Blockchain analytics platform Artemis highlighted that although several issuers have attempted to enter the non-USD stablecoin market, they have not been able to disrupt the dollar’s hegemony in this asset class. Nevertheless, Euro stablecoins have shown consistent growth.

Artemis: Virtually no non-USD stablecoins exist, Euro stablecoins show consistent growth

fact

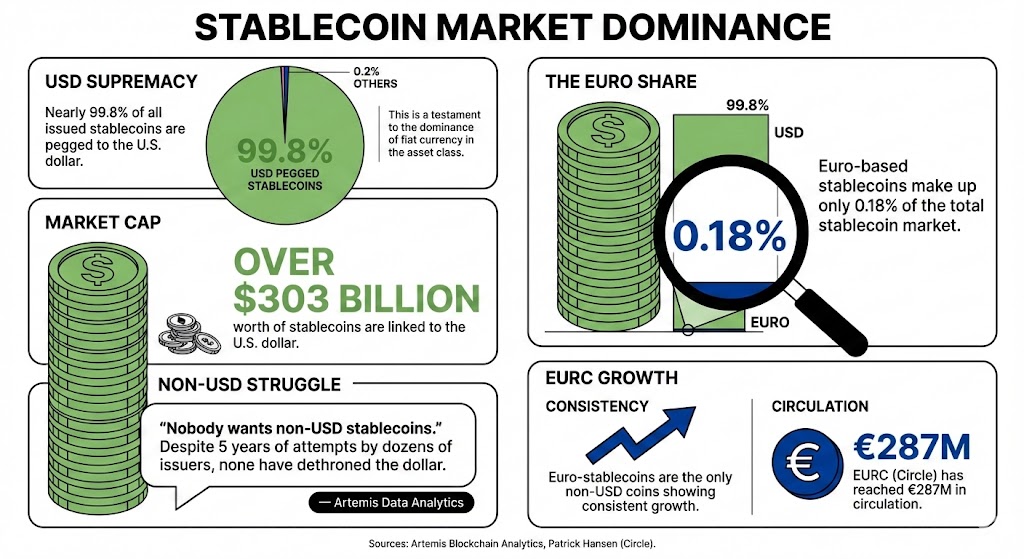

According to data from Artemis, a platform providing blockchain analytics, almost 99.8% of all stablecoins issued are pegged to the US dollar, evidence of the dominance of fiat currencies in this asset class.

$303 billion worth of stablecoins are tied to the US dollar, a figure dwarfed by all other currencies combined. Artemis addressed this fact on social media, claiming that attempts to introduce stablecoins linked to currencies have so far failed.

It stated:

No one wants a stablecoin other than USD. Over five years, dozens of new issuers have been tried in every major currency, but none have made any progress in dethroning the dollar.

Euro-based stablecoins only amount to 0.18% of the stablecoin market, a small number compared to the share of dollar-based stablecoins. Nevertheless, Circle’s Patrick Hansen emphasized that this number is likely to continue to grow.

Hansen explained that while the dollar’s dominance is certainly true, the evolution of stablecoins pegged to the euro was important. “Euro stablecoins are essentially the only non-USD stablecoins that have shown consistent growth over the past year, primarily driven by the EURC, with their circulation currently reaching €287 million,” he noted.

Why is it relevant?

The undeniable dominance of the US dollar in the stablecoin ecosystem may provide insight into the true value of these instruments. While it is undoubtedly true that it offers transactional improvements over traditional dollars, its real value lies in extending the availability of the U.S. currency to jurisdictions that face difficulties accessing physical dollars.

This is because the value of the underlying fiat currency is transferred to the stablecoin, providing holders with the same properties that the dollar has as a hedge against inflation and currency devaluation.

read more: Historic: Bolivia integrates stablecoins into banking system and uses them as legal tender

I’m looking forward to it

While the dominance of US stablecoins is unlikely to be reversed in the short term, stablecoins pegged to other currencies such as the euro are expected to continue to grow as more markets begin to adopt national stablecoins for payments and other transactions.

FAQ

What percentage of stablecoins are pegged to the US dollar?

almost 99.8% Of all stablecoins issued, it is linked to the US dollar, underscoring its dominance in the market.How much is a dollar peg stablecoin worth?

That’s all $303 billion The value of stablecoins is tied to the US dollar and is significantly higher than that tied to other currencies.What is the market share of euro-based stablecoins?

Euro-based stablecoin accounts only 0.18% This reflects the challenges faced in gaining traction against dollar-pegged alternatives.What trends are emerging in Europegged stablecoins?

Despite the dominance of the dollar, stablecoins pegged to the euro, especially EURChas shown consistent growth and currently has €287 million in circulation.