Ethereum continues to trade within a narrow range after rebounding strongly from its late December lows. Price action around the $3,100 level reflects consolidation rather than depletion. Market data shows that ETH is trading above major moving averages, suggesting a balance between buyers and sellers.

Short-term structure is above key support

On the 4-hour chart, ETH is still restricted to swing highs below $3,300. However, the lows from around $2,700 continue to support the broader recovery structure. As a result, the market is still honoring its previous upward impulse.

Immediate resistance lies between $3,130 and $3,150, where short-term averages are concentrated. A sustained move above this band could expose the $3,290 to $3,300 zone. This area coincides with an important Fibonacci retracement and previous supply. Beyond that, $3,450 is the upper end of the previous range.

ETH price dynamics (Source: TradingView)

Support remains well defined. The $3,080 to $3,100 zone serves as the current value area. Additionally, there is strong structural support in the $3,000 to $2,995 region.

Related: Story Price Prediction: IP Extends Rise After Major Breakout Signal…

If it fails there, the focus will shift to $2,890. A break below $2,716 will invalidate the recovery narrative. The moving average between the 100 and 200 periods is now clustered around the price. Therefore, ETH trades in equilibrium rather than trend extension.

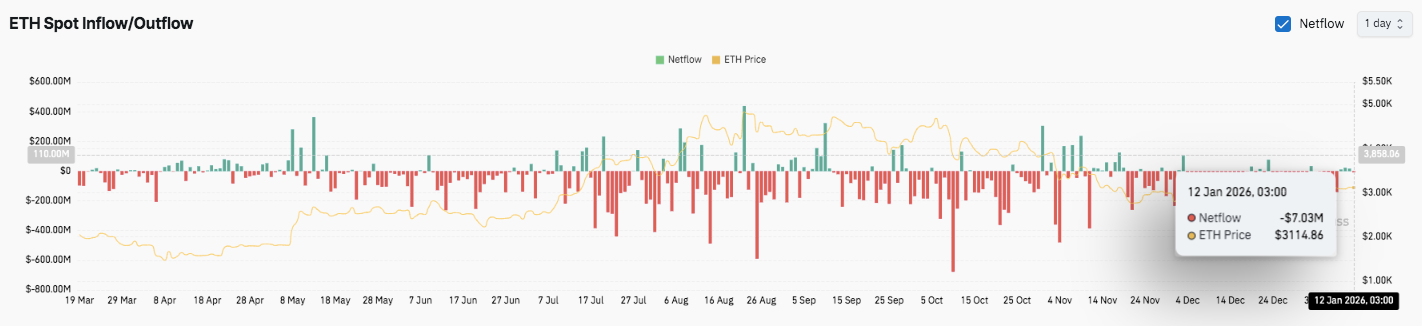

Signal tension for derivatives and spot flows

Futures data adds another layer to your setup. Ethereum’s open interest continues to grow despite the flat price. Open interest remains near cycle highs of around $40 billion. This behavior suggests that the trader rotates the leverage rather than closing out the position.

Historically, such situations increase the likelihood of sharp directional movements. Additionally, increased leverage often amplifies volatility from liquidations when prices move out of that range.

Source: Coin Glass

Spot flow data shows a cautious picture. Net outflows accounted for most of the deals, indicating continued sell-side pressure. However, recent flows have been smaller and seem more balanced around $3,100. This stabilization suggests a temporary equilibrium. As a result, upward momentum will remain subdued until sustained inflows return.

Staking activity quietly reduces circulating supply

Long-term positioning adds a structural dimension. Tom Lee’s Bitmine recently increased its Ethereum staking by over 86,000 ETH. Currently, total stake holdings exceed 1 million ETH. Each deposit takes supply away from the active circulation.

Tom Lee (@fundstrat)’s #Bitmine staked another 86,400 ETH ($266.3 million) 5 hours ago.

In total, #Bitmine has currently staked 1,080,512 $ETH($3.33B). https://t.co/P684j5YQaG pic.twitter.com/TpEf32m6AF

— Lookonchain (@lookonchain) January 11, 2026

Additionally, staking rewards encourage long-term holding rather than short-term trading. As a result, ETH quietly absorbs supply without immediately reacting to the price. When demand increases, this imbalance often precedes volatility.

Related: Monero Price Prediction: Privacy Coin Soars to $573 on Peter Brandt’s Chart…

Technical outlook for Ethereum price

Ethereum is trading within a tightening range around $3,100, with key levels still clearly defined.

Upside levels include the first resistance zone at $3,130-3,150, followed by $3,290-3,300 around the 0.786 Fibonacci retracement. If a breakout of this area is confirmed, the rally could extend towards the previous range high of $3,450.

On the downside, immediate support is between $3,080 and $3,100. Below that, $3,000 to $2,995 remains a key demand zone along the 0.382 retracement, with $2,890 acting as deeper structural support. If the price returns to $2,716, the broader recovery will be nullified.

The technical structure suggests that Ethereum is compressing above its medium- to long-term moving averages, indicating balance rather than weakness. This correction phase often precedes an increase in volatility.

Will Ethereum rise further?

Ethereum’s near-term direction will depend on whether buyers can confidently defend the $3,000 region and recover $3,150. A successful rally could pave the way for prices above $3,300.

However, if $3,000 is not sustained, the focus will shift to $2,890 and the recovery structure will weaken. For now, Ethereum remains in a critical zone, with range resolution likely to determine the next big move.

Related: 2026 Canton Price Prediction: DTCC Treasury Tokenization and $6 Trillion Asset Processing Target at $0.25-0.50

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.