While some Ethereum OGs are cashing in, the top 1% of wealthy Ethereum holders continue to quietly accumulate the world’s second-largest cryptocurrency despite the market downturn.

Ethereum new coin offering (ICO) participants sold an additional $60 million in Ether (ETH) on Wednesday after generating a 9,500x return on investment over the past 11 years.

During the ICO, investors bought Ether at around $0.31 per token, spending a total of $79,000 on 254,000 Ether tokens, now worth more than $757 million, according to blockchain data platform Lookonchain.

After the latest sale, ICO participant wallet 0x2Eb was reduced to just $9.3 million in Ether, according to cryptocurrency intelligence platform Nansen.

Ethereum ICO participant wallet 0x2Eb, token holdings, 1 year chart. Source: Nansen

While some crypto investors praised the patience of long-term holders, others took the profit-taking as a worrying sign ahead of further declines in the crypto market.

“This trend of OGs selling their bags is alarming,” X user Ray responded on Wednesday.

Despite the concerns, whale activity does not indicate sudden panic selling, but rather a steady profit-taking strategy as wallets have been releasing their holdings since early September.

Related: Cathie Wood says ARK’s $1.5 million Bitcoin bullish price remains unchanged amid market attention

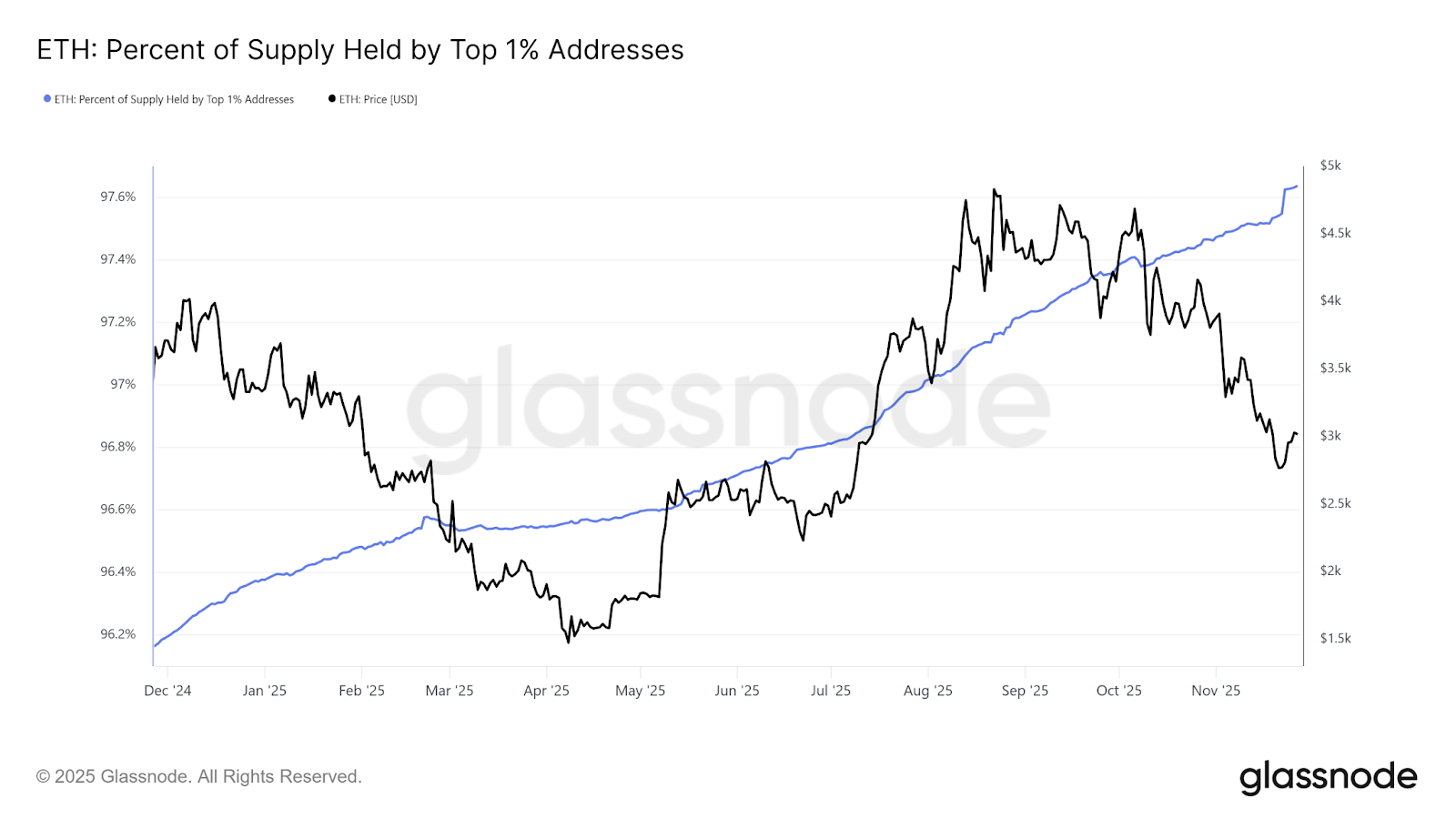

The top 1% of Ether holders continue to accumulate, untroubled by the downturn in the crypto market.

Despite the market downturn, the top 1% of wealthy Ether holders have been quietly accumulating steadily.

The top 1% of addresses held 97.6% of the Ether supply on Wednesday, up from 96.1% a year ago, according to blockchain data platform Glassnode.

ETH: Percentage of supply held by top 1% of addresses, graph over 1 year. Source: Glassnode

Related: More than 8% of Bitcoin traded in one week, market on ‘knife edge’, analyst says

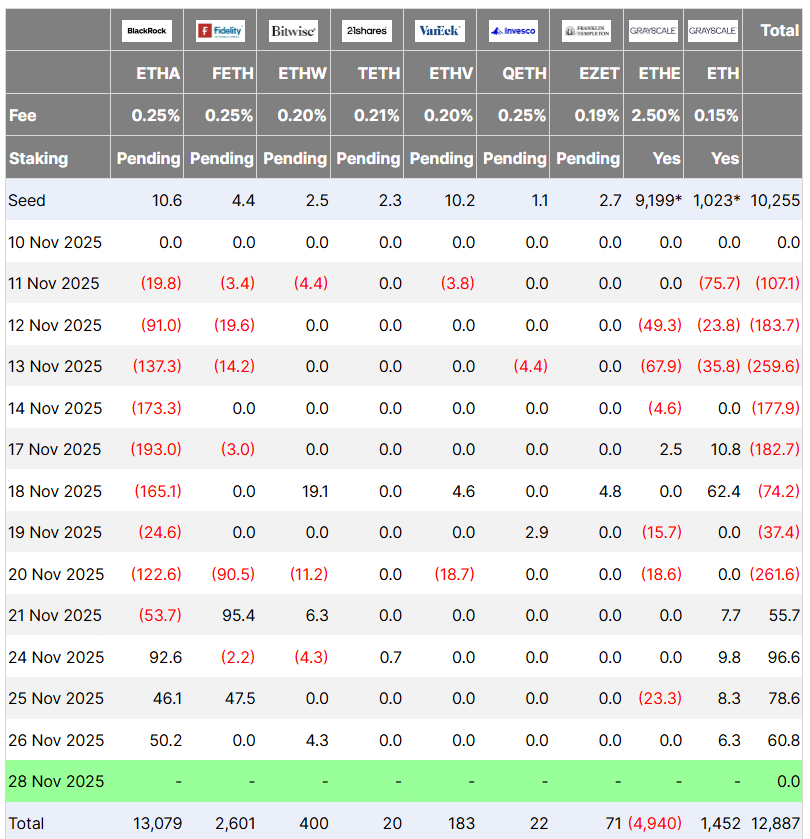

The U.S. Spot Ether exchange-traded fund (ETF) also resumed accumulation this week, recovering from eight consecutive days of net outflows.

The Ether ETF recorded $60 million worth of net inflows on Wednesday, marking its fourth consecutive day of positive gains, according to Pharcyde Investors.

Ethereum ETF Flow (USD, million). Source: Farside Investors

Despite “constructive” Ether ETF inflows and upcoming Ethereum Fusaka upgrades, the market reaction remains “measured,” according to Ilya Karchev, a dispatched analyst at digital asset platform Nexo.

“The combination of steady inflows and increased derivatives activity suggests investors are selectively restructuring their exposure rather than actively rotating across the complex,” the analyst told Cointelegraph.

magazine: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom