A deeper problem became apparent as Ethereum’s price fell to $2,700 as network activity remained low for nearly two years.

DeFi and NFT usage remains subdued despite lower fees, pushing down Ethereum’s overall network revenue.

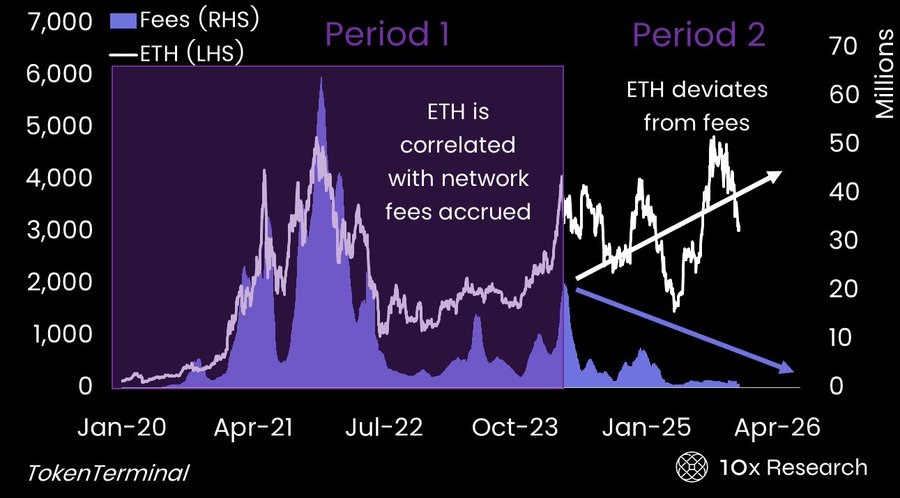

10x Research warns that ETH valuation currently relies on actual blockchain usage, not just speculation.

Ethereum is once again under pressure as ETH has fallen by 8% to $2,700 in the past 24 hours. But it’s not just the price chart that worries traders. According to 10x Research, Ethereum’s biggest problem is its own network activity, which has been weak for nearly two years.

With fewer users, lower fees, and quieter DeFi activity, the Ethereum network is not making as much money as it used to.

And now, this weak demand is raising questions about how ETH should be valued going forward.

ETH activity decreases even as fees fall

ETH has always been strongly tied to network demand. From 2020 to 2021, people rushed into DeFi, NFTs, staking, and crypto gaming, and ETH fees skyrocketed. These high fees have allowed ETH to remain strong even during market downturns.

But since mid-2024, things are moving in the opposite direction.

Despite lower fees and many users moving to layer 2 networks such as Arbitrum, Optimism, and Base, activity on Ethereum’s main network has not increased.

DeFi usage remains weak, NFT transactions are a fraction of what they used to be, and overall fee generation has plummeted.

Network demand has been weak for nearly two years now, and that weakness is clearly visible in today’s ETH price.

Net inflation is rising again

Ethereum was expected to become “deflationary” with more ETH being consumed than being produced. However, in the last three years,

- 4.2 million ETH issued in the past 3 years

- Only 3.5 million ETH was burned

This means that Ethereum has become net inflated, mainly because the burn is not enough to cancel new supply.

Will Ethereum price recover?

According to 10x Research, price recovery will be determined by actual usage, not just hype. Two things could push ETH higher:

However, 10x Research points out two possible paths forward that could push ETH prices higher.

- First, clarifying regulations in the US and unlocking organized DeFi participation

- Second, there could be a new wave of Web3 activity, leading to higher prices and increased usage again.

Until then, the market is likely to continue treating Ethereum more like a speculative asset than a productive network.