Ethereum price daily chart The tentative signs of recovery come just as the Fed faces one of its most complex meetings this year. Markets are reacting with uncertainty as policymakers debate whether to postpone or cancel their December meeting due to the lack of employment data. In the case of Ethereum prices, this kind of macro hesitation often increases volatility, especially when interest rate expectations change rapidly.

Ethereum price prediction: Fed indecision and investor nervousness

The Fed’s dilemma is simple but significant. Without labor data for November, the central bank will have to decide whether to cut interest rates for the third time or leave them unchanged to combat inflation. Historically, interest rate cuts have stimulated risk assets like Ethereum; timing It’s important.

If the Fed postpones its meeting, the uncertainty could temporarily stall the overall bullish momentum in cryptocurrencies. Futures markets are currently pricing in an 83% chance of a rate cut, but any hesitation could cause another wave of volatility before a decision is made.

ETH price fights mid-band resistance

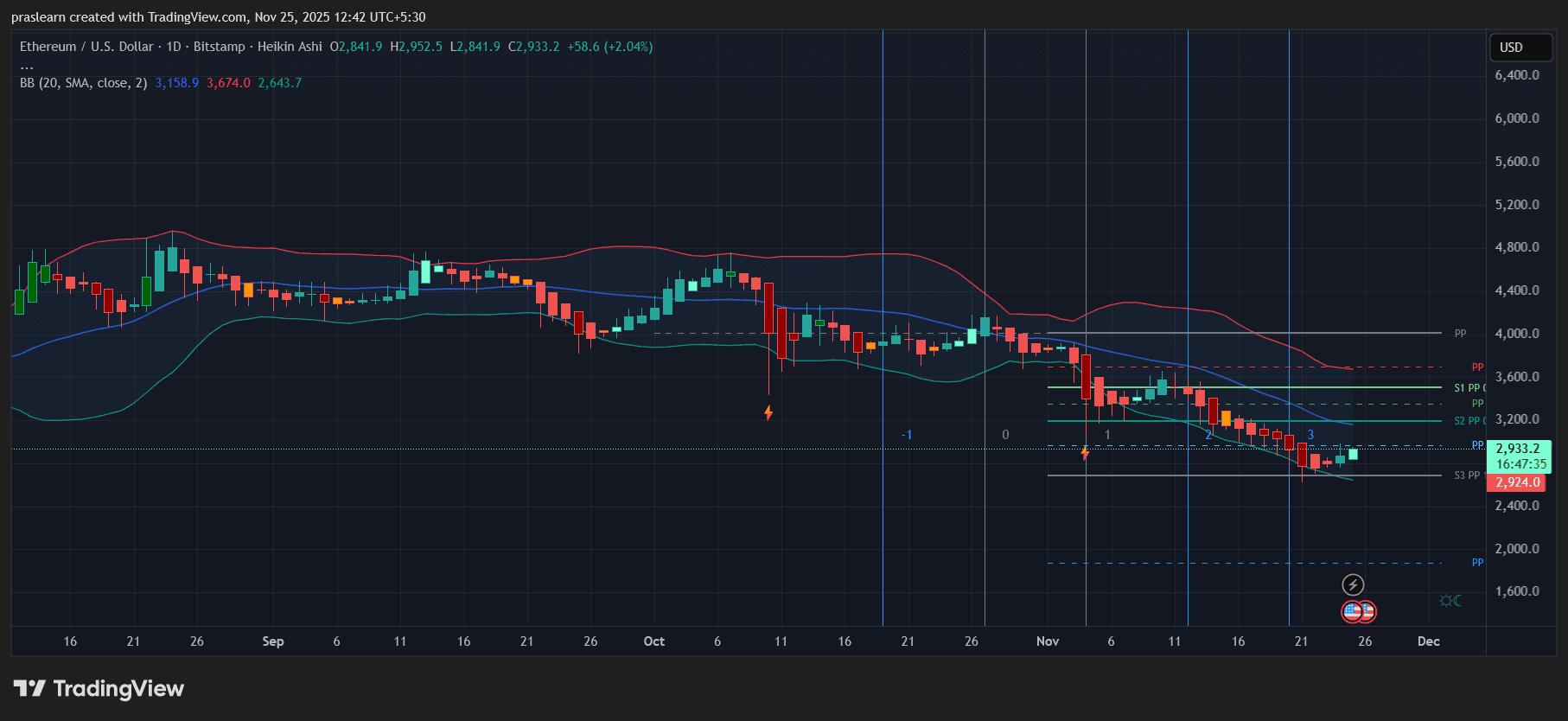

ETH/USD Daily Chart – TradingView

On the daily chart, Ethereum price is trading around $2,933test its midline bollinger bands After weeks of downward trend. Recent candlesticks indicate that Heikin Ashi is bullish, suggesting the strength of a short-term reversal. 20-day SMA near $3,158 remains an important barrier to resistance.

- Support zone: $2,640–$2,700

- Resistance zone: $3,150–$3,200

- Next pivot target: $3,400 if breakout continues above 20-day SMA

ETH’s current movement suggests consolidation ahead of a possible bullish expansion. Bollinger Bands are starting to narrow, which often precedes a volatility breakout. A decisive daily close above $3,200 will likely confirm the start of that phase.

Fed policy responds to technological pressures

Ethereum’s chart movements over the past two months have reflected investor sentiment regarding Fed policy. Whenever expectations for a rate cut increase, ETH rebounds from the lower band, much like it did this week from around $2,640. If the Fed delays its meeting or signals policy uncertainty, traders could take early profits and push ETH back toward support.

However, if the Fed moves forward and confirms a rate cut, liquidity inflows could push ETH prices higher towards the upper Bollinger Bands. $3,674. This coincides with the Fibonacci retracement from the previous big swing, indicating a strong confluence of intermediate-term resistance.

Short-term Ethereum price prediction: “More liveliness than data” market

Analysts at UBS call the Fed’s current situation “operating in a fog,” a sentiment that perfectly captures Ethereum’s pricing. Technical analysis shows that ETH price is about to reverse, but confidence remains weak. Much will depend on whether macro transparency returns by December 10th.

If ETH sustains support above $2,850 for three consecutive days, the likelihood of a retest of $3,200-3,400 increases exponentially. However, a drop below $2,800 would negate this pullback and reopen the path to support at $2,600 and even $2,400.

Ethereum Price Prediction: ETH Reaction to December Decision

If the F.R.B. interest rate cut or Delays decision but signals dovish intentionsEthereum price could rise towards $3,600 in December. a uncut stance Combined with continued inflation warnings, the stock could return to the $2,600-$2,700 zone.

The next move will likely be focused on macro confidence rather than charts. Ethereum price is currently hovering at the intersection of policy uncertainty and trader sentiment, and either way, volatility is guaranteed. Ethereum’s rebound from $2,640 shows early strength, but it needs to be confirmed above $3,150 to prove this is more than just a rescue rally. The Fed’s December meeting will determine whether $ETH resumes its bullish trend or reverts to winter.