Bitcoin is dancing in tight shoes today, hovering just below the psychological $90,000 level, as if to flatter commitment. With a 24-hour price range as narrow as a New Year’s diet plan, the asset conveys a sideways vibe with a market capitalization that would make some countries blush. The trading volume of $18.29 billion suggests that traders are either indecisive or too hungover from the recent volatility to take action.

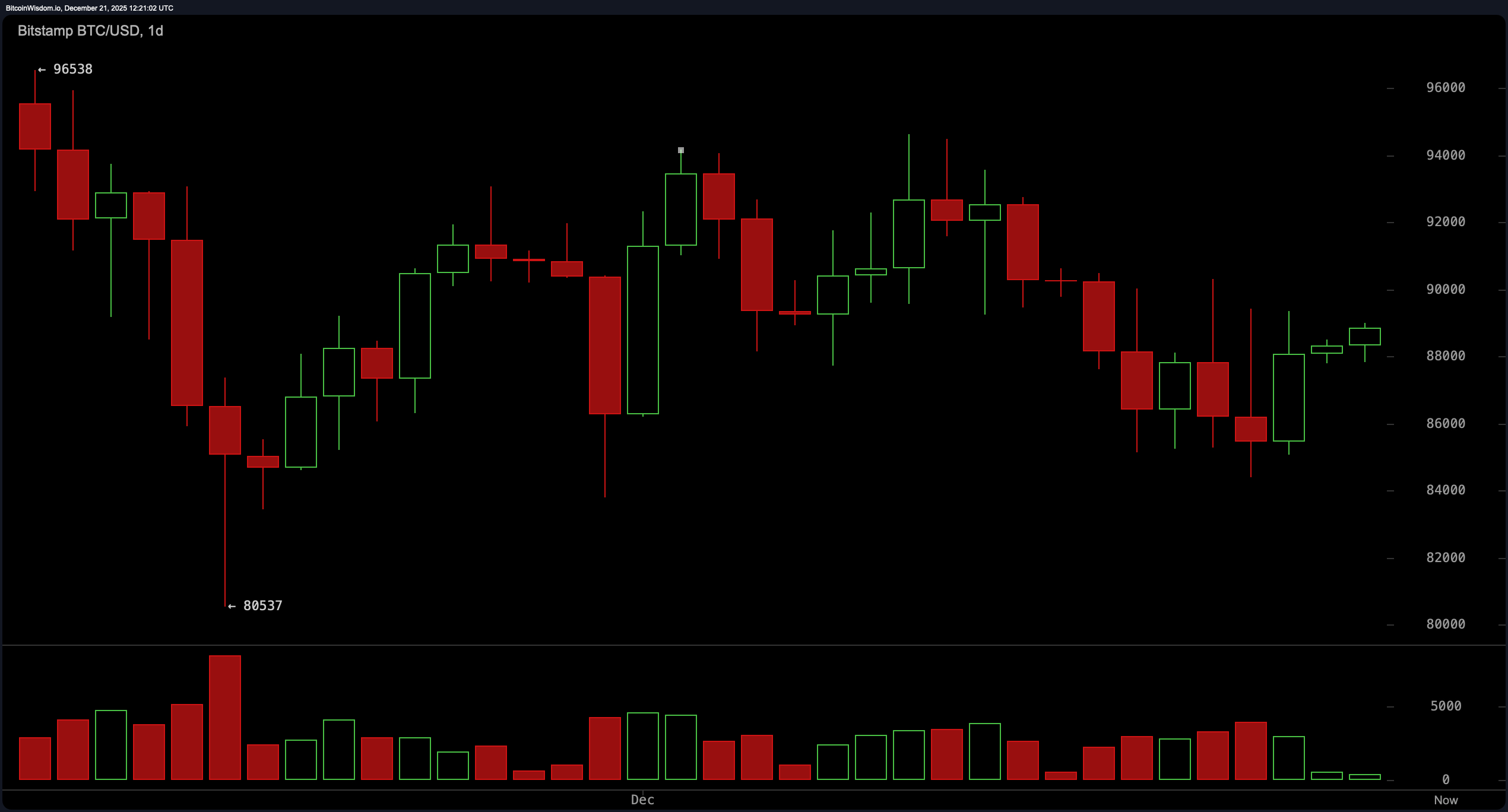

Bitcoin chart outlook

Bitcoin’s daily chart is trying to regain some composure after a melodramatic drop from around $96,538 to around $80,537. Prices have been boldly lowered in an effort to stabilize, and are currently spiraling between $86,000 and $90,000.

The Relative Strength Index (RSI) is 46, reflecting more indecision than enthusiasm, while the Moving Average Convergence Divergence (MACD) level is slightly optimistic at -1,561, deviating from the neutral set of oscillators. The 10-period Exponential Moving Average (EMA) and Simple Moving Average (SMA) support the current price, but what about the 20-period, 30-period, 50-period, 100-period, and 200-period variations? Although not very generous, they are all comfortably parked above their current level, forming a resistance phalanx worthy of Sparta.

BTC/USD 1-day chart via Bitstamp for December 21, 2025.

Zooming in on the 4-hour chart, Bitcoin’s short-term story looks like a recovery story with unresolved trauma. After a wild liquidation candle fell from $90,317 to $84,398 on December 18th, it has been climbing higher and lower. This structural rally, which is currently testing the 88,500 to 90,000 supply zone, lacks strong volume momentum, suggesting that while prices want to move higher, they are not yet convinced. The stochastic oscillator at 39 and the Commodity Channel Index (CCI) at -47 whisper rather than scream, giving traders more room for interpretation than a modern art museum.

BTC/USD 4-hour chart via Bitstamp on December 21, 2025.

On an hourly level, Bitcoin has drawn a cozy consolidation pattern, trading closely between $88,000 and $89,000. A nice oscillator of -1,590 and a momentum reading of -3,804 add a bit of a grimace to the picture, indicating that the asset may be holding its breath or simply getting tired. Low volume is the uninvited guest here, so a breakout above $89,500 will require serious participation. Until then, this microwaving action may feel like watching paint dry, even if it’s very expensive.

BTC/USD 1 hour chart via Bitstamp for December 21, 2025.

From a structural perspective, Bitcoin has the backbone of a bullish story, but lacks the power to act confidently and flexibly. The high low price is encouraging, and the $86,000 support is acting like a firm mattress. However, the macro resistance at $90,000 is still the velvet rope of the nightclub, and while the price wants to rise, the bouncers (volume) are unfazed. If volume finally wakes up and price breaks through that ceiling, we may see a decisive shift in momentum. Until then, patient strategy takes precedence over impulsive heroism in this setting.

Bottom line: Bitcoin is playing a careful balancing game on December 21st. With mixed signals on the oscillators and moving averages, and prices consolidating that scream “wait for confirmation,” now is not the time to make rash decisions. Instead, watch the chart, respect the range, and focus on the 90,000 mark as if you were owed money. Because if it belies conviction, Bitcoin may have a lot more to say.

Bullish verdict:

If the price closes above $90,000 with strong volume support, the bullish case will build undeniable momentum. With lows forming across all time frames and early support in the short-term moving averages, Bitcoin could be poised for another rally. If the breakout structure is confirmed, the bias will be toward continued upside, even if volume ultimately decides to show up at the party.

Bear verdict:

Failure to break above $90,000 could indicate that the recent rally was just a blip, especially if increased volume pushes it below $85,000. Sustained resistance across all long-term moving averages, along with weakening momentum and neutral oscillator readings, suggests the bulls are on probation. A break below $84,000 would invalidate the recovery narrative and open the door to a more serious correction.

Frequently asked questions 🧠

- What is the price of Bitcoin today? Bitcoin is trading at $88,787 as of December 21, 2025.

- Is Bitcoin expected to rise above $90,000?Whether it will break above $90,000 will depend on solid volume confirmation.

- What are the major support and resistance levels?Support is near $86,000 and resistance is near $90,000.

- Is now a good time to trade Bitcoin?Current technicals suggest waiting until a clearer trend is confirmed.