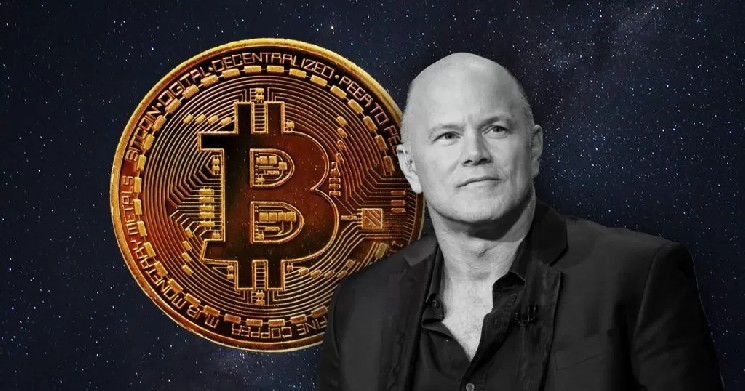

Mike Novogratz, CEO of Galaxy Digital, said the Bitcoin and Ethereum treasury company model has reached a critical breaking point, and companies that started with this structure are now being forced to choose between “transforming or slowly dying.”

In a podcast with investor and former Trump administration official Anthony Scaramucci, Mike Novogratz argued that simply owning crypto assets is no longer a sustainable business model. With a few exceptions like Strategy and BitMine, finance companies need to transform into businesses that provide real products and services, Novogratz said.

“Holding the underlying assets alone does not create shareholder value. Management needs to transform these structures into real companies,” Novogratz said.

According to the current situation, about 40% of Bitcoin treasury companies are trading below the net asset value (NAV) of the crypto asset. Additionally, over 60% of these companies purchased Bitcoin at prices significantly above the current market rate.

A similar stagnation is occurring on the Ethereum side. Novogratz pointed out that purchases in the market have all but stopped, and the only major company that continues to make regular purchases is Bitmine, which has accumulated more than 50% of ETH in the $21 billion Ethereum treasury ecosystem.

Novogratz admitted he too got caught up in the hype. “We have all been caught up in hype trading at some point,” Novogratz said, adding that the NAV premium is no longer in play and nearly half of the entire Bitcoin treasury space is trading at a discount. According to prominent investors, the fundamental reason is structural: Bitcoin and Ethereum ETFs give investors direct access to the assets and no longer have to pay a premium for their own shares.

Novogratz noted that Strategy’s financial strategy, launched in August 2020, has increased the stock price by approximately 10 times, but this success remains unprecedented.

“Out of 50 companies, only three have actually been able to implement this model. The rest have to dig themselves out of their own holes,” he said. Even strategy stocks are down more than 50% in the past six months, showing the model is under increasing pressure.

Asked what he would do if he were running a troubled financial company, Mr. Novogratz said his first step would be to buy back discounted shares to bridge the gap between NAV and stock price. But the real solution, he said, would be to develop a new business model based on the company’s existing human and asset base.

“If you own Bitcoin, Ethereum, Solana, you can use that money to set up a neobank and create a real product,” Novogratz said, adding that simply “holding cryptocurrencies” is no longer a marketable strategy.

*This is not investment advice.