The dYdX community has approved a plan called the Liquidation Rebate Pilot Program, proposed for late November 2025. This has been touted as a compensation system that is expected to reduce the fallout from future liquidations, thereby promoting liquidity and risk management.

According to a recent X post: dYdXthe compensation plan has been approved by a governance vote and is considered a measured experiment, so it can be further refined.

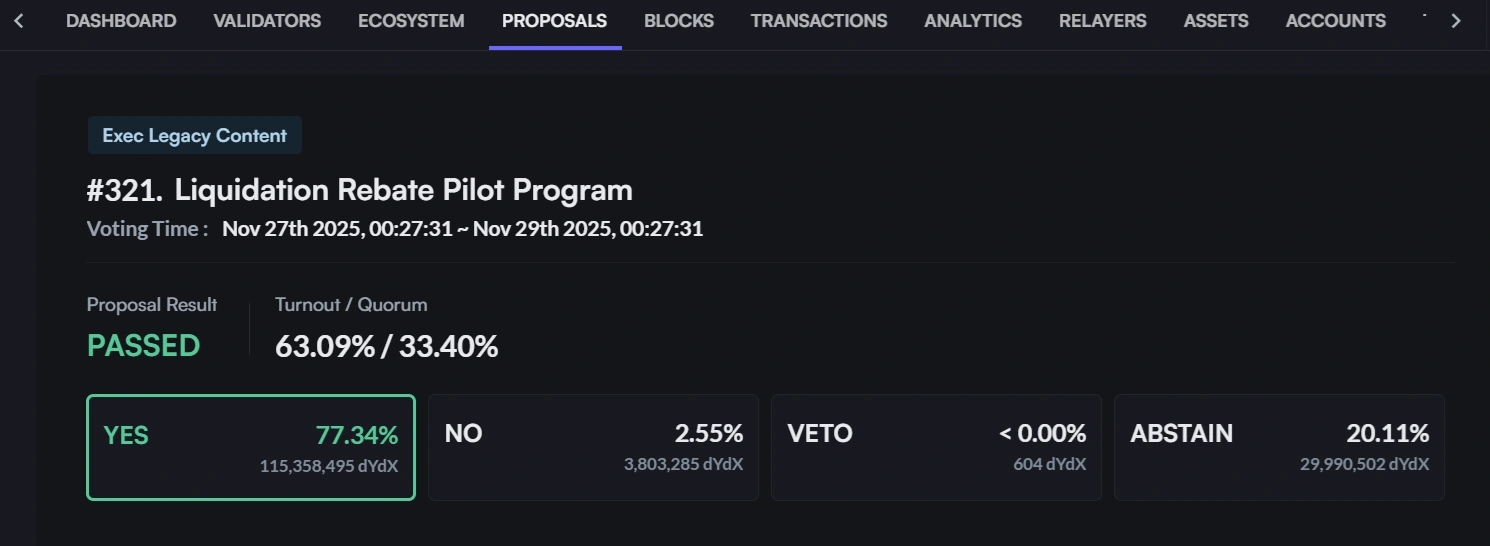

The post revealed that 42 active set validators and 32 out of 112 accounts voted, with a turnout of 63.09%, including 77.34% upvotes, 2.55% downvotes, and 20.11% abstentions.

dYdX has approved a Liquidation Rebate Pilot Program that will provide liquidation traders with a reward pool of up to $1 million. Source: Mintscan

Compensation plan details

of Liquidation Rebate Pilot Program is proposing to begin a one-month trial starting December 1, 2025, which will award points and rebates to traders who experience a liquidation event, with rewards capped at $1 million in total.

Eligible participants will be able to accumulate stated rewards through the pilot’s structured framework, designed to provide tangible value to active traders while maintaining a transparent process.

The scheme has a total incentive pool of up to $1 million and has been praised as a prudent approach to supporting liquidity and risk management within the platform.

dYdX moves forward after October network outage

The compensation plan for dYdX traders was announced after the exchange was affected by an on-chain outage that halted operations for about eight hours during last month’s market crash.

In a post-mortem investigation and subsequent update, the exchange first floated the idea of voting to compensate affected traders with up to $462,000 from the protocol’s insurance fund.

dYdX is claimed It said the October 10 outage was “due to a misordered code process, and its duration was made worse by delays in validators resuming Oracle Sidecar services.”

According to the DEX, when the chain was restarted, “the matching engine processed trades/liquidations at incorrect prices due to outdated oracle data.”

Additionally, it reported that no user funds were lost on-chain. However, some traders suffered liquidation-related losses as services were suspended during the outage. dYdX is not the only exchange to take proactive measures in the wake of the October 10 market crash. Binance’s response to the disruption has also been praised.

The market crash, which wiped out around $19 billion in positions and became the largest liquidation event in crypto history, also tested Binance’s trading services, which had to deal with soaring volatility, user concerns and regulatory attention.

It was called out due to a technical glitch that prevented traders from closing their positions, as well as an issue with the interface showing the price of some tokens below zero and the depegging of USDe on Etena.

Binance refused to take any responsibility for the traders’ losses. However, the company announced a $400 million relief initiative, including $300 million in token vouchers for affected traders and $100 million for affected ecosystem participants.

Binance also launched an airdrop of $45 million in BNB tokens to memecoin traders who suffered losses in the crash to “boost market confidence.” The exchange has pledged a total of $728 million in aid to traders affected by the crash.