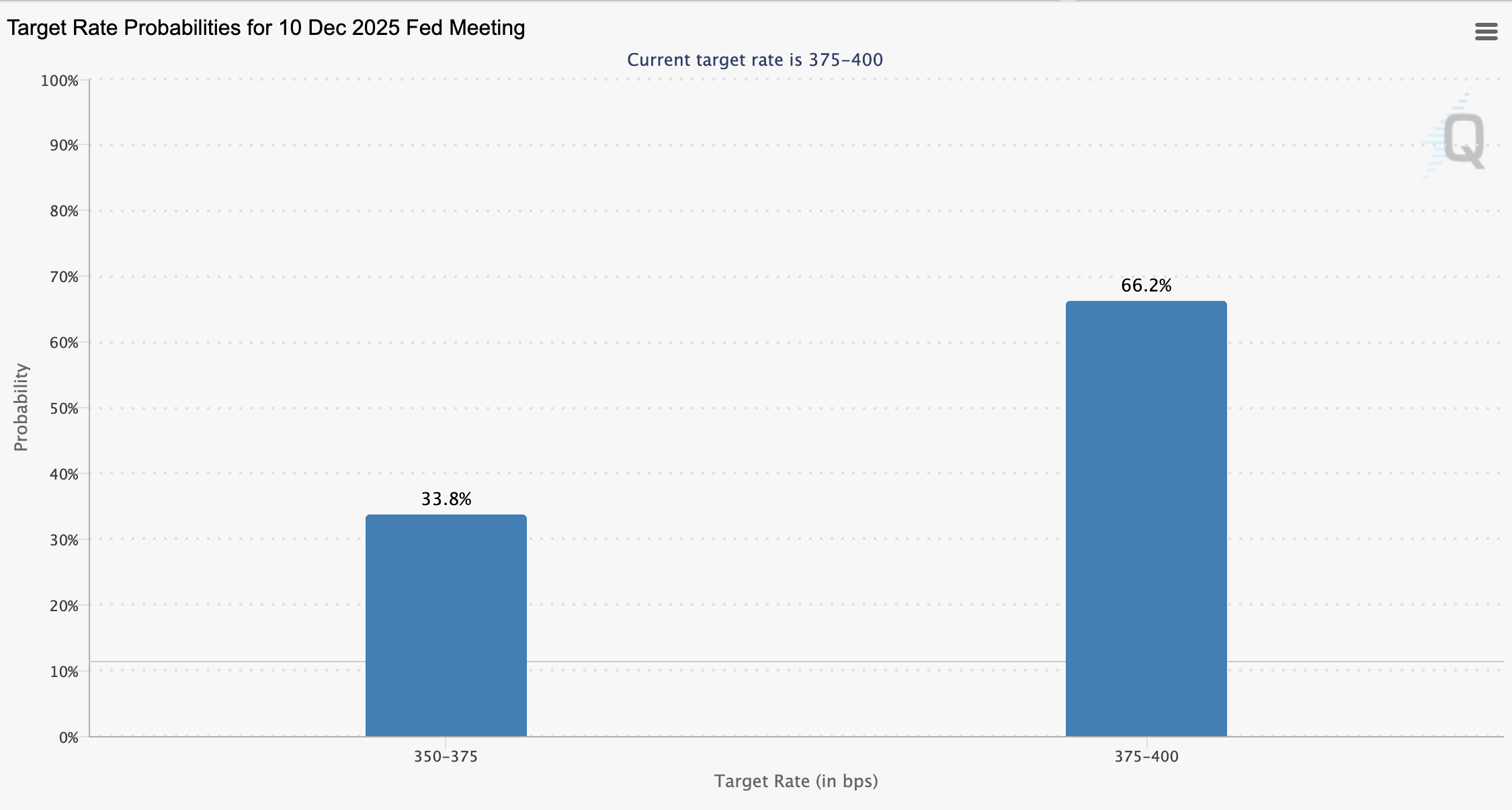

With “extreme fear” gripping the crypto market and the price of Bitcoin (BTC) below $89,000, the probability of a rate cut at the Federal Open Market Committee (FOMC) in December has dropped to 33%.

Investors had been pegging the probability of a December rate cut at about 67% in the first week of November, but that probability fell below 50% on Thursday, according to data from the Chicago Mercantile Exchange (CME).

Traders at prediction markets Calsi and Polymarket are pegging the probability of a December rate cut at about 70% and 67%, respectively. Although higher than the CME, traders appear generally reluctant to cut rates due to persistent concerns about inflation, according to the Kobessi letter.

Interest rate target probability for December FOMC meeting. sauce: CME Group

The sharp decline in the probability of a December interest rate cut and the drop in crypto prices has caused panic, with some analysts now warning that this drop could signal the beginning of a prolonged crypto bear market and decline in asset prices.

BTC price dips below $89,000 as market sentiment remains just above yearly lows

BTC price failed to defend the key support level and fell below $90,000 again on Wednesday, and has been trading well below the key support level, the 365-day moving average, for the past six days.

Bitcoin’s 50-day exponential moving average (EMA) also fell below the 200-day EMA. This signal, known as a “death cross”, signals a further decline in BTC.

Bitcoin price trends at the time of writing this article. For the past six days, the price has ended below the 365-day moving average. sauce: TradingView

Some analysts are now predicting that the price could fall to $75,000 and bottom before rebounding by the end of 2025, while others speculate that the top of the cycle may already be in.

Market analyst Benjamin Cowen said on Sunday: “If the cycle is not over, the period of Bitcoin’s rebound will begin sometime next week.”

“If a rebound does not occur within a week, we could see another sharp decline before a further rebound, perhaps to the 200-day simple moving average (SMA), which would mark a macro downside high,” Cowen added.

The Crypto Fear and Greed Index remains just above its year-to-date lows, warning crypto investors. sauce: coin market cap

This prediction was announced amid heightened cryptocurrency investor sentiment. Investor sentiment, as measured by the “Crypto Fear & Greed Index,” is at 16 at the time of writing, indicating “extreme fear” among investors.

According to CoinMarketCap, this puts crypto investor market sentiment just one point above the yearly low.