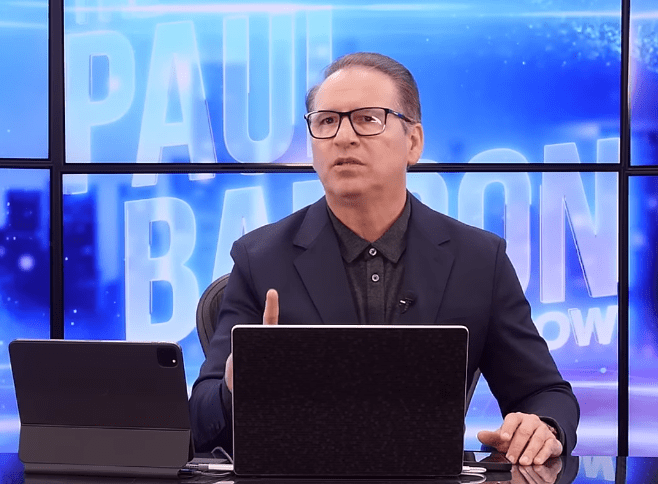

At the icy Davos summit, where financial order is often tightened, disruptive ideas are beginning to gain traction. This was announced by analyst Paul Barron, who predicts that the 2026 World Economic Forum could be the site of the end of financial multilateralism and the birth of a dollar backed by tangible and digital assets such as Bitcoin (BTC).

If Baron’s scenario comes true, it would cause the biggest earthquake in international finance since the 1970s. According to his comments, Donald Trump is preparing a presentation. “New Bilateral Bretton Woods” Plana strategy designed to dismantle the global debt system that has prevailed for the past 80 years.

Baron argues that the Trump administration is abandoning the current “trust and confidence” model, based purely on trust in the nation, in order to peg the dollar to a basket of real goods.

This “basket of goods” will include not only traditional gold, but also oil, strengthened by the hemisphere’s new energy independence, and, in a 21st century twist, other digital assets such as Bitcoin and XRP.

“[Trump]could raise the idea of backing the dollar with hard assets rather than a simple promise,” Baron said on January 11, 2026. For analysts, this means: “Direct declaration of war” on the central bank model It is led by the Federal Reserve and the Bank of England.

The end of the debt trap?

According to Barron, the aim of the movement is to liberate the Allies from what he defines as the “British imperial system.” Seen from this perspective, institutions that emerged in the mid-20th century, such as the International Monetary Fund (IMF) and the World Bank, would have played the following roles: Permanent debt tool to confiscate national assets When the country can’t pay.

According to speculation, President Trump’s vision is to move away from traditional multilateralism and embrace one-on-one agreements. The president will seek to protect economic sovereignty from the dictates of financial elites in Washington and Brussels by withdrawing the United States from various global organizations.

To understand the magnitude of change, we need to look back. In July 1944, in a New Hampshire hotel, representatives from 44 countries designed the original Bretton Woods system. This agreement linked the dollar to gold ($35 per ounce) and other currencies to the dollar, providing stability to the world. Richard Nixon broke that bond in 1971.

Since then, the world has lived in a system of floating exchange rates, backed by government bonds and capital flows, known as Bretton Woods II. But the rise of emerging economies and debt crises in countries like Argentina, which continues to battle the IMF’s debt cycle, has increased the appetite for a “Bretton Woods III” with a focus on real assets.

gold, oil, bitcoin

Far from being the aspiration of digital enthusiasts, Bitcoin’s strategic readiness has been reinforced as the axis of America’s new economic principles. President Donald Trump’s administration is refocusing its priorities on three assets defined by scarcity: gold, oil, and bitcoin. This strategic shift, supported by the approval of the Bitcoin Act of 2025, directs the Treasury Department to acquire 1 million BTC and marks the beginning of a historic revaluation of national reserves.

Despite the uproar caused by Barron’s publication, the White House has maintained hermetic silence. There is still no official confirmation that this ambitious plan will be formally presented to world leaders in Switzerland. The United States has launched a criminal investigation into Fed Chairman Jerome Powell.

This view is shared by other analysts who agree with Barron’s diagnosis. As reported by CriptoNoticias, the creation of a strategic Bitcoin reserve in the United States is emerging as a catalyst for a new global financial order akin to a modern-day Bretton Woods. In this sense, Bitcoiner Jack Mallers argues that Donald Trump’s strategy is deliberately trying to weaken the dollar. Promote the reconstruction of the national economy.

As the World Economic Forum in Davos takes place from 19 to 23 January 2026, questions remain about whether countries are really ready to move from the current statutory model to an order underpinned by scarcity of physical resources. If Mr. Barron’s prediction comes true, the international financial framework will be approaching its most decisive challenge in decades.

(Tag Translate) Featured