BitMine has released 3.63 million ETH, one of the largest Ethereum treasuries ever recorded. But the company’s published average purchase price of $2,840 sparked an immediate backlash from analysts who argued the math didn’t add up.

This update is significant as BitMine is now approaching its long-held goal of capturing 5% of all Ethereum. This goal is what Fundstrat calls “the alchemy of the 5%.”

BitMine discloses $11.2 billion in crypto and cash holdings

In an update on November 24th, Bitmine (BMNR) reported that its total holdings in cryptocurrencies, cash, and “moonshots” were $11.2 billion. The company holds 3,629,701 ETH, 192 BTC, $38 million in Eightco Holdings stock, and $800 million in unencumbered cash.

🧵

BitMine provided its latest holdings update on November 24, 2025.$11.8 billion in cryptocurrencies and “moonshots”:

-3,629,701 ETH ($2,840 per ETH) (@coinbase )

– 192 Bitcoin (BTC)

– $38 million in Eightco Holdings (NASDAQ: ORBS) stock (“Moonshot”) and

– $800 in unencumbered cash…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 24, 2025

According to BitMine, 3.63 million ETH was accumulated at an average price of approximately $2,840 per token. This position is marginally profitable if the current market level is above $2,900.

Ethereum (ETH) price performance. Source: BeInCrypto

Chairman Thomas “Tom” Lee reiterated that Bitmine has acquired 3% of the Ethereum network.

BitMine currently holds 3% of the ETH supply

Two thirds left until “5% Alchemy”

👏👏👏👏 https://t.co/7gvPmCC7Ql

— Thomas (Tom) Lee (not the drummer) FSInsight.com (@fundstrat) November 24, 2025

Weekly purchases show significant accumulation

BitMine also publishes weekly ETH purchases, and has consistently seen significant inflows from October to November.

BitMine Ethereum Purchase. Source: BitMine

This accumulation establishes BitMine as the world’s largest ETH treasury. It is also the second largest crypto asset overall after MicroStrategy, which holds 649,870 BTC worth $57 billion.

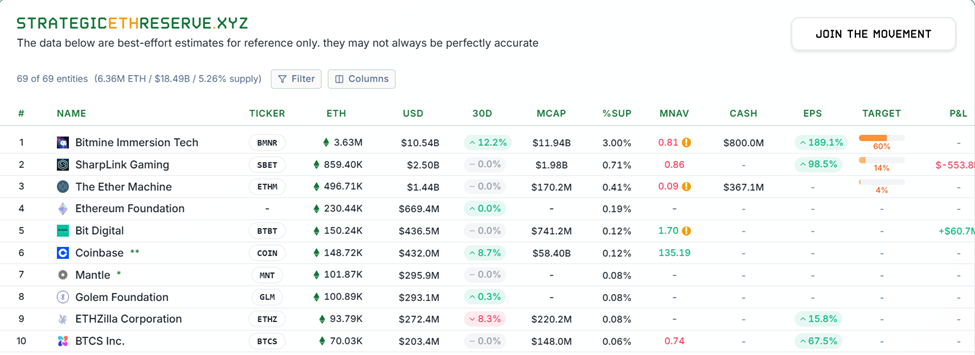

Ethereum government bonds by size. Source: StrategicETHReserve.xyz

Lee claimed that the recent decline in cryptocurrency prices is consistent with “lower liquidity since October 10th” and weak technical conditions.

.@fundstrat’s Tom Lee points out mechanical “glitches” that may be driving crypto rollovers. $BTChttps://t.co/ZrsrCWaDHu

— Power Lunch (@PowerLunch) November 20, 2025

However, he noted that ETH is already approaching $2,500, the downside level previously predicted by Fundstrat.

BitMine highlighted BMNR’s rapid rise as one of the most actively traded stocks in the US. With average daily trading volume of $1.6 billion (5-day average as of Nov. 21), the stock ranks No. 50 in the U.S., just behind Mastercard and ahead of Palo Alto Networks.

Investor disputes reported average purchase price

Despite the bullish disclosure, market participants quickly took issue with Bitmine’s stated cost standards. Blockchain analysis account Lookonchain estimated the average purchase price of BitMine to be around $3,997, and claimed that there was an unrealized loss of more than $4 billion.

Tom Lee (@fundstrat)’s #Bitmine bought 69,822 $ETH ($197.25M) last week and currently holds 3,629,701 $ETH ($10.25B).

With an average purchase price of approximately $3,997, #Bitmine has unrealized losses of $4.25 billion. https://t.co/Gw7A8KXKPw pic.twitter.com/TMvDPsroUt

— Lookonchain (@lookonchain) November 24, 2025

Another analyst wrote that BitMine’s “$2,840” number only reflects the spot price of ETH at the time of the company’s post, rather than an accurate average purchase price. Additional users independently calculated implied averages closer to $3,800 to $4,000.

“The average price per ETH should be around $3,840…Is this accurate?” they paused.

BitMine has not yet addressed this discrepancy nor provided a detailed cost-based breakdown. Therefore, all eyes are now on whether BitMine clears its accounting, continues its weekly ETH accumulation, and reaches the symbolic 5% ownership threshold.

With the Made in America Validator Network (MAVAN) scheduled to be introduced in early 2026 and BMNR increasing its visibility in the market, BitMine’s financial strategy is likely to remain a central narrative in the Ethereum ecosystem in the coming months.

The post Tom Lee’s BitMine reveals 3.6 million ETH holdings amid average purchase price discussion appeared first on BeInCrypto.