In this article, we take a look at how larger trends, intraday flows, and volatility interact and what that means for the next decisive move.

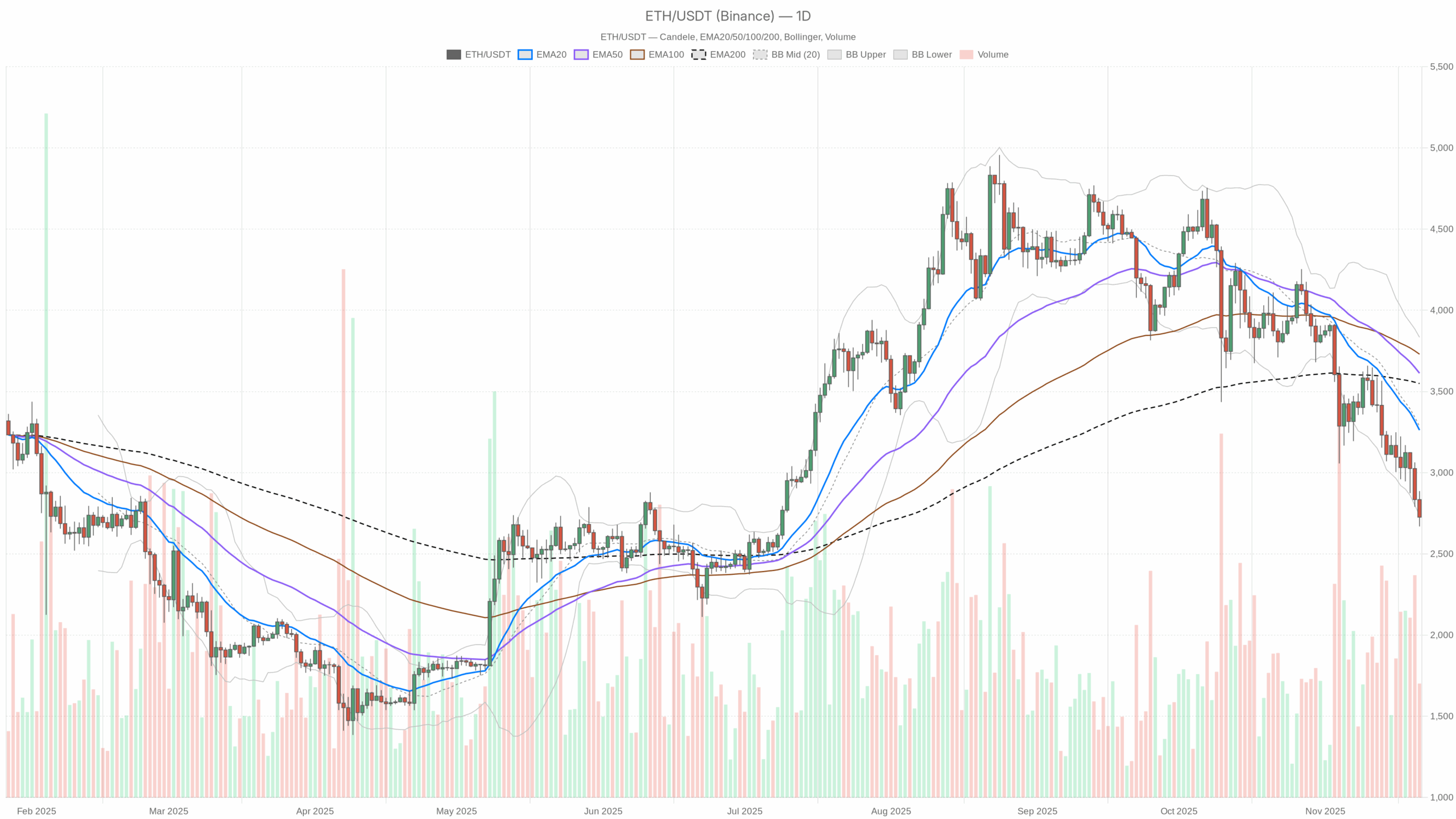

ETH/USDT — Daily chart with candlesticks, EMA20/EMA50, and volume.

summary

The broader cryptocurrency market is approximately 8% of total capital in 24 hoursindicating widespread risk aversion rather than an isolated move. Bitcoin currently commands an edge of around 56%, underscoring the flight to relative safety and putting further pressure on large altcoins.

On the daily chart, ETH is trading with an RSI below almost all major EMAs. 27, firmly in oversold territory. Momentum gauges such as the MACD remain negative, but the downside acceleration is starting to slow.

Additionally, volatility is rising, as evidenced by the wide average true range, but prices are still being pulled near the bottom of the Bollinger Bands. Overall, the main scenarios for the daily chart are: Although it is bearish, the growth is becoming increasingly sluggish.the possibility of a relief rebound is increasing.

Ethereum (ETH) USD: Market status and direction

The reason behind this move is that the global cryptocurrency market capitalization has reached nearly $2.95 trillion, and is shrinking significantly by more than 8% per day. This type of gross drawdown is often Systematic risk-off behavior rather than token-specific news. Bitcoin’s market power of over 56% confirms the rotation of capital away from high-beta assets and into benchmark coins, which tends to occur at the end of declines or at the beginning of long-term downtrends.

Meanwhile, sentiment data reinforces this cautious trend. The Fear and Greed Index is: 14, in extreme fearThis shows that retailers and many voluntary participants are highly risk averse. That said, such low readings are often consistent with conditions such as: stage like surrendereven if the headlines seem grim, forced sales may have all but dried up. In the case of ETH, this means that the prevailing direction is still down, but as the market becomes more unilaterally crowded, the risk-reward of a fresh short becomes less attractive.

Technical Perspective: Read the overall setup

On the daily chart, ETH ended around 2726, well below the 20-day EMA of 3262, the 50-day EMA of 3613, and the 200-day EMA of around 3549. This wide divergence indicates that: A well-established downtrend Sellers have had the upper hand here for weeks. Additionally, trading below the 200-day average continues to put pressure on the long-term structure, and any pullback is likely to face supply midway through.

The daily RSI is around 27, clearly indicating an oversold situation. In practice, this often indicates: The downward momentum is growing And it seems likely that there will be a rebound, at least in the short term. However, being oversold does not automatically result in a reversal. It simply suggests that renewed aggressive selling could lead to diminishing returns for the bears.

The MACD on the daily timeframe remains negative. The line is near -254, below the signal near -217, and the histogram is slightly negative. This configuration ensures the following: Bearish momentum remains subduedbut modest histogram values suggest that the strongest parts of the impulse may already be behind us.

If the histogram begins to rise towards zero, it may indicate an early transition towards stabilization or consolidation, rather than an immediate return to a strong upward trend.

Bollinger bands add another layer. The middle band is around 3285 and the lower band is around 2737, which is close to the current price. Trading near the lower band after a sharp decline is typically Volatility expands downwardsprice hugs the band during a strong trend. That said, once the candlestick stops definitively closing below this area, it often develops into a base building phase or a reactive pullback towards the middle band.

The daily ATR is around 229, highlighting the following regime: Increased realized volatility. For traders, this means greater intraday volatility, greater risk of slippage, and the need to set more generous stops. It also suggests that any upcoming rebound or breakdown could quickly move through nearby levels.

Intraday outlook and ETHUSDT token momentum

On the hourly chart, ETH is trading around 2725, below the 20-, 50-, and 200-period EMAs (centered between 2832 and 3102). This arrangement is Short-term downtrend consistent with daily weakness. As a result, intraday gains to these moving averages are likely to be met with aggressive selling, at least on an initial test.

The hourly RSI near 31 confirms the picture of short-term fatigue, but not as extreme as the daily. Meanwhile, the hourly MACD remains negative and the histogram has shrunk slightly, suggesting: The downward momentum is weakening somewhat. Even if it hasn’t turned bullish.

The situation is similar on the 15 minute chart. Price is below all EMAs, the RSI is near 31, and the MACD is bearish, indicating that the market is still under pressure but potentially stabilizing.

Bollinger bands for the intraday timeframe show that the price is moving around the lower band and the midline is well above. This structure is suitable for environments such as: A short-term pullback is more likely to be a correction than a change in trend.. Traders focused on very short time periods may prefer mean reversion from extreme values, but they are going against the broader trend.

Ethereum Key Levels and Market Reactions

In the daily pivot framework, the central pivot is around 2761. Price is currently just below this area, suggesting that this is acting as the first intraday ceiling. A sustained return to the top indicates: Buyers are starting to take back some control And around 2852, the door to the first test of resistance may open.

On the downside, there is initial support around 2634 accentuated by the pivot structure. We will see a clean break and consolidation below that zone. Continuation of current bearish scenario Especially if accompanied by new volumes and new expansion of ATR, it could cause further downside.

Conversely, if sellers repeatedly fail to break below this band decisively, the likelihood of short covering up towards the Bollinger mid-region will increase.

Ethereum future scenario and ETH investment outlook

Overall, Ethereum (ETH) USD is currently trading within a clearly bearish but increasingly widened configuration. The combination of heavily negative EMAs, oversold RSI, and extreme fear across the market indicates a tug of war between trend followers and contrarian buyers.

In the prevailing scenario, the path of least resistance remains down or sideways until the price is able to regain the faster moving average on the daily chart and hold above. However, oversold indicators and a pessimistic view on sentiment also increase the likelihood of: Sharp sentiment-driven relief rallies That can catch late sellers off guard.

For long-term investors, this environment rewards patience and careful scaling over all-in decisions. For active traders, risk management is of paramount importance. Position sizes should reflect increased volatility, and plans should consider both the possibility of sudden pullbacks and still-active downtrends. Until the technical results are convincing Confirmation of new upward trendany bounces are best treated with caution.

This analysis is for informational purposes only and does not constitute financial advice.

Readers should conduct their own research before making any investment decisions.