In cryptocurrencies, acting early can probably pay off big. This certainly seems to be the case with Ripple Labs, a San Francisco-based blockchain company currently worth more than $40 billion.

And while the company has been at odds with the SEC for years, the regulatory environment has improved considerably since President Trump took office. Since the US presidential election, the price of XRP, the altcoin Ripple launched back in 2012, has been hovering above $2, a price range not seen since the 2017 blockchain bull market.

But are there any real use cases for XRP?

XRP Payment Corridor

Hedy Wang, CEO of crypto liquidity provider Block Street, said that while Ripple’s footprint in the US could now expand, it already has momentum in other parts of the world.

““In the US, there have been more constraints because of the whole SEC dynamic, so the focus has been skewed toward retail stores and offshore venues. Historically, we’ve seen significant XRP traction in Japan, parts of East Asia, and some regions with high remittances like the Philippines and Latin America via partners,” Wang told BeInCrypto.

What is undeniable is that investors have been acquiring XRP over the past year. Since Trump was elected in November 2024, the price of XRP has increased 330% from $0.50 to $2.15.

XRP price performance since November 2024. source: CoinGecko

“Bitcoin is considered ‘digital gold,’ and Ethereum is known for its smart contracts,” said Gregory Monaco, a certified public accountant who runs a CPA firm with the same name. “The value of XRP comes from cross-border payments.”

Monaco cited Ripple’s 300 financial partners in 45 countries and annual cross-border payments volume of $15 billion as key indicators of Ripple’s use case.

Therefore, it is possible that companies operating cryptocurrencies such as Ripple will invest actual personnel and work on realizing important payment channels.

“XRP can survive as a niche financial conduit if Ripple continues to accumulate licenses and bank/fintech integrations,” Block Street’s Wang added.

Crossing borders is not so simple

The term “cross-border payments” may sound like corporate jargon. But ask anyone who has sent money from one country to another, and it’s clear that this is a problematic process. It may be late. Can be expensive.

In addition, you will also need to exchange foreign currency. Cryptocurrencies like XRP are borderless, global, and cheap. There is value in reducing reliance on TradFi’s regular payment system.

Working at Airbnb helped Coinbase’s Armstrong understand cross-border payments. sauce: ×

Still, “hopium” alone doesn’t necessarily mean XRP’s valuation is so closely tied to its payments use case, notes Paul Holmes, a researcher at BrokerListings.

“XRP is still very much a speculative asset,” Holmes told BeInCrypto. “For cryptocurrencies as a whole, their valuations are not supported by their own revenue sources and are therefore a function of liquidity production and reallocation from other stores of value.”

Crypto investors and OG whales may simply be accumulating more XRP, as Ripple Labs, the largest investor in the cryptocurrency, appears to be a fairly well-performing crypto company.

Ripple’s recent influx of $500 million in capital from Fortress Investment Group and Citadel Securities at a valuation of $40 billion certainly reflects that.

XRP as an ETF catalyst

Recently, UK-based CoinShares withdrew from launching a US XRP ETF product, which would likely increase demand from investors sticking to public markets.

“CoinShares likely pulled out because the SEC hasn’t made it regulatory clear that XRP is ETF-compatible,” said BrokerListings’ Holmes.

It is important to keep in mind that CoinShares also decided not to launch an ETF for Solana or Litecoin. As such, XRP is not alone in the hesitance to launch products backed by these cryptocurrencies.

“XRP is already being used to move value between currencies, stablecoins, and the growing number of tokenized financial assets on the network,” said Raquel Amanda, senior communications lead at Ripple. “As the ecosystem grows, the need for fast and neutral payments will grow, and we believe XRP will naturally continue to fill that role.”

According to data from CoinGecko, the price of XRP has increased more than 36,000% since it was first listed on the exchange on August 3, 2013.

Historical price performance data for the XRP cryptocurrency. sauce: CoinGecko

But the irony of speculative assets being used to pay is not lost on BrokerListings’ Homes.

“On-chain activity shows that there are 50 million to 55 million XRP transactions per month, the majority of which are payments,” he noted. “At the same time, XRP is still used by many as a more speculative asset than practical, and cannot be relied upon as a reliable store of value.”

Rift to the moon?

Although it may seem confusing to use a volatile asset like XRP as a payment rail, it is important to remember that many cryptocurrencies like XRP are highly divisible and fast.

XRP is essentially “programmable money.” You can implement code that uses the amount of XRP you want based on the current trading price.

And for high-end institutional payments where XRP is used, it doesn’t really matter what the backend looks like as long as the money gets to its destination.

While stablecoins may be popular for consumer use and transactions, XRP serves as a type of logistics funds transfer vehicle for companies that need to transfer value globally.

This explains why, according to Monaco Chartered Accountants, 58% of the activity on the network originates from just 10 wallets.

This use case, along with the aborted battle between Ripple Labs and the SEC, is likely the basis for a bullish narrative.

By early 2024, there were over 5 million XRP wallets on the network. After Trump’s victory, on November 13, 2024, the securities app Robinhood relisted XRP on its app.

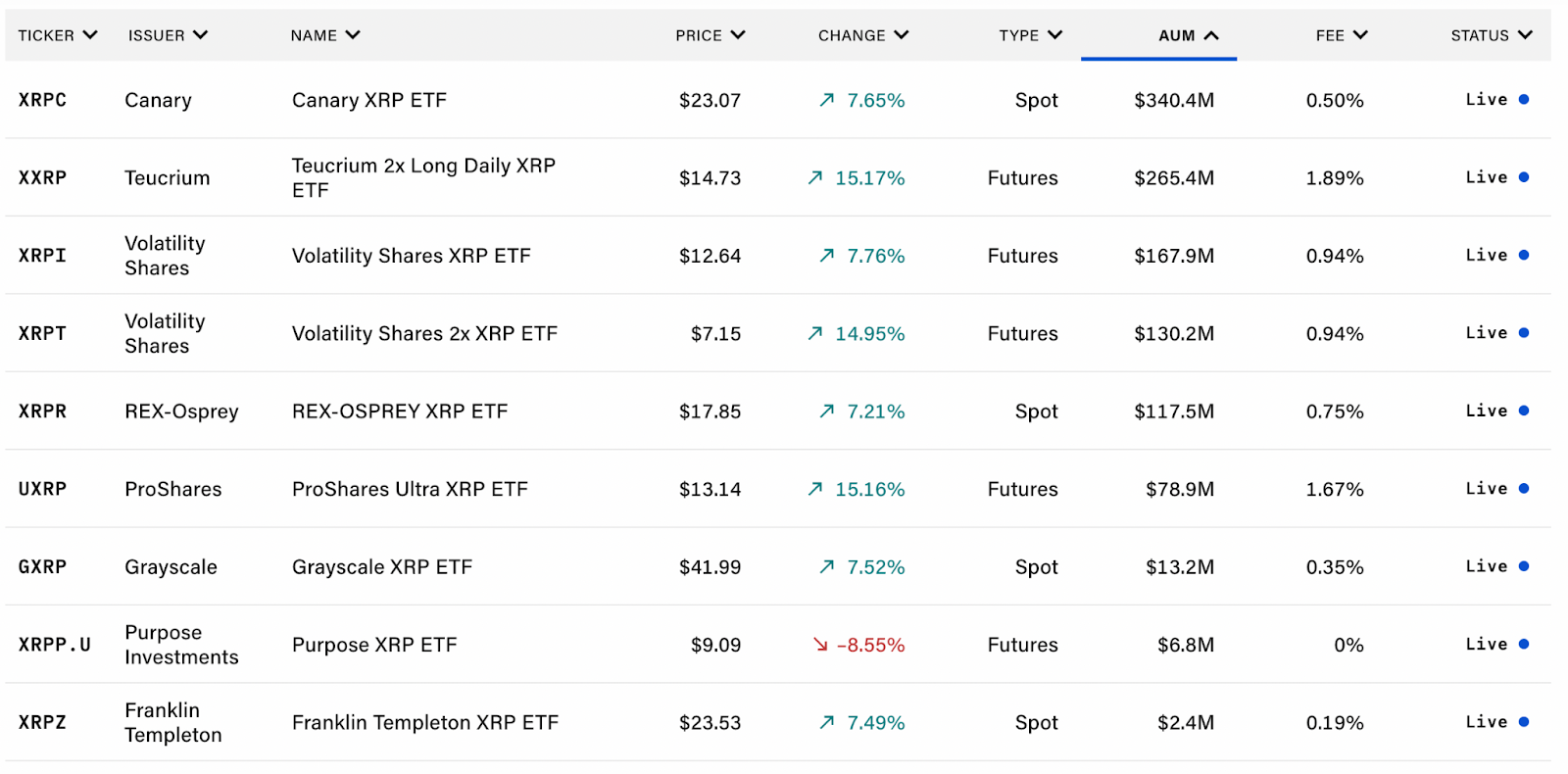

A list of XRP ETF products already operating on the public market.

In May 2025, Ripple Labs agreed to a $50 million judgment in a dispute with the SEC, ending a years-long quagmire that likely held back XRP for some time.

Also, XRP doesn’t necessarily need a CoinShares ETF, as there are already nine live products on the market with $1.1 billion in total assets under management (AUM).

Yes, the XRP legion (as the chain’s avid investors like to call it) believes there are many reasons to be hopeful about the future, with far less downside risk than ever before.

The post XRP Is Up 330% Since President Trump’s Election, But What’s It Really For? appeared first on BeInCrypto.