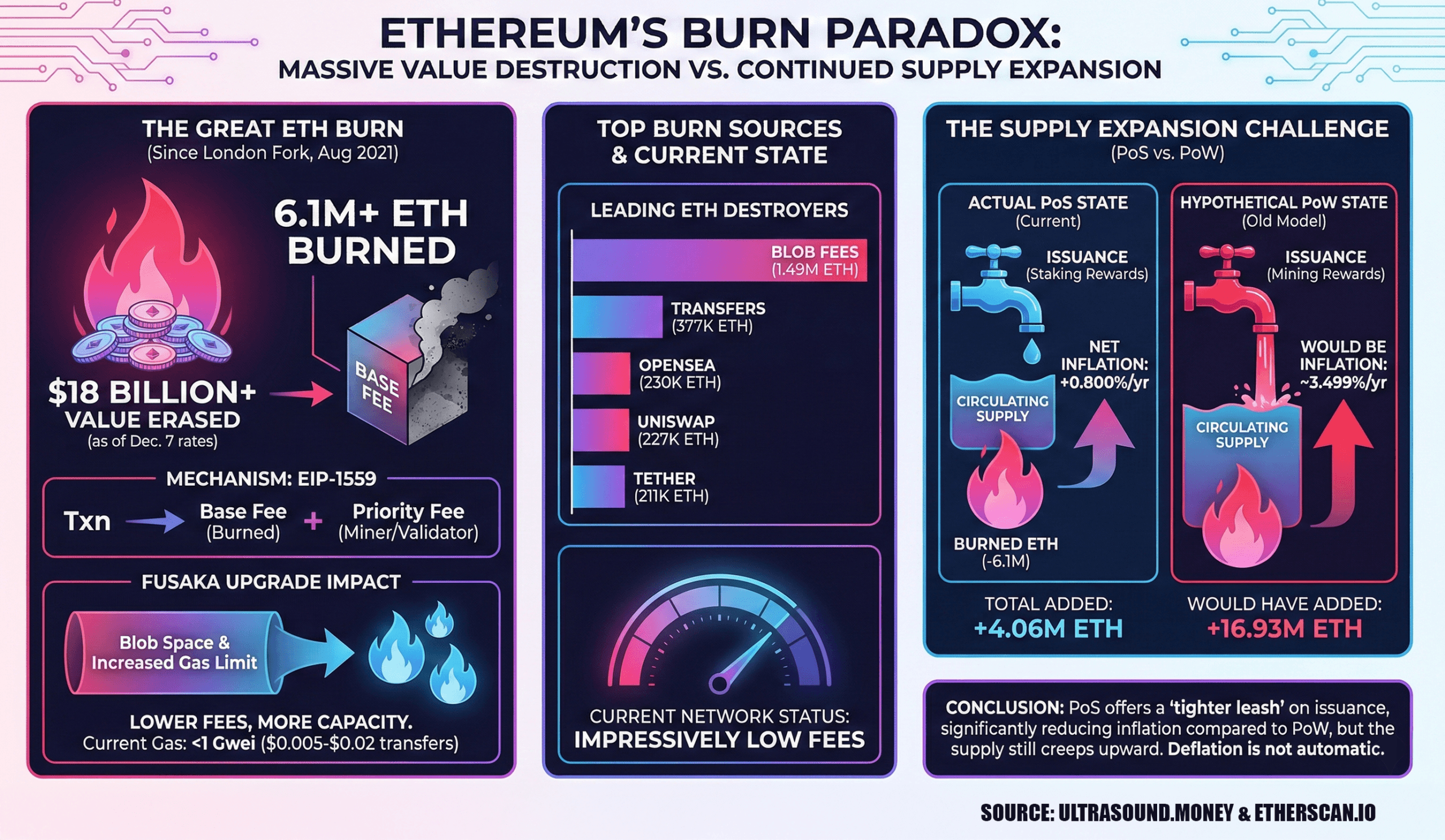

According to the index, the total amount of ETH burned in fees is over the 6 million mark, meaning that as of December 7th exchange rates, more than $18 billion in value has effectively disappeared since the London hard fork on August 5, 2021.

ETH Bonfire Crosses 6 Million ETH Since 2021 London Upgrade

Just recently, Ethereum rolled out the Fusaka upgrade. This dramatically expanded the data and gas capacity of the network (think higher block gas limits and much larger blob space), allowing each block to handle more call data and rollup blobs.

The Fusaka upgrade reorganized Layer 2 (L2) charges and by extension reduced on-chain (L1) gas charges. According to etherscan.io’s gas tracker, Ethereum’s on-chain fees are surprisingly low, below a single gwei.

As of 11 a.m. ET on Dec. 7, the low priority rate was hovering around 0.305 Gwei, while the high priority rate was around 0.326 Gwei. This puts Sunday transfer costs between $0.005 and $0.02, while smart contract moves such as swaps, NFT sales, and bridging run between $0.14 and $0.50 per action.

When the London hard fork arrived in August 2021, EIP-1559 was introduced. This is a complete overhaul of Ethereum’s transaction fee mechanism, which introduces dynamic base fees that are automatically burned on every block and disappear forever.

The fork landed 4 years, 4 months, and 2 days ago (including the leap year peculiarity), and since then, 6.1 million ETH worth $18 billion has been removed from circulation. Ultrasound.money’s indicators reveal that BLOB fees reign as the largest ETH burner, with 1,492,094 ETH disappearing alone.

A traditional Ether transfer will torch 377,388 ETH, while non-fungible token (NFT) marketplace Opensea will reduce 230,051.12 ETH to digital ash. Decentralized exchange (DEX) Uniswap v2 was not far behind, with 227,337.27 ETH consumed, and Tether (USDT) usage vanished with 211,342.55 ETH. Rounding out the top five, Uniswap v1 has erased an additional 153,585.62 ETH since 2021.

read more: Isn’t there a Santa Rally? Bitcoin derivatives market hints at a cold December

Despite 6.1 million ETH being burned, the network still shows an annual inflation of 0.800%, according to statistics over the past four years. Approximately 4,065,657 ETH has been added to the supply since the London hard fork. The proof-of-stake (PoS) model offers relaxed issuance compared to the proof-of-work (PoW) model. If Ethereum were still operating in a PoW system, the annual inflation rate would have remained at 3.499% and a large amount of 16,931,820 ETH would have been added to circulation, according to simulated data.

While PoS maintains issuance in tougher conditions, Ethereum supply is still slowly increasing, reminding everyone that dreams of deflation are not automatic. Nevertheless, the network has come a long way since the London hard fork, dramatically reducing potential inflation compared to the old PoW era.

Frequently asked questions ❓

- What caused the Ethereum mass write?

Ethereum write activity stems from EIP-1559, which destroys the dynamic base price of every block. - How much ETH has been spent since the London hard fork?

More than 6 million ETH worth approximately $18 billion was removed from circulation. - Did the Fusaka upgrade affect Ethereum fees?

Yes, Fusaka has expanded block capacity and mainly improved L2 transaction costs. - Is Ethereum deflationary after all this flare-up?

No, even though a significant amount of ETH has been destroyed, the network remains slightly inflated.