The Bitcoin market structure is believed to have undergone significant changes following a significant price drop that occurred on October 10, 2025. The top cryptocurrency has been on a similar stage of its recovery path since the market carnage, but some sectors believe the bear season has already begun.

With BTC below its 2025 market cap, it is becoming increasingly difficult to make a bullish case for the world’s largest cryptocurrency. Moreover, interesting data points about the relevant Bitcoin investor class have emerged, further lending credence to the start of a bear market.

Are Bitcoin treasury companies offloading their coins?

In a new post on This conclusion is based on the balanced growth of a group of investors known as “Dolphins.”

Dolphins refer to a group of cryptocurrency investors holding significant amounts of coins, positioned between the smallest investors (shrimps) and the largest investors (whales). In particular, Moreno described Dolphin as a wallet address that holds a significant amount of BTC, between 100 and 1,000 coins.

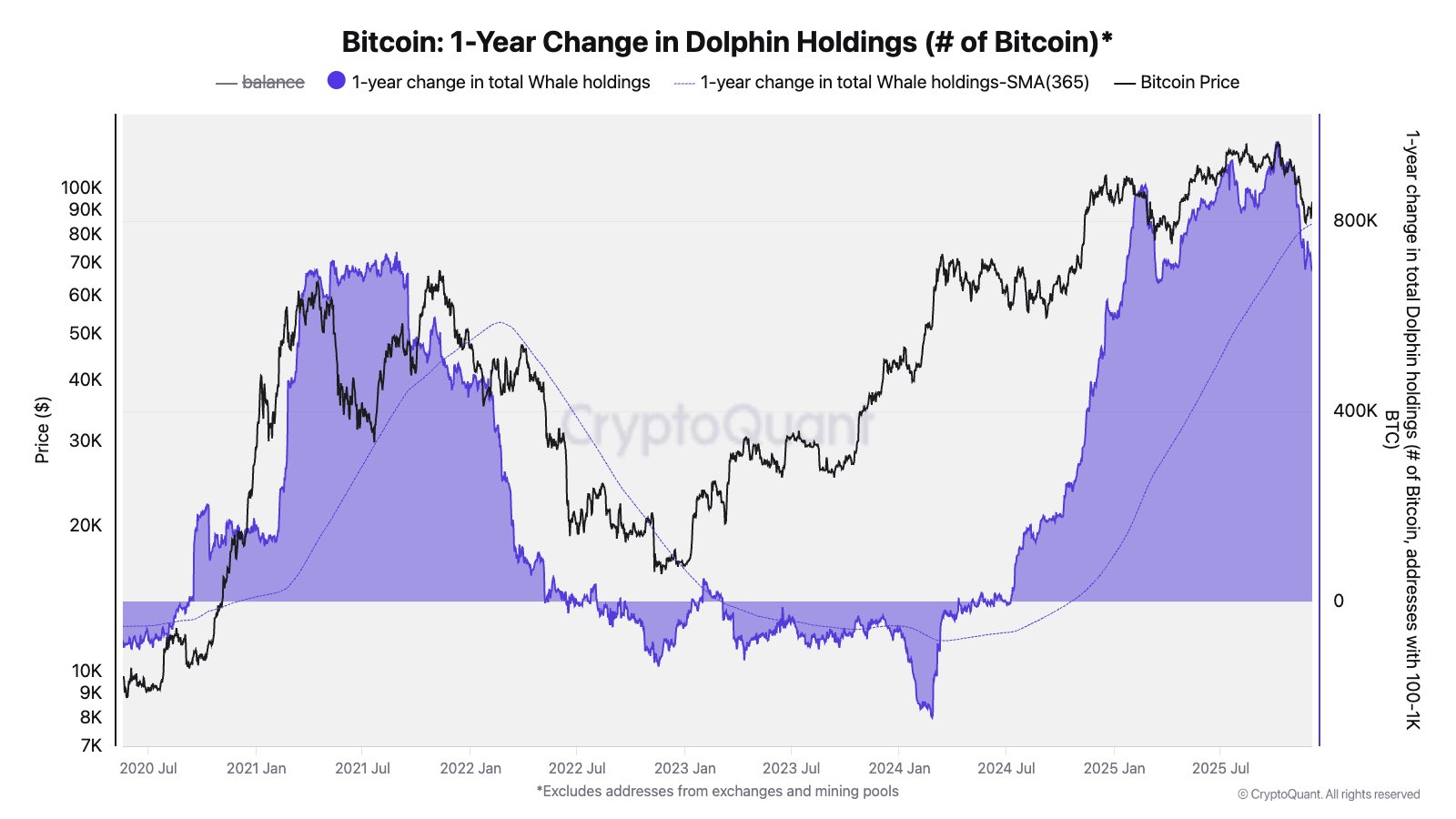

According to the latest data from CryptoQuant, the growth rate of the Dolphins’ BTC holdings has slowed over the past year and appears to be trending downward. Moreno believes that these negative changes signal the emergence of a Bitcoin bear market.

Source: @jjc_moreno on X

Moreno said these Dolphin addresses increased by about 965,000 BTC year-on-year when the BTC price reached its current all-time high of about $125,000. Now that the BTC price is nearly 30% below its all-time high, Bitcoin Dolphins’ balance stands at around 694,000 coins.

Moreno wrote to X:

This group of addresses includes ETF and Treasury companies that have stopped buying.

More interestingly, the CryptoQuant research director revealed that this group of investors is made up of ETF issuers and Treasury companies that have stopped buying Bitcoin. US-based Bitcoin exchange-traded funds have seen net outflows in five of the last six weeks, according to data from SoSoValue.

Meanwhile, BTC and cryptocurrency finance companies have struggled over the past few months with individual investors losing tens of billions of dollars due to the hype. While there have been few reports of cryptocurrency treasury selling, this decline in dolphin holdings tells a completely different story.

Bitcoin price at a glance

As of this writing, the BTC price is around $89,151, down more than 3% in the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image by Dall-E, chart from TradingView

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.