Hong Kong-based investment firm Trend Research continues to accumulate ether even though one of the largest corporate ETH holders predicts a significant withdrawal in the first quarter of 2026.

According to blockchain data platform Lookonchain, Trend Research acquired $35 million in Ether (ETH), bringing its holdings to over 601,000 ETH, worth approximately $1.83 billion.

The company has borrowed a total of $958 million in stablecoins from decentralized lending protocol Aave, with an average purchase price of approximately $3,265 per ETH, Lookonchain wrote in an X post on Monday.

Trend founder Jack Yee said he is “bullish” on cryptocurrencies for the first half of 2026 and pledged to continue buying Ether “until the bull market arrives” with “our largest position in ETH” and a “heavy” position in the Trump family-linked World Liberty Financial (WLFI) token.

He added, “2026 will be an overall positive environment for financial on-chain, stablecoins, interest rate cut cycles, crypto policy, etc.”

sauce: look on chain

Related: Bitcoin rises to $88,000 as Aave faces governance drama: redefining finance

Bitmine Immersion Technologies, the largest corporate holder of Ether, relies on dollar-cost averaging, but Trend Research has pledged to continue acquiring Ether regardless of “fluctuations of a few hundred dollars.”

Trend Research is the third largest Ether holder after Bitmine and SharpLink Gaming, but as a private company it is not listed on most tracking websites such as StrategicEthReserve.

Related: Crypto Speculation Hits 2024 Lows as TradFi Leveraged ETF Hits Record High of $239 Billion

FundStrat calls $1.8,000 ETH a bottom, but smart money shorts ETH price

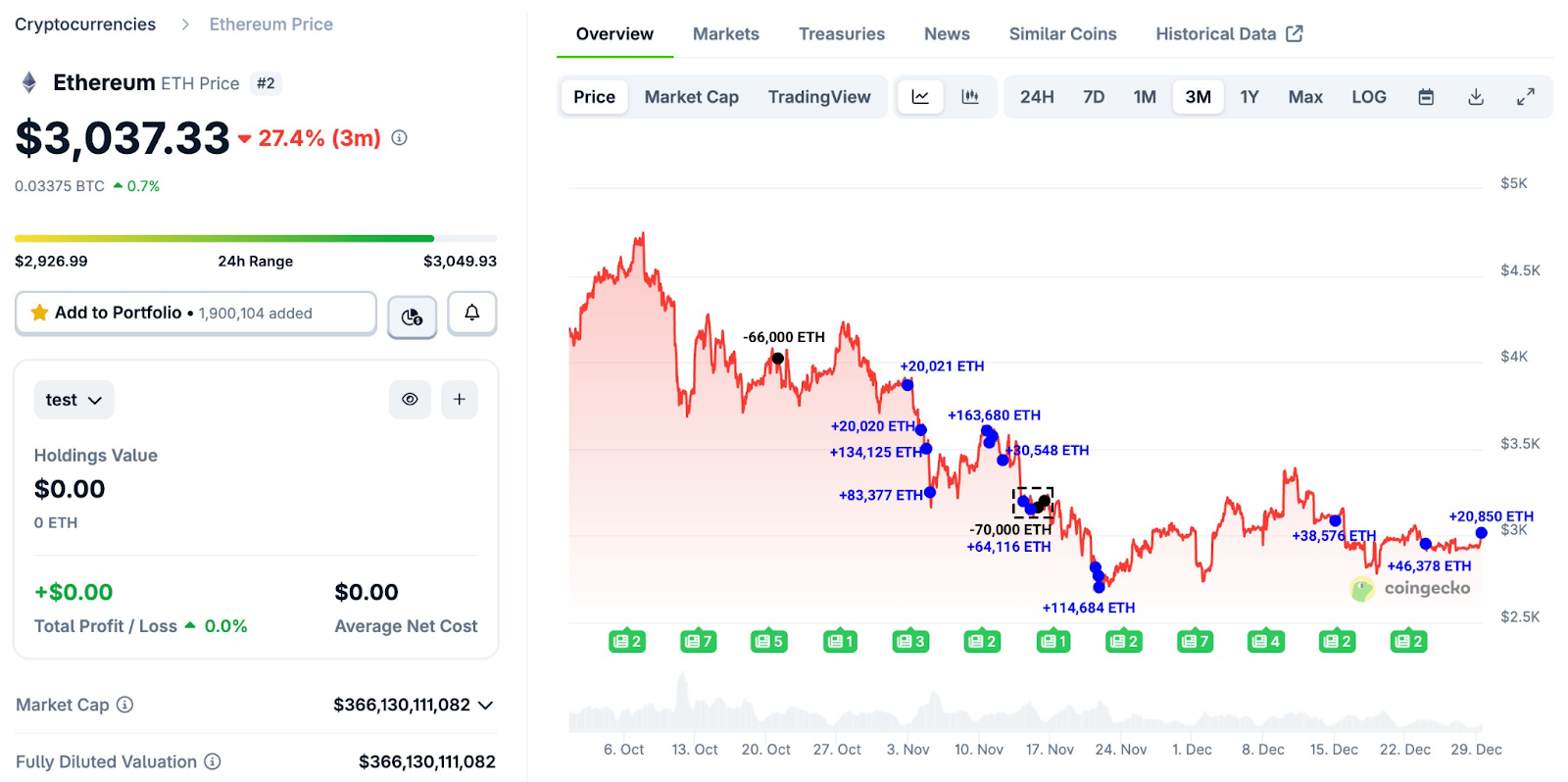

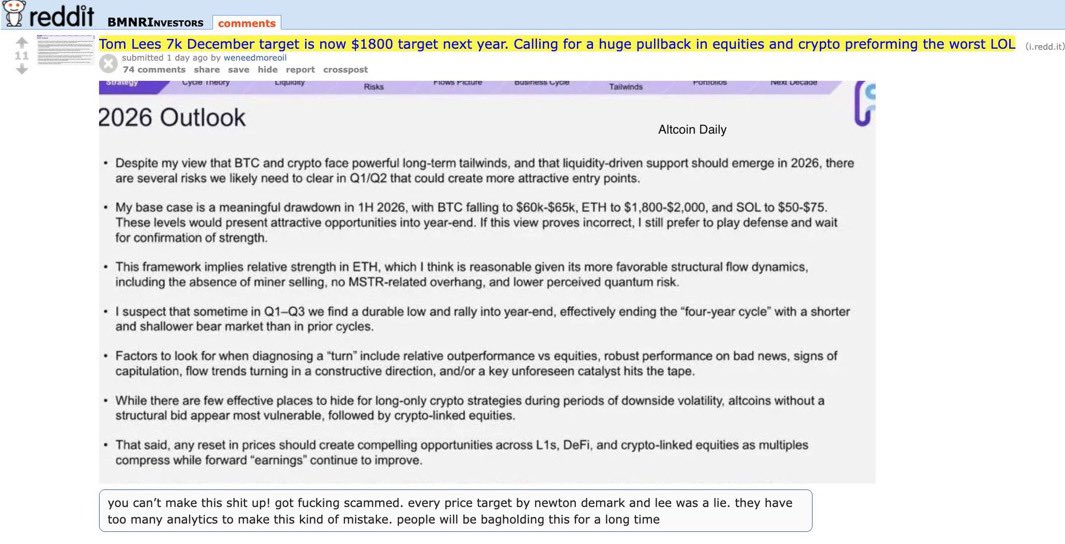

Mr. Yee’s optimistic outlook contrasts with insights shared by Fundstrat Global Advisors, which predicted that Ether would bottom near $1,800 in the first quarter of 2026.

On December 21st, screenshots of Fundstrat’s internal research notes by Tom Lee, co-founder and managing partner, were released. He predicted a “significant drawdown” in the first half of next year.

“My base case is a significant drawdown in the first half of 2026, with BTC falling from $60,000 to $65,000, ETH from $1,800 to $2,000, and SOL from $50 to $75. These levels represent attractive opportunities towards the end of the year.”

The note suggests the market could form a “sustained low” in the first or third quarter before rebounding towards the end of the year, resulting in a shallower bear market than in previous cycles.

The bearish prediction came as a surprise to investors, given that Lee is also the chairman of Bitmine, the largest corporate ether holder with approximately $12.3 billion in ETH holdings.

sauce: Alejandro BTC

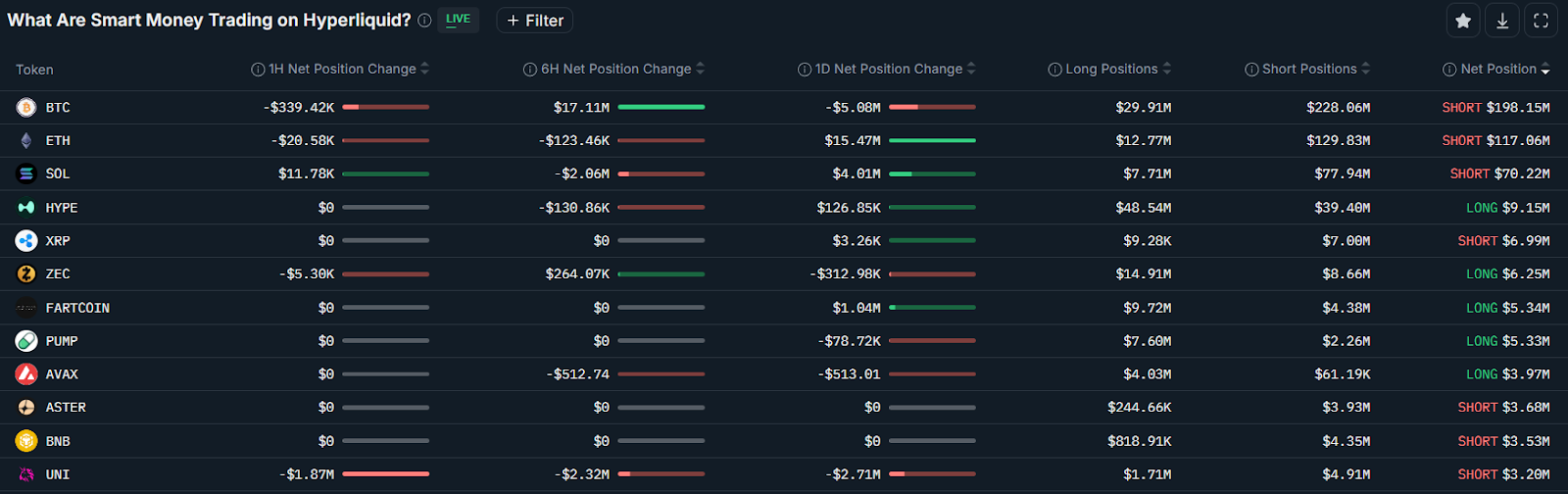

Meanwhile, the industry’s most profitable traders, tracked as “smart money” traders on Nansen’s blockchain intelligence platform, also continued to bet on a short-term price decline for Ether.

Smart money traders hold top perpetual futures positions in Hyperliquid. Source: Nansen

Smart money had a cumulative net short position of $117 million in Ether, according to Nansen data, but added $15 million worth of long positions in the past 24 hours, indicating a slight recovery in risk appetite among this key segment.

magazine: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom