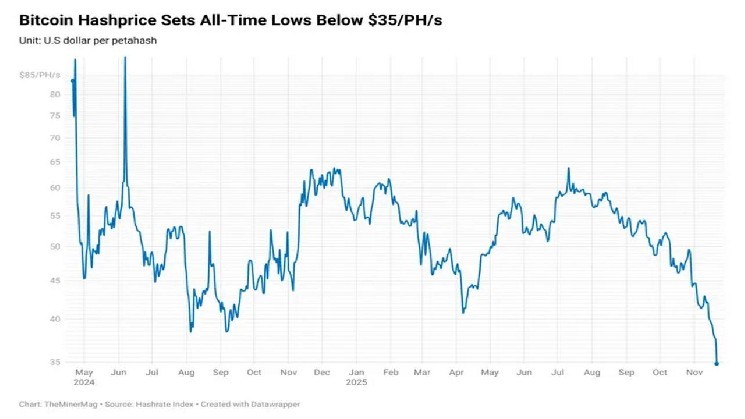

Bitcoin hash prices have fallen to an all-time low of less than $35 per petahash per second (PH/s), hit by a combination of falling Bitcoin prices and persistently high network difficulty.

This article comes from Theminermag, a trade publication for the crypto mining industry, focusing on the latest news and research about institutional Bitcoin mining companies.

As of Saturday, BTC was trading near $83,000, down more than 30% from last month’s all-time high. The decline wiped out all gains made since the start of the year, pushing the mining economy further into the red. This downturn comes on top of record hashrates and difficulty levels set earlier this month, which further reduces the amount Bitcoin miners can produce per unit of hashrate.

But now there are early signs that miners are starting to scale back. Bitcoin’s seven-day rolling hash rate average has fallen to around 1.06 ZH/s from around 1.124 ZH/s in mid-November, suggesting some operators may already be disconnecting their hardware as margins tighten.

At the current pace of block generation, the network is on track for a negative difficulty adjustment of approximately 2% in approximately 4 days. If the hashrate continues to decline in the coming days, the correction could deepen further.

The recent contraction in mining profitability follows months of weak transaction fee income and a rapid expansion in installed hashrate following the halving since last year, leaving operators more exposed to market-driven hash price fluctuations.

The original article can be found here.