A handful of big deals drove nearly half of Web3 venture capital activity in the third quarter of this year, according to Galaxy Digital research released this week.

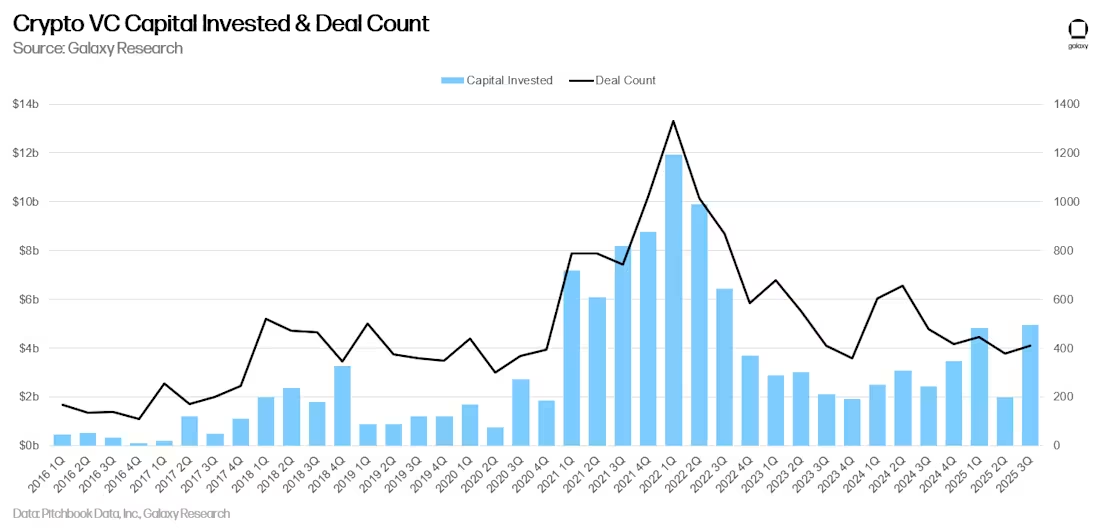

VCs invested $4.65 billion in crypto-focused startups and private companies in 415 deals over the same period, an increase of 290% from the second quarter, but activity remains below 2021-2022 levels, the report notes. This growth is primarily driven by later-stage companies, indicating that capital continues to be concentrated around established companies rather than early start-ups.

Cryptocurrency VC investment capital and number of transactions. Source: Galaxy Digital

Just seven deals accounted for about 50% of all capital pumped into crypto companies, including a $1 billion round for European fintech giant Revolut, which saw their valuation soar to $75 billion. Another $500 million was invested in Kraken, giving the US exchange a value of $15 billion.

It is worth noting that this quarter, the exchange raised an additional $800 million, increasing its valuation to $20 billion.

Other large checks went to blockchain infrastructure platform Erebor, crypto asset management company Treasury, tokenized payment network Fnality, Mesh Connect, which connects financial institutions to blockchain, and cryptocurrency custody platform ZeroHash.

Together, these seven deals raised more than $2.26 billion in the third quarter, accounting for 48.7% of all venture capital poured into crypto and blockchain-related companies during the same period. Despite improving sentiment and increased activity, Galaxy Digital suggests that “the golden age of pre-seed crypto venture investing is behind us.”

According to Galaxy’s separate Q3 report, crypto lending surged last quarter to a new all-time high, led by DeFi lending.