Stablecoin cards may have limited use in developed markets

However, not everyone is convinced that stablecoin payments will compete with traditional cards in developed countries, with Sheel Mohnot of Better Tomorrow Ventures GP saying stablecoin merchant acceptance lacks a captive audience, exclusivity and killer incentives to make meaningful change.

Mason Nystrom, an investor at Pantera Capital, disagreed with Mohnot, stressing that stablecoin payments offer merchants instant payouts, instant settlement, and chargeback protection.

“Stablecoin rails are going to be deployed across the fintech stack. Some incumbents will adopt them, while others will be completely replaced. Stablecoin checkouts are going to be massive.”

Stablecoin regulation progresses

Regulatory momentum appears to have increased with the passage of the GENIUS Act in the US late last year, and Canada and the UK have renewed efforts to introduce stablecoin frameworks in 2026 or the near future.

Adoption by institutional investors is also increasing, with money transfer platform Western Union planning to introduce a stablecoin payment system on the Solana blockchain in the first half of 2026, alongside a stablecoin card to enable consumer spending in emerging markets.