Ethereum price has rebounded nearly 10% from this week’s lows near $2,600, and today’s price is up about 1%. Although this move looks positive, the recovery may not be long-lasting.

Two major bearish signals emerged at the same time. Together, they threaten to end the bounce before it can grow.

Holder sales spiked by 300% with death cross formation

Two connected signals indicate a deeper weakness.

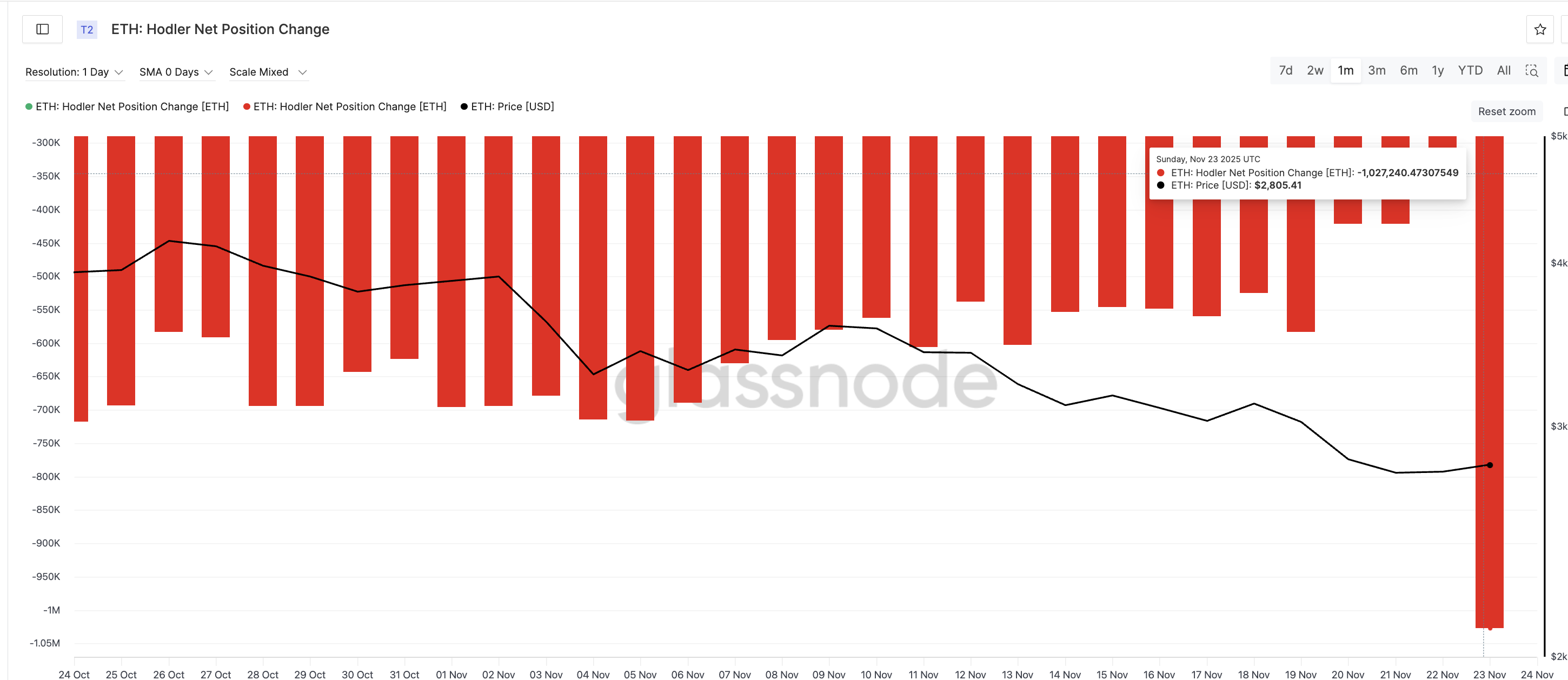

The first is from long-term investors, often called hodlers. These are wallets that typically hold ETH for more than 155 days. When hodlers increase selling, it usually indicates fear or a change in long-term beliefs.

On November 22nd, net sales from these wallets were approximately 334,600 ETH. It soared to 1,027,240 ETH on November 23rd. That’s a 300% jump in one day. This is a major withdrawal from long-term holders and adds a large amount of supply at a time when ETH is already trading in a broad downtrend.

ETH sellers dominate: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

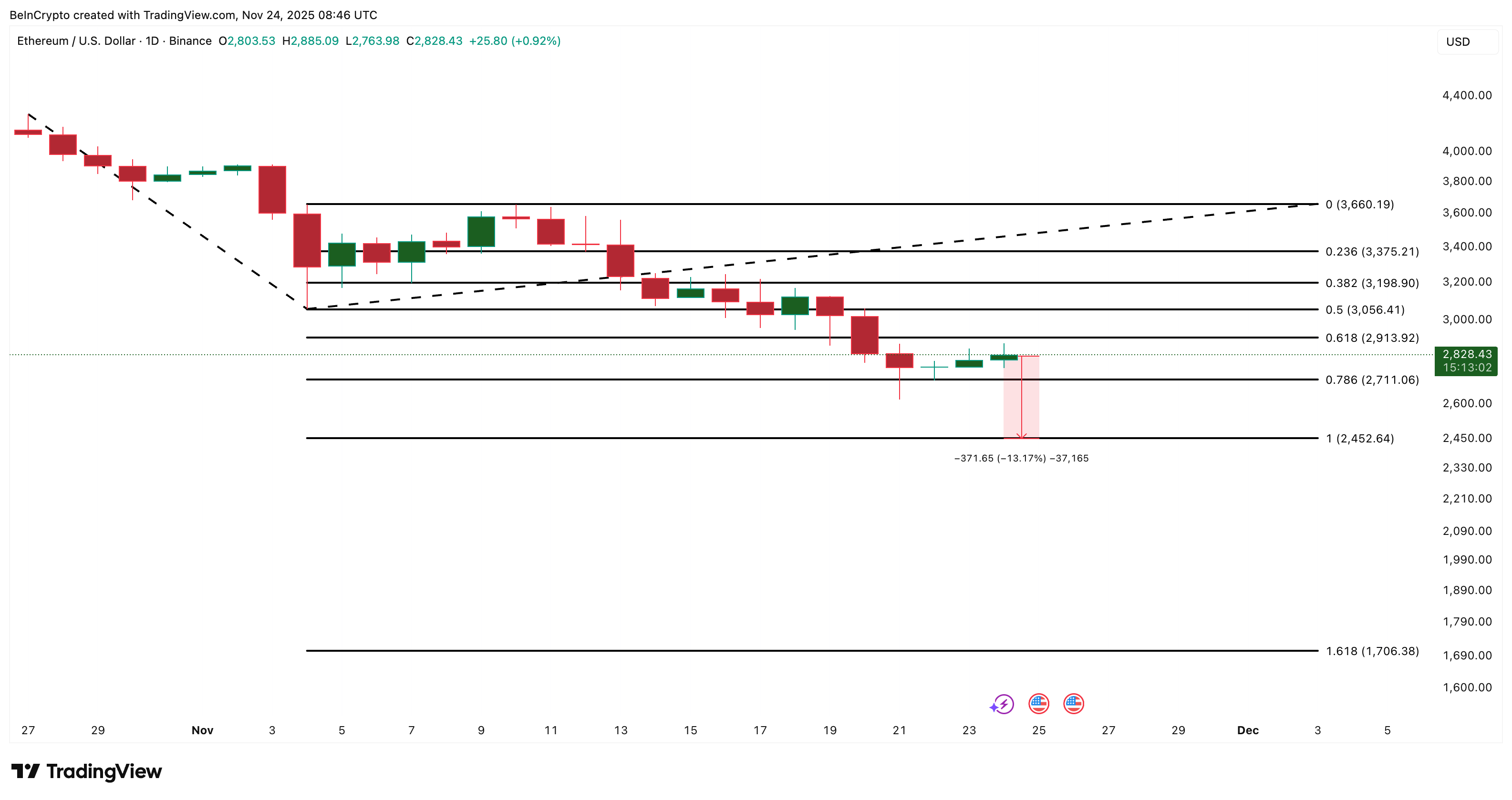

At the same time, the cross of death is almost formed. A death cross appears when the 50-day exponential moving average (EMA) falls below the 200-day EMA. EMAs give more weight to recent prices, so they react faster than simple moving averages.

When the 50-day EMA falls below 200-days, it indicates strong downward momentum. If selling pressure continues to increase, it could have a significant impact on ETH price.

Building Bearish Risk: TradingView

The important connections are:

Hodler selling is surging at the exact moment when the EMA structure is turning bearish. In other words, selling pressure is strengthening the death cross signal rather than delaying it. When these two occur together, the recovery usually fails and the price retests the lower support.

Ethereum price trend: Downside risk still outweighs rebound

Ethereum is currently trading around $2,820, but the chart shows more upside pressure than downside support.

The first level that ETH must protect is $2,710, the 0.786 Fibonacci zone. A loss of this level would initiate a decline towards $2,450, representing a decline of approximately 13% from current levels. If the death cross completes while the Hodler selloff continues, ETH could fall directly towards this level and even below it if market conditions weaken.

Ethereum Price Analysis: TradingView

Below $2,452, the next deepest support is near $1,700. This is a broader range from a descending structure. This will only work if the trend accelerates and sellers continue to dominate.

Until ETH price recovers, upside will remain limited.

- $3,190, first meaningful resistance

- $3,660, strong upper bound indicating early trend reversal

In the current situation, these levels look difficult to reach as both bearish signals (Hodler sell surge and death cross setup) remain active.

The post 300% spike in selling pressure could threaten Ethereum price rebound appeared first on BeInCrypto.