table of contents

What is the Chainlink Reserve? How has the Reserve grown since its inception? Technical Structure and Transparency Connection to Chainlink Network Activities Conclusion Source FAQ

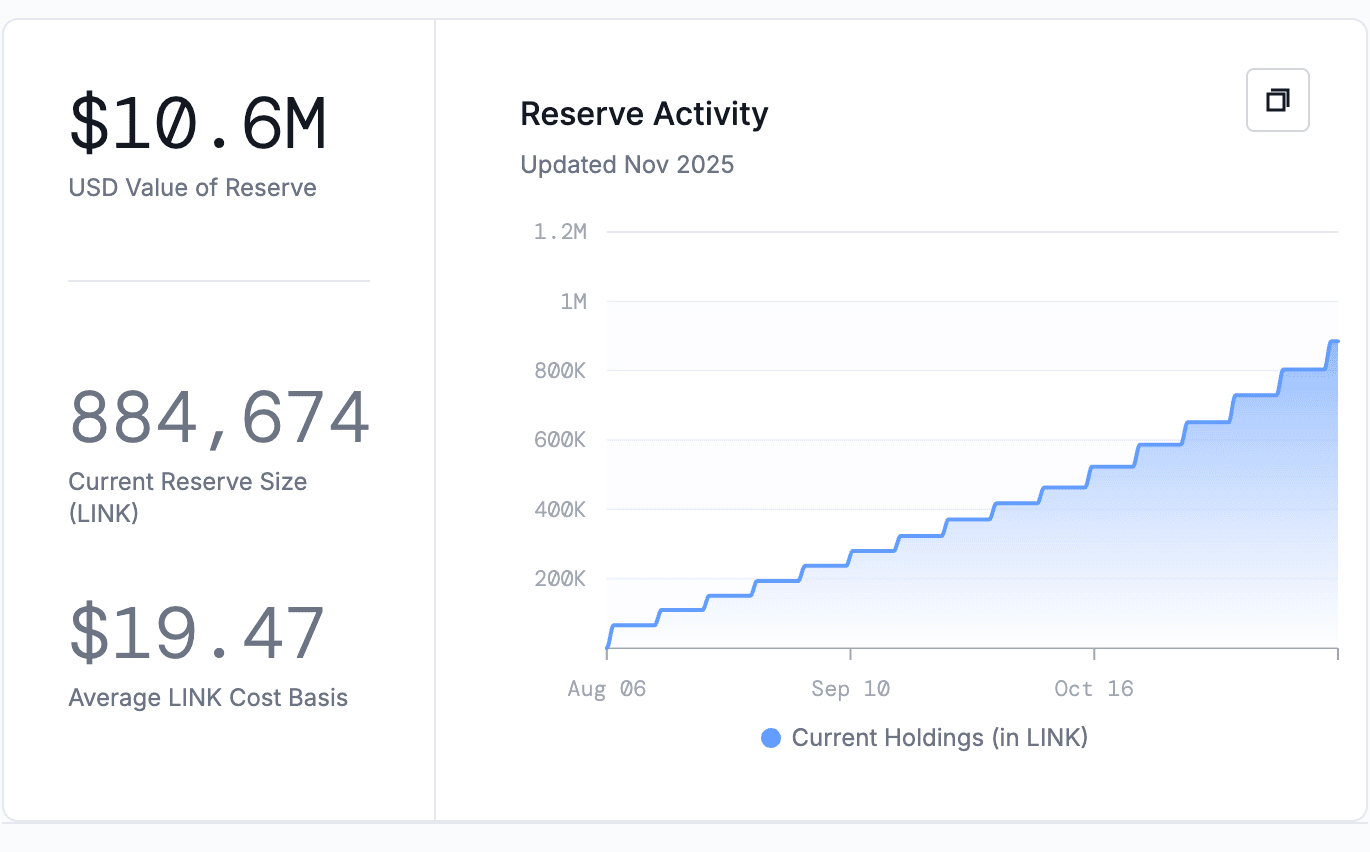

Since its launch in August 2025, chain link reserve There were no down weeks. On-chain treasury contracts that accumulate automatically link token Network revenue reached 884,673.64 LINK on November 20th, with 16th consecutive week of deposits reaching 81,285.98 LINK.

This reserve converts both off-chain corporate payments and on-chain service fees into LINK through decentralized exchanges, primarily Uniswap V3, locking the tokens under a multi-year no-withdrawal policy enforced by time-locked smart contracts.

We take a look at the current status and recent activity of the reserve, which at the time of writing is approaching $11 million, following a steady accumulation despite market fluctuations.

What is Chainlink Reserve?

Chainlink Reserve is an on-chain reserve designed to store LINK tokens funded by both companies and on-chain royalties. The goal is to strengthen the long-term sustainability of the network by funneling revenue from large institutions and decentralized applications directly into LINK. This platform will be released on August 7, 2025, on August 7, 2025. Recently concluded SmartCon 2025.

This reserve works through a feature called Payment Abstraction. How does this work? Institutional customers and businesses using chain link Services such as Cross-Chain Interoperability Protocol (CCIP), data feeds, and verifiable random functions (VRF) can settle invoices in fiat currency or stablecoins (most commonly USDC).

These payments will be routed through a decentralized liquidity pool where a portion of the deposited funds will be exchanged to LINK on Uniswap V3, and the remaining percentage will come from on-chain fees paid directly on LINK. Once acquired, the tokens are transferred to a reserve contract and have a built-in multi-day timelock, so they cannot be removed for several years.

All holdings and transactions are official dashboard and can be independent Verified with Etherscan.

How has the reserve increased since launch?

Chainlink deposits new LINK into the reserve every Thursday. The first public accumulation exceeded $1 million in LINK value within days of launch in August 2025. Since then, this reserve has recorded 16 weekly inflows and no withdrawals.

Recent deposits for November 2025 show consistent growth.

- November 6, 2025: 78,252.51 LINKs added for a total of 729,338.41 LINKs.

- November 13, 2025: 74,049.24 LINKs added for a total of 803,387.65 LINKs.

- November 20, 2025: 81,285.98 LINKs added for a total of 884,673.64 LINKs.

The Reserve currently holds 884,674 links, valued at approximately $10.6 million.

The Nov. 20 deposit was worth approximately $1.06 million at the time of purchase. The monthly savings amount has increased visibly. In late October 2025, this reserve added an average of approximately 63,500 LINK per week, compared to approximately 77,900 LINK per week in the three November deposits reported so far.

Technical structure and transparency

The preliminary agreement includes several safeguards. Timelocks prevent withdrawals for multiple years, and governance authority is entrusted to a multi-signature wallet managed by the Chainlink team. Future uses of accumulated tokens, such as staking reward funding, node operator incentives, and ecosystem subsidies, will be determined through community discussions via existing Chainlink governance channels.

In addition, real-time data shows current balances, past inflows, acquisition cost basis, and percentage of total LINK supply held.

Connecting to Chainlink network activity

The revenue flowing into Reserve comes from multiple Chainlink products. The biggest factors include CCIP fees due to cross-chain token transfers, data feed subscriptions used in DeFi protocols, and corporate integration with traditional financial institutions.

Notable trends supporting revenue growth in November 2025 include:

- Chainlink Runtime Environment (CRE) launches for institutional tokenization workflows on November 4, 2025

- Announcement of cross-border payments pilot using CCIP between Brazilian digital currency Drex and Hong Kong Monetary Authority

- On-chain FTSE Russell index integration via Chainlink data feed

- UBS continues piloting tokenized funds

- Chainlink Rewards Season 1 will start on November 11, 2025, and third-party project tokens will be distributed to LINK stakers.

Chainlink continues to hold an estimated 70% share of the blockchain oracle market, with over $100 billion in total locked up across DeFi and real-world asset protocols.

Important future milestones include: Swift SR2025 This update allows more than 11,000 member banks to send authenticated instructions to Chainlink CCIP, potentially increasing payment-related fees to cover reserves.

conclusion

Chainlink Reserve provides a transparent and verifiable mechanism to convert real revenue from oracle services and cross-chain infrastructure into perpetual LINK holdings. Since its launch in August 2025, it has accumulated tokens at an accelerated pace, reaching 884,674 links by November 20, 2025, through 16 consecutive weekly deposits, primarily funded by corporate adoption and on-chain fees.

Combined with high-value staking participation and future institutional integrations such as SWIFT’s SR 2025 rollout, this reserve establishes a direct on-chain record of LINK token value accrual based on actual network usage rather than speculative narratives.

source of information

- chain link reserve: Track booking metrics with real-time updates.

- ether scan: Chainlink reserve confirmed on Etherscan.

- chain link blog: Announcing the release of Chainlink Reserve

- chain link x: Cumulative total number of LINKs as of November 20th.