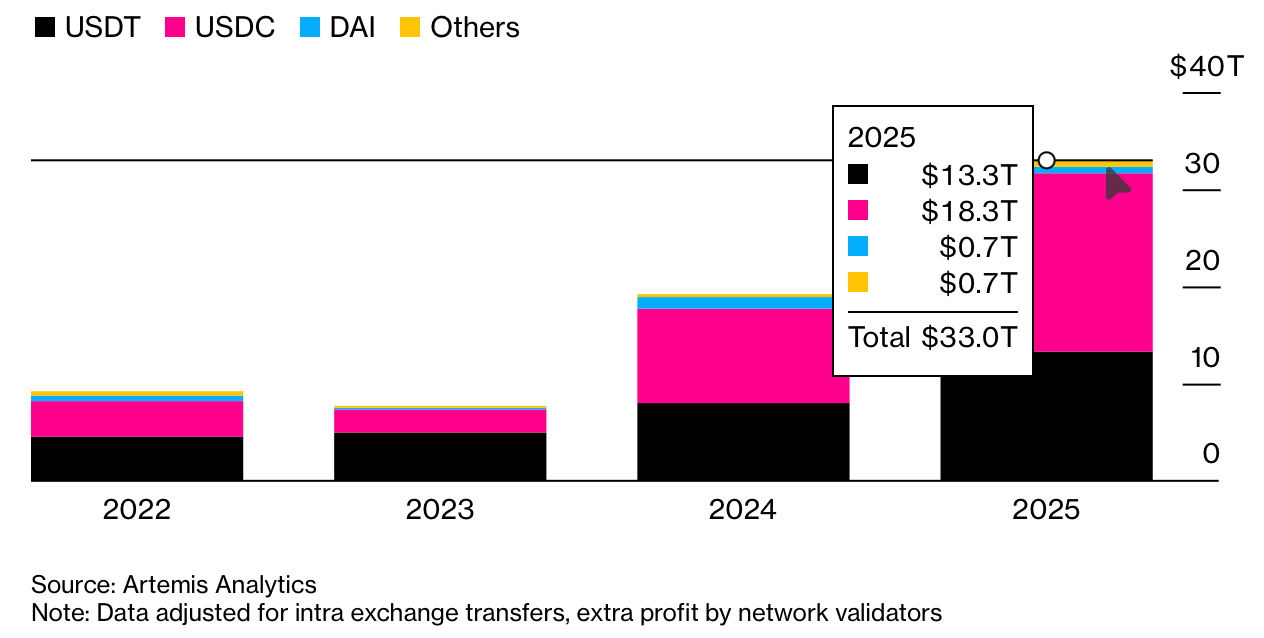

Due to favorable US policies and increased institutional adoption, stablecoin trading volume soared to a record high of $33 trillion in 2025. Data shows that USDC is leading the trade flow while USDT continues to dominate market value.

Pro-Crypto US Records stablecoin activity in the climate

Stablecoin usage surged to a new high in 2025, with transaction volume increasing 72% year over year to $33 trillion, according to data compiled by Artemis Analytics. This growth was fueled in part by a more cooperative regulatory environment in the United States under President Donald Trump’s secret currency administration.

USDC accounted for the largest share of activity, with annual transaction value reaching $18.3 trillion. Tether’s USDT followed with $13.3 trillion. Together, the two tokens dominated global stablecoin flows as adoption expanded beyond crypto-native users.

Policy changes played an important role. The passage of the Genius Act in July established a clear legal framework for stablecoins and fostered broader institutional interest. Companies like Walmart and Amazon are exploring stablecoin initiatives, and Trump family venture World Liberty Financial launched its own token, USD1, in March.

Artemis data also shows a shift in where stablecoins are used. Although overall trading volumes have increased, the proportion of transactions on decentralized crypto platforms has decreased, suggesting that mainstream and real-world usage is increasing.

Even though USDT is the largest stablecoin with a market capitalization of $187 billion, USDC is heavily used in DeFi and therefore dominates the transaction flow. In contrast, USDT is often used for payments, business transfers, and stores of value.

read more: Trump-linked World Liberty Financial seeks National Trust Bank approval for $1 stablecoin

Growth shows little sign of slowing. Stablecoin transaction value reached $11 trillion in the fourth quarter alone, up from $8.8 trillion in the previous quarter. Bloomberg Intelligence estimates that total stablecoin payment flows could reach $56 trillion by 2030.

Frequently asked questions 💵

• Why did stablecoin trading volume skyrocket in 2025?

Annual trading volume has reached an all-time high of $33 trillion, driven by U.S. Procrypt policies and increased institutional adoption.

• Which stablecoin led global trading activity?

USDC dominates $18.3 trillion in transaction flows and exceeds USDT in on-chain usage.

• Why is USDT still leading in market value?

USDT remains the largest by market capitalization due to its widespread use in payments and storage of value.

• How are stablecoins used outside of the crypto market?

Due to increased real-world usage, activity is shifting from DeFi to mainstream payments.