ETH deposited into the Aave lending protocol reached a new record, peaking at over 3 million tokens. Collateral deposited doubled in 2025, with Aave becoming the leader.

ETH deposits into Aave accelerated throughout 2025 as confidence in DeFi grew. Aave was a way to tap into the value of ETH, either directly as collateral or through wrapped tokens. According to data from Sentora, Aave is now being taken over 3M Ethereumthe highest record ever.

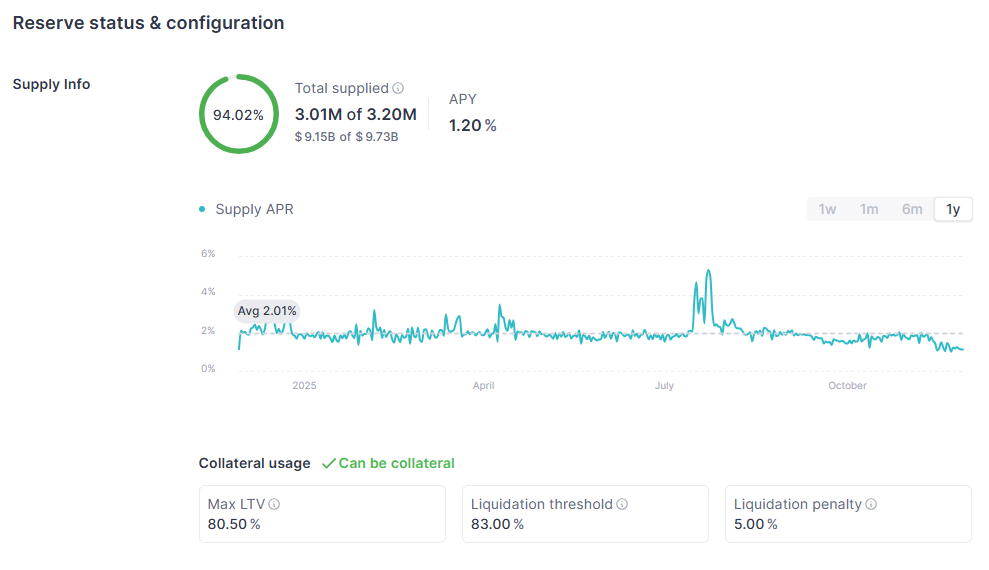

Aave’s ETH supply is currently over 3 million tokens, with a utilization rate of over 94%, suggesting that Aave may raise the limit further. |Source: Aave

As the available ETH is currently 94% utilized, the Aave lending threshold may need to be increased. Aave has the following priority usage restrictions: 92% of collateral. If utilization rates are high, lenders may not be able to easily withdraw funds. The main concern regarding usage is the possibility of funds being redirected to other risky and opaque protocols.

Aave’s APY for ETH lenders is 1.2%, which is low even compared to simple validator staking. Although lent ETH is less liquid and more unpredictable, lenders were still eager to grow Aave’s vaults. Aave currently has $21.4 billion in outstanding loans, according to the company. data From token terminals, it was down from over $30 billion in September. The drop in ETH price has increased the need to deposit more tokens.

Aave’s ETH collateral has doubled in the past year

ETH collateral has also doubled in the past year as traders regained trust in DeFi. Lending accelerated as ETH moved away from centralized exchanges, and holders discovered on-chain tools to unlock the value of their ETH.

Aave remains valued at more than $32 billion, up from its peak of $44 billion as of Oct. 8. Collateral is also provided in the form of wstETH, WETH, and other wrap or liquid staking tokens based on the value of ETH, making ETH the main driver for Aave.

In total, Aave currently holds approximately 50% of the value of the lending protocol. 64 billion dollars In fluidity.

Aave remains the leader in DeFi lending

Both Aave and Morpho have increased their locked totals over the past year. Aave has a fixed growth of 5x its value, while Morpho starts at $550 million and has a TVL of approximately $6 billion as of November 2025.

DeFi lending has rebounded above previous bull market levels, driven by the increasing supply of stablecoins. Improved liquidation protocols also mean that loan liquidations will become more rare, allowing holders enough time to post new collateral.

The lending protocol suffered from overutilization, with some vaults being emptied to deposit funds into riskier lending protocols. However, Aave is more stringent regarding collateral and utilization requirements.

Aave’s GHO stablecoin remains highly reliable, with supply increasing to a record 451 million tokens. In the past two weeks, Aave has retired part of its supply, reducing it to 416 million tokens. AAVE was trading at $184.39 and has fallen over the past three months.