Main highlights

- Bitcoin rises, jumping 8% in 24 hours to more than $92,000

- The rise came after Vanguard announced: This will give the brokerage’s clients access to investment funds such as ETFs focused on Bitcoin, Ethereum, XRP, and Solana.

- The cryptocurrency’s surge is seen as sparking further upward momentum ahead of the Fed meeting on December 10th.

On December 2nd, the largest cryptocurrency Bitcoin (BTC) soared more than 8% on the daily chart, jumping from $84,800 to more than $92,000.

At the time of writing, the cryptocurrency was trading at around $91,740, with a market cap of an impressive $1.83 trillion, according to CoinMarketCap.

Why is Bitcoin rising?

One of the main reasons for the upward trend is the accumulation of Bitcoin by whales. Crypto whales took the initiative last month and launched a number of large-scale transfers. They are moving millions of dollars worth of Bitcoin from secure personal wallets to exchanges and to new, unknown addresses.

BlackRock deposited 1,634 $BTC($142.6M) to #CoinbasePrime. https://t.co/qmuDIrPHc6 pic.twitter.com/sP3Mm1JOPW

— Lookonchain (@lookonchain) December 2, 2025

For example, BlackRock has deposited 1,634 Bitcoins worth $142.6 million with Coinbase Prime. Some experts believe this may be a tactic to sway small investors and create an opportunity to buy more Bitcoin at a lower price.

Data from the analysis platform Arkham shows unusual levels of whale activity in November. Over $100 million worth of Bitcoin was transferred from cold storage wallets to exchanges in multiple transfers.

Generally, this type of transaction indicates that a major holder is preparing to sell their holdings.

Vanguard opens the door to Bitcoin ETFs

Vanguard, a major asset management company, made a major announcement on December 2nd. The company changed its previous stance and revealed that it will now allow brokerage clients to access investment funds such as ETFs focused on Bitcoin, Ethereum, XRP, and Solana.

Vanguard effect: Bitcoin rose 6% near the US Open on the first day after the ban on Bitcoin ETFs was lifted. Coincidence? I’m afraid not. Additionally, IBIT’s trading volume reached $1 billion in the first 30 minutes of trading. Even among the most conservative investors knew there was a bit of perversion in Vanguardian… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

“Crypto ETFs and mutual funds have been tested through periods of market volatility and have performed as designed while maintaining liquidity,” said Andrew Kajeski, head of brokerage and investments at Vanguard. “The management processes for servicing these types of funds have matured and investor preferences continue to evolve.”

This is considered to be one of the most important news stories of today that caused a rise in the cryptocurrency market.

According to market experts, the cryptocurrency market is showing signs of recovery. We’re already starting to build a bullish outlook for the big day of December 10th, when the next Fed meeting will be held.

According to crypto fortressthe next important point is expected to be on December 4th. The intraday price action will likely indicate short-term direction. If prices rise on December 4th, a short-term reversal is expected. Conversely, if prices fall, the downtrend is likely to continue.

The price of Bitcoin is currently trading just 19% above the estimated average cost of electricity for miners to produce Bitcoin. Historically, market prices have fallen below this important production cost threshold only twice in the past five years. The first time was during the global financial crisis in March 2020, and it happened again in April 2024.

This level is currently a major focus for experts, as any potential decline below this level is likely to trigger a wave of mine surrenders.

However, there are also some contradictory predictions regarding Bitcoin. For example, one analyst said that Bitcoin’s 4-hour candlestick failed to close the body above a certain level.

“Currently, no one can confidently say that Bitcoin will rise until it breaks through that level, that is, until the definitive 4-hour candlestick breaks above that level,” the analyst said.

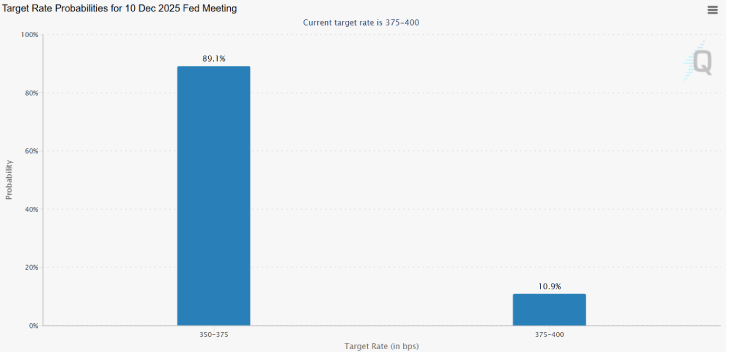

(Source: CME Group)

Separately, expectations for lower federal interest rates are also rising. CME Group’s indicators show there is about an 89% chance that the Fed will cut rates by 25 points.