Cryptocurrency traders and investors who have been buying near the highs in recent months are now being fully vindicated as the hype fades and the market bleeds.

Bitcoin has fallen to around $88,000, down more than 20% in the past 30 days. Today’s overall cryptocurrency market fell by 4.82% in 24 hours to $3.04 trillion, with 95% of all coins dyed red. The Fear and Greed Index reached 16, the lowest reading since April and firmly in extreme fear territory. To put this into perspective, Zcash is the only coin in the top 50 market capitalization that remains green, with a 4% gain.

And what about macro photography? That doesn’t help.

With hopes of a December Federal Reserve rate cut waning, Bitcoin ETFs just posting their fifth straight day of outflows (BlackRock alone saw a record $523 million in outflows yesterday), and the prospect of a 2026 crypto winter becoming more likely, traders are looking for hedges.

Myriad, on the other hand, decryptionDastan’s parent company – traders are preparing for more carnage. A whopping 73.3% of Myriad’s funds are betting that Bitcoin will rise to $85,000 instead of $115,000. Regarding Ethereum, Myriad users see a 62% chance that ETH, currently trading at around $2,800, will rise to $4,000 and fall to $2.5,000.

are they right? Here’s what the chart shows:

Bitcoin (BTC) Price: Death Cross Confirmed

Bitcoin opened today at $92,911, but quickly fell off a cliff, dropping more than 4% to its current price of $88,605. This is a $4,000 drop in one day, sending BTC back below the psychologically important $90,000 level and hitting a seven-month low.

The technical setup is starting to look ugly.

Bitcoin (BTC) price data. Image: Tradingview

Exponential moving averages (EMAs) help traders identify the direction of a trend by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA is below the long-term 200-day EMA, it usually means that sellers are controlling the market structure.

In the case of Bitcoin, the 50-day EMA just fell below the 200-day EMA, forming a scary “death cross” pattern that indicates long-term bearish momentum. Bitcoin is currently trading well below both moving averages, creating troubling overhead resistance that bulls will need to reclaim before a meaningful recovery can begin.

What’s worse is that the average directional index, which measures trend strength regardless of direction, is at a solid level of 38.25. An ADX measurement above 25 indicates a strong trend exists, and above 35 indicates a very strong trend. This indicates that the current downtrend is not a weak, directionless chop. There is real momentum behind this decline, as reflected in the Crypto Fear and Green Index’s “Extreme Fear” numbers.

Bitcoin’s Relative Strength Index (RSI) has surged to 27.12, firmly in oversold territory below 30. The RSI measures whether an asset is overbought or oversold based on recent price movements, and as of 27, Bitcoin is stretching like a rubber band. This does not mean the sell-off will stop anytime soon, but it does suggest that we are nearing a depletion level where a strong rebound is likely. That could mean that the price will soon test the support (now resistance) level it has been in since June, as seen by the white dotted line in the chart above.

The Squeeze Momentum Indicator shows market stages in price and helps identify when the trend is shifting, while flashing bearish impulse signals and confirming that compression is being released downwards.

So are the Myriad forecasters correct in setting an $85,000 goal?

Maybe the wisdom of the crowd will help us figure something out. The chart shows Fibonacci support near $84,451 and stronger support near $71,486. If Bitcoin loses the currently testing $88,000 to $89,000 zone, there will be little to stop it from moving below $85,000.

However, the RSI is oversold, suggesting that a drop to $85,000 is likely to be a quick rally rather than a sustained decline. Capitulations tend to reverse violently once the last leveraged long positions (futures contracts using borrowed funds to bet that Bitcoin’s price will rise) are washed away.

A rise to $115,000 would require Bitcoin to recover the death cross and break out of the downtrend line near $100,492, a tall order that explains why only 26.7% of traders are betting on Bitcoin.

Main level:

resistance:

- $92,000 (immediate);

- $100,492 (downtrend line)

support:

- $84,451 (over);

- $71,486 (major)

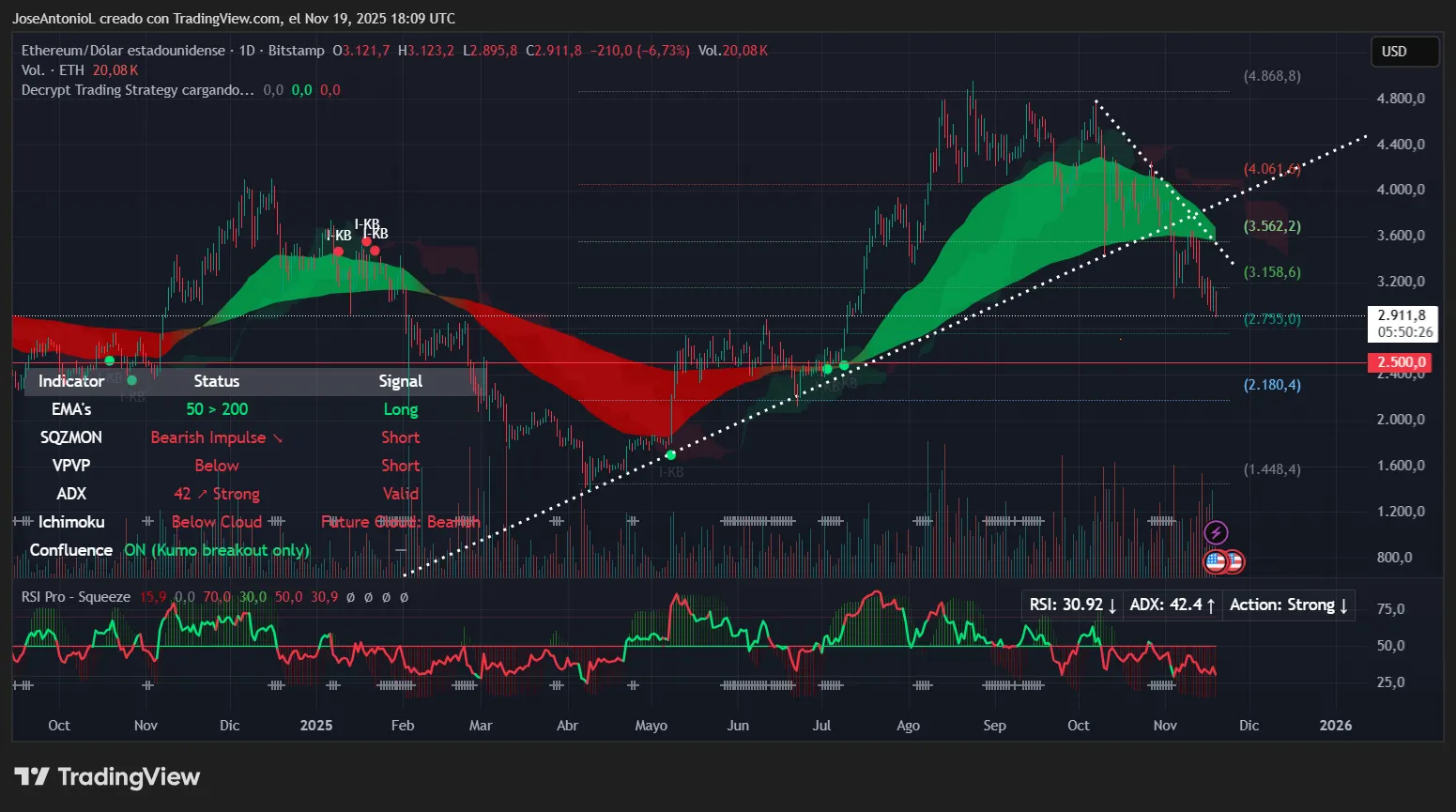

Ethereum (ETH) price: when good indicators turn bad

And if Bitcoin is in bad shape, Ethereum is going to be even worse. ETH plunged 6.73% today from its opening price of $3,121.7 to close at $2,911.8 and hit an intraday low of $2,895.8.

Ethereum (ETH) price data. Image: Tradingview

Unlike Bitcoin, Ethereum’s 50-day EMA is still trading above its 200-day EMA, or “golden cross” which is supposed to be bullish. So why is ETH being destroyed?

A golden cross indicates that the long-term trend structure is intact, but it does not protect you from sharp corrections within that trend. Ethereum is trading below both moving averages despite the golden cross, meaning the bullish structure is being severely tested.

Also, the setup is very likely to turn bearish soon. The two EMAs are about to cross, so if ETH falls for a few days, we will see another death cross here.

And understand this: Ethereum’s ADX is even more extreme than Bitcoin’s 42.4. Traders would consider this a very strong trend, but the trend is firmly bearish at the moment. ETH Squeeze Momentum Indicator Is Showing a Bearish Impulse Signal as well

What makes this especially painful for ETH holders is that despite Ethereum’s strong downside momentum (high ADX), the RSI is barely above oversold territory at 30.92, just shy of the 30 threshold. This creates a knife-edge situation where a strong downtrend can push the RSI further into oversold before reversing.

The ETH chart shows support near $2,796 and stronger support near $2,300. At the moment, countless users are once again strongly supporting the downside, and the probability of Ethereum falling below $2.5 million is close to 67%, which is consistent with technical analysis.

Ethereum needs to maintain the $2,700-$2,800 zone (expressed in Fibonacci levels) to maintain the 200-day EMA. If it breaks, the next meaningful support is certainly around $2,300 to $2,500, which is exactly what most Myriad users are looking for.

What if 33% bet on $4,000? For that to happen, ETH would need to reclaim the $3,100-$3,200 zone, hold it as support, and overcome multiple resistance levels. It is possible if macro conditions improve, but the current technical support does not support it.

Keep praying, bulls. After all, this is cryptography. Something even crazier happened.

Main level:

resistance:

- $3,100 (50-day EMA)

- $3,562 (previous resistance)

support:

- $2,700-2,800 (200-day EMA is important)

- $2,300 (high)

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.