$WULF targets 250-500 MW of new HPC signatures each year and plans to mine Bitcoin until at least the end of 2026.

The following guest post is from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and crypto treasury strategies. First published by Cindy Feng on November 13, 2025.

It’s earnings season again, and many companies have announced interesting updates, but TeraWulf’s Q3 2025 conference call caught my attention. Not because of the revenue numbers, but because it signals what could be the next operating model for Bitcoin miners. Underneath all the talk about AI/HPC, leasing, and gigawatts, some miners come to light energy infrastructure provider Towards the AI era.

Let’s break it down.

Expansion of transaction size

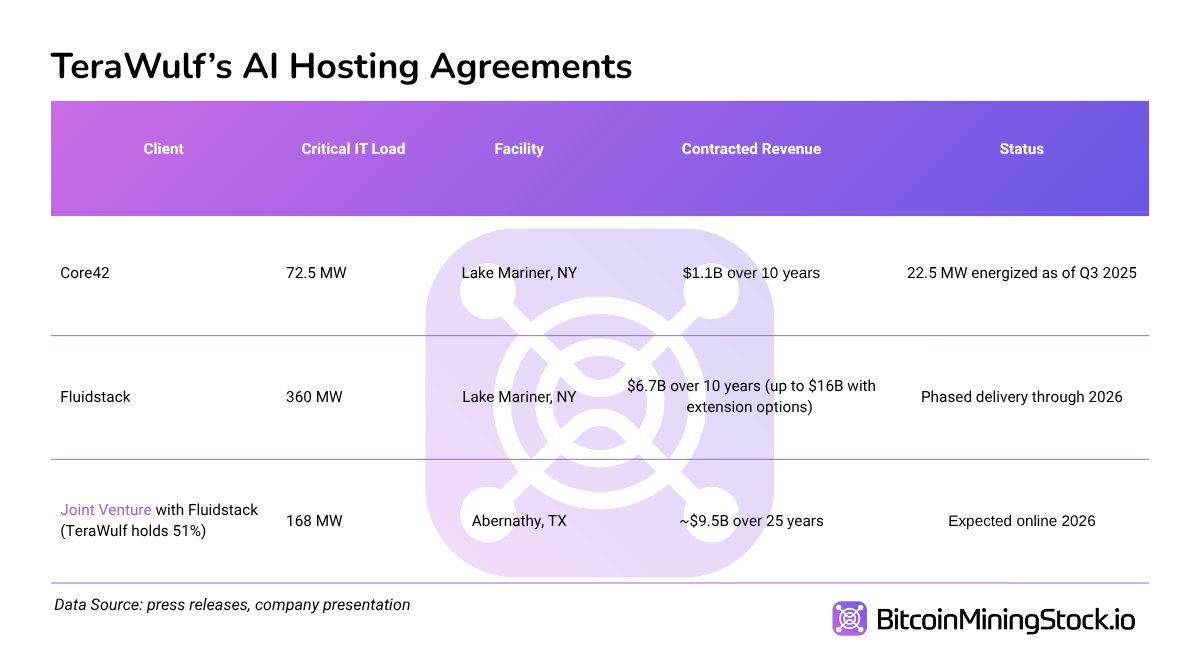

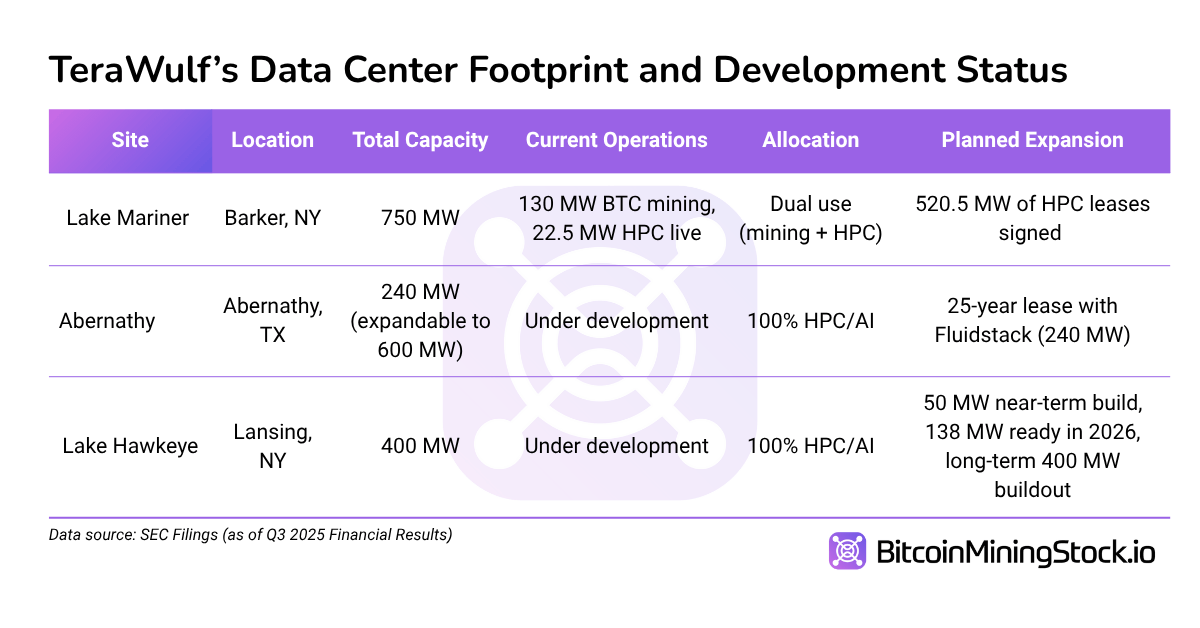

Inked by TeraWulf in August 2 HPC lease agreements With Fluidstack, that’s a total of 360 MW. These deals brought something new to the mining sector: Google. Tech giants backstopped leasing and placed institutional trust in building crypto infrastructure that was previously considered speculative.

In November, TeraWulf reported more than 520 MW of total contracted HPC IT workload. This is one of the largest scales we have ever seen in the Bitcoin mining space, and it happened within a few months.

Of note is the 72.5MW Core42 leasesigned late last year and still part of the mix. But that is fluid stack who came out as a key partner In this play. Beyond the lease scale, the two companies have entered into a partnership (along with credit enhancement from Google). joint venture We jointly developed the Abernathy site. 240MW HPC campus, with expansion potential up to 600 MW.

This is a subtle point, but important shift: Rather than leasing land and space to hyperscalers, TeraWulf is now co-building.

Joint venture in Texas

Abernathy’s joint venture is different structure From what we’ve seen in the industry. The deal includes a 25-year lease with Fluidstack (longer than typical AI leases) and is backed by $1.3 billion in credit enhancement from Google. TeraWulf retains up to 51% control and the right to participate in the construction of an additional 200 MW led by Fluidstack.

This multi-layered approach, consisting of land ownership, lease structures, client partnerships, and access to hyperscalar credits, provides something rare in mining: long-term visibility.

Interestingly, this wasn’t even WULF’s idea. CEO Paul Prager said in an earnings call that it was Google that asked Abernathy to anchor the joint venture. This comment reveals how hyperscalers think. Forget mining labels, what matters is grid access, execution history, and site control. Like it or not, WULF has all three of those things.

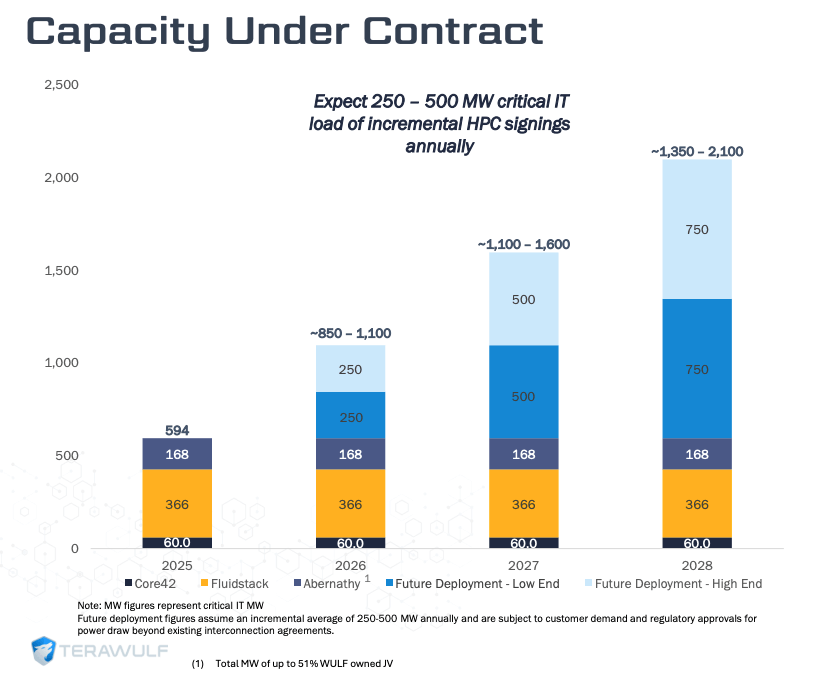

Targeting 250-500 MW of new HPC contracts per year

Perhaps the boldest moment of the third quarter conference call was when TeraWulf increased its annual goal for HPC contracts. Previously, it was directed as 100-150 MW per year; New target is 250-500MW per year. If realized, this would equate to an annual revenue increase of between $465 million and $930 million (assuming a calculation of $1.86 million/MW).

TeraWulf screenshot Investor presentation (10 pages)

Although execution risks remain, management expressed strong confidence in achieving these goals, citing more than 150 sites evaluated last year and an expanded development/acquisition team. While some of the $5.2 billion in funding has been earmarked to support these expansions, capital needs remain steep, especially for purpose-built HPC data centers (which conservatively range from $8 million to $11 million per MW).

Compared to traditional miners that chase hashrate and halving cycles, this model aims for continuous revenue primarily driven by client demand rather than block rewards.

The future of Bitcoin mining business

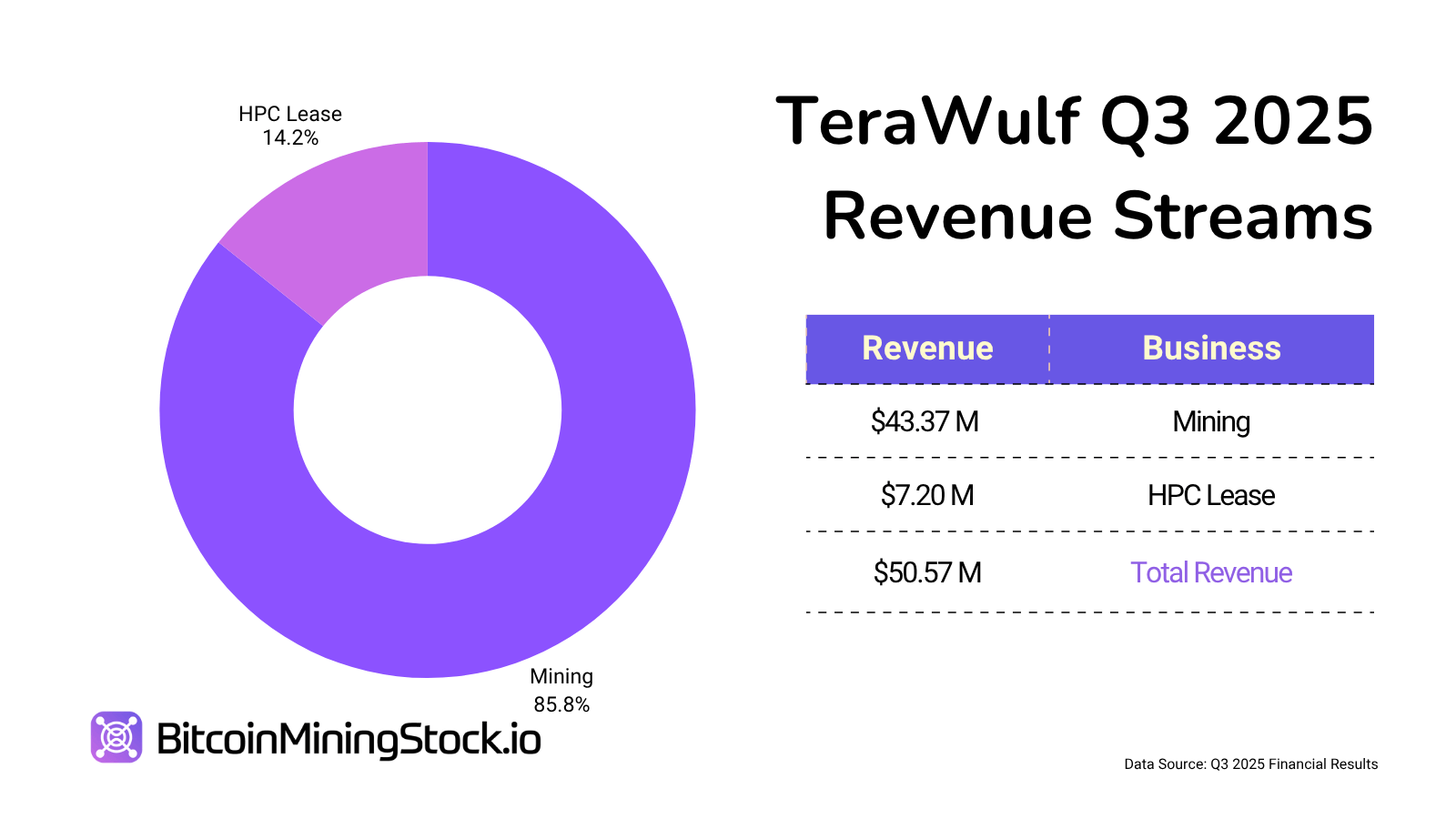

HPC is a new frontier for the company, but Bitcoin mining remains Main revenue contributors today. In Q3, TeraWulf self-mined 377 BTC (down from 485 BTC in Q2) as it decommissioned old mining units and began reallocating infrastructure to HPC.

Future developments at Mariner Lake, a major hub where the transition to HPC is in full swing, are as follows: Focused solely on AI/HPC. The company revealed that No new Bitcoin mining infrastructure is being built Unless it supports dual-use functionality.

Still, TeraWulf said it intends to mine Bitcoin “at least until the end of 2026.”

This approach is nothing special, but it sets a clear signal. Some miners may have talked about AI pivots, but TeraWulf hardcoded it into site-level strategies, capital investment priorities, and annual KPIs.

final thoughts

TeraWulf’s third quarter doesn’t just represent a win for Reese, it also points to a possible path for other Bitcoin miners to follow in the AI era. Rather than simply leasing infrastructure, the company leverages what it already controls (land, power, project execution) to form long-term capital-based partnerships. In doing so, we secured a multi-billion dollar HPC/AI commitment and de-risked our roadmap. The question is no longer whether miners can attract AI deals, but whether miners are in a position to scale quickly. Few people have the resources to copy this strategy, but the market is watching to see who makes the next move.