Ethereum is struggling to hold on to the $2,800 level after a brutal correction that wiped out more than 45% of its value since late August. This sharp decline has turned market sentiment decidedly bearish, with many traders worried that ETH has entered a long-term downtrend. Uncertainty is only increasing as bulls have struggled to establish reliable support levels and we have not seen a strong reaction from the buy side so far. Liquidity remains thin across major exchanges, reinforcing the view that the market remains in a deep risk-off phase.

However, despite strong selling pressure and overwhelming price performance, not all major players are holding back. In fact, some have doubled. Lookonchain’s latest on-chain data reveals that Tom Lee’s Bitmine, a well-known crypto-focused investment business, continues to actively purchase ETH at current prices. Bitmine is one of the few companies that has consistently increased its position even during downturns, demonstrating strong belief that Ethereum will remain undervalued in the long term.

The disconnect between retail fears and whale accumulation is becoming increasingly pronounced. With ETH hovering near psychologically critical levels, the coming days may determine whether this whale’s confidence leads to broader market stabilization or remains an isolated bet on the general trend.

Bitmine’s aggressive accumulation shows confidence

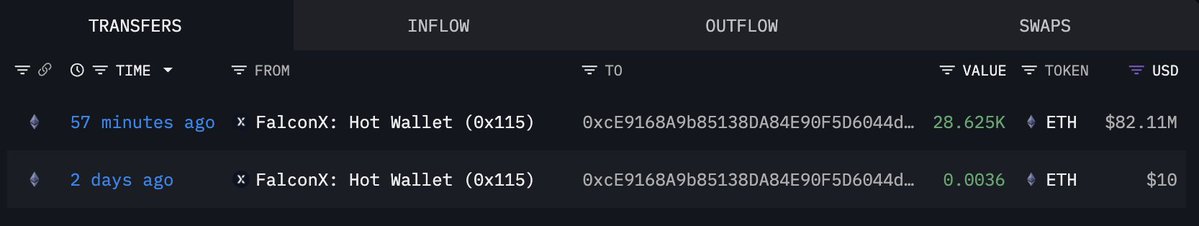

According to Lookonchain, Tom Lee’s Bitmine continued its aggressive accumulation, purchasing an additional 28,625 ETH worth $82.11 million. The move reinforces a growing narrative that some of the market’s most sophisticated players are poised for a rebound despite widespread fear and relentless selling pressure. Large-scale buying during deep corrections has historically coincided with early reversal zones, and Bitmine’s confidence lends weight to the idea that Ethereum may be nearing a key turning point.

Still, recovery is not guaranteed. ETH remains trapped near the $2,800 zone, a level that has served as a weak line of defense during this economic downturn. To change momentum, Ethereum needs to not only hold this area, but also regain the $3,000 mark, which has turned into a key resistance zone. A decisive move above this level would signal that buyers are finally starting to return strongly and could set the stage for a broader trend reversal.

Until then, the situation remains delicate. While Bitcoin accumulation provides a bullish signal, Ethereum continues to walk a tightrope without any confirmation from the price structure. Failure to maintain current levels could lead to another wave of capitulation, but stability here could trigger the rebound that the whales seem to be hoping for.

Testing major weekly support zones

Ethereum’s weekly chart shows the asset sitting in a key support zone after a sharp fall from the $4,800 region. The price has now returned to around $2,800, a level roughly in line with the 200-week moving average, a historically important area where ETH has often found long-term support. This zone has previously served as a launch pad during major market reversals in 2022 and mid-2023, making its protection critical to maintaining broad-based structural strength.

The recent breakdown below the 50-week and 100-week moving averages highlights the severity of the current decline. Momentum has clearly shifted in the bears’ favor over the past few weeks, with several large red candlesticks confirming the aggressive distribution. However, ETH is currently stabilizing above the 200-week moving average, indicating that buyers are finally stepping in and preventing a further decline to $2,400.

If Ethereum is able to break above this support area and regain the psychological $3,000 level, a recovery structure could begin to form. However, if the 200-week moving average breaks convincingly, the market could face a longer correction.

Featured image from ChatGPT, chart from TradingView.com