Ethereum Layer 2 Scaling Solution Optimism is rethinking its strategy after years of helping other projects build networks based on its technology. The company’s CEO, Jing Wang, says this approach came at a significant cost.

Optimism was designed to offer cheaper transactions, just as Ethereum experienced gas price increases from 2020 to 2021. The company’s OP Stack software is used to launch chains like Coinbase’s Base and Kraken’s Ink, and will allow you to build your own blockchain while remaining compatible with Ethereum.

However, in a Nov. 27 X post, Wang said the team had “overachieved and not focused enough,” pointing to over-hiring and a lack of strategy in response to changing market conditions. He said the company had been “immersed in tactics for a long time” with its partner chain and “never built the operational structure to continue that momentum into today’s dramatically different market.”

Although Optimism has cut costs by reducing staff and combining all teams into one group, competition from Solana, Stripe-backed Tempo and other networks is increasing, Wang said.

Wang went on to tease the change in focus. Optimism doesn’t just help launch new chains, it also gives companies more control over their networks, though he didn’t say exactly how.

“At the end of the day, companies want to be in control of their own finances. They don’t want to be sharecroppers on Stripe’s blockchain,” Optimism’s CEO wrote.

Optimism did not immediately respond to The Defiant’s request for comment.

Declining on-chain metrics

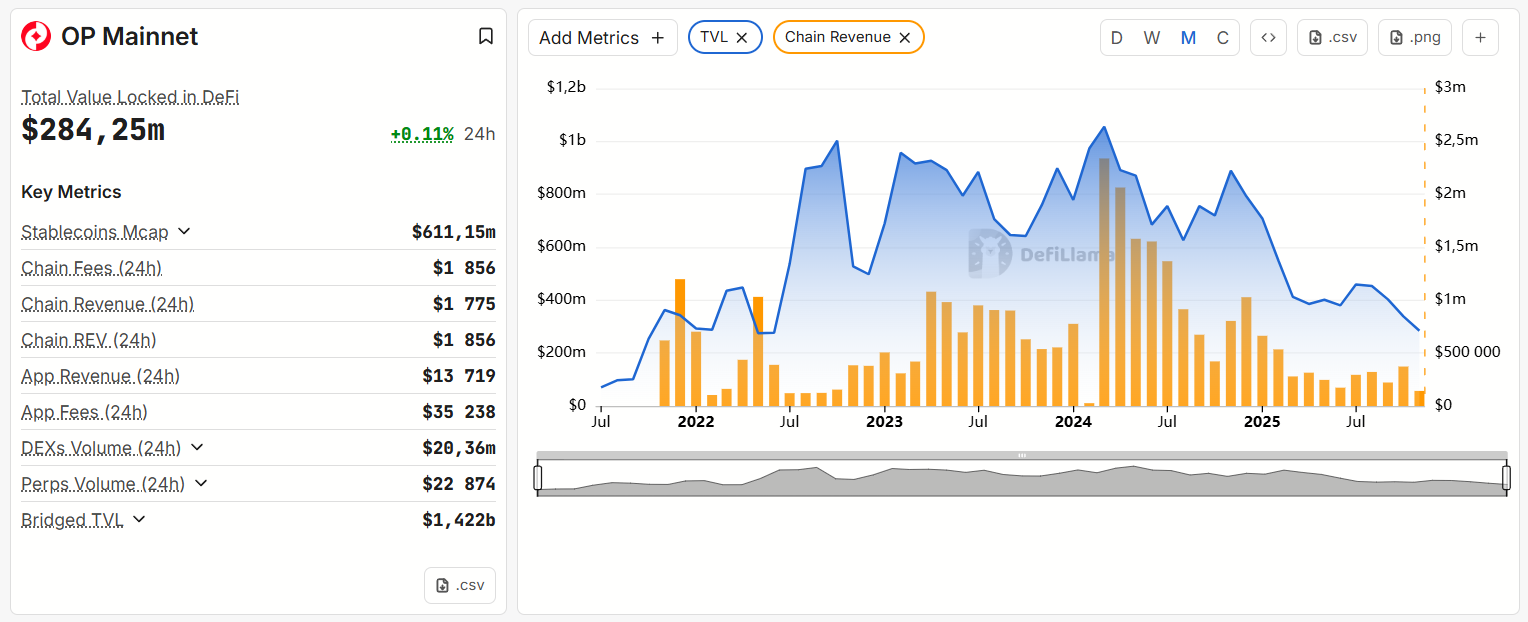

Wang’s comments came as key indicators of optimism continued to weaken. According to DefiLlama data, the network’s total locked value has fallen to 2022 levels.

Comparison of OP Mainnet monthly revenue and TVL. Source: Defilama

On-chain monthly revenue decreased from approximately $2.3 million in March 2024 to approximately $373,000 in October, likely due to a roughly 90% drop in transaction fees following Optimism’s Ecotone upgrade in Q1 2024.

The network’s OP token is also struggling. As of this writing, OP is down over 85% over the past year and over 90% from its all-time high, according to data from The Defiant’s price page.