Bitcoin prices took a big hit this week, with mining revenues falling along with it as the price per petahash fell even deeper than the April slump. Miners are feeling the squeeze from a tough pricing environment and thin on-chain fees associated with newly discovered block rewards.

Bitcoin mining calculations become cruel due to fee depletion and hash price crater

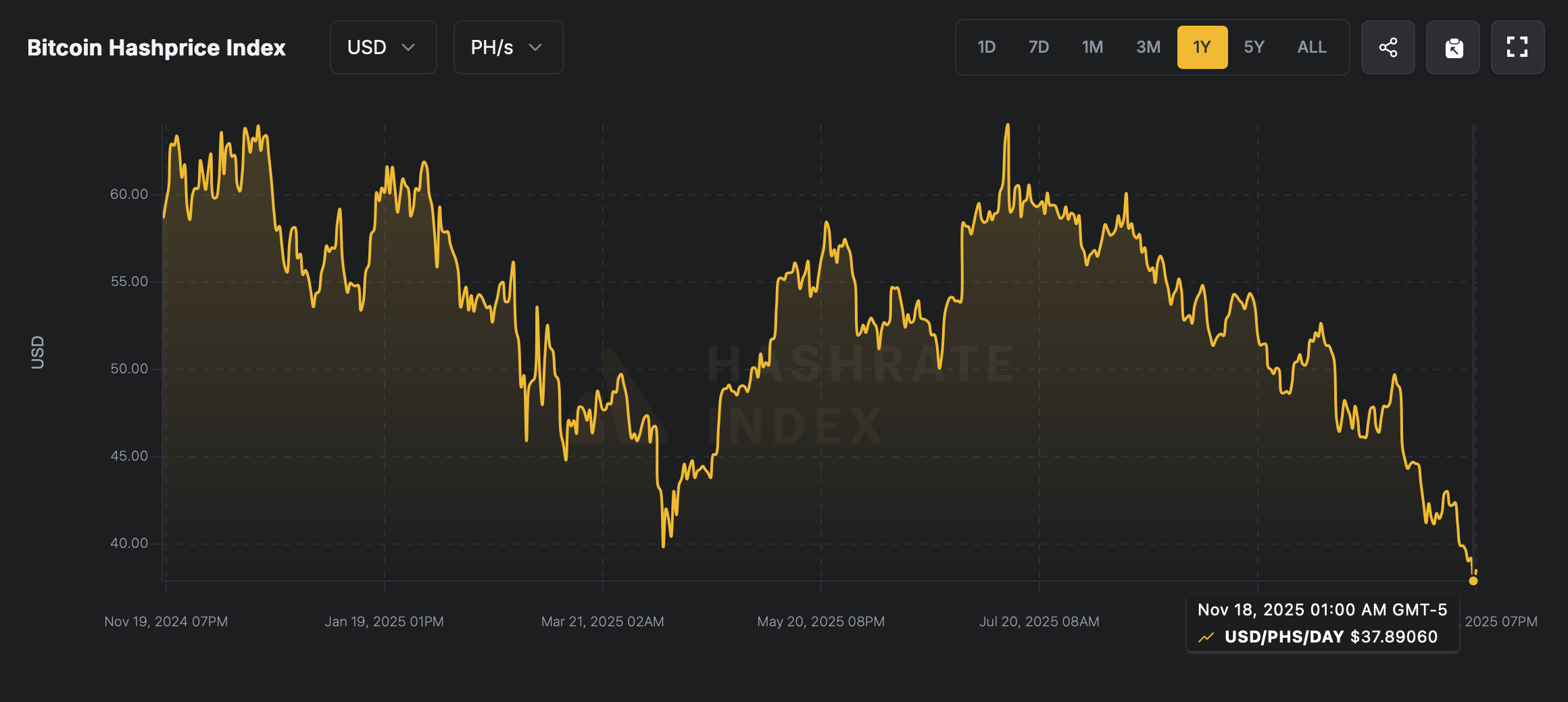

Bitcoin’s hash price (the expected value of hash power in petahash per second (PH/s) per day) has fallen to an all-time low since Luxor City began tracking the index in December 2016.

Much of that revenue decline can be traced back to the 2020 and 2024 halvings, which were compounded by the dramatic decline in on-chain fees in their aftermath. Currently, when a miner lands a block, only about 0.73% is paid out from transaction fees, and the rest is tied to a subsidy of 3.125 BTC.

Source: Luxor hashrateindex.com.

Bitcoin closed at $79,874 on April 7, 2025, and the hash price (value of 1 petahash) remained at $39.83. Fast forward to November 19, 2025, and the price of Bitcoin is $91,172, an increase of $11,298 per coin, but a lower estimate of $38.14 per PH/s.

Yesterday, the hash price fell further to $37.48 per PH/s. At rates like these, unless something is released, Bitcoin miners will find themselves in an economic mess from which there is no easy way out. As it turns out, the numbers paint a very straightforward picture. The miners cannot continue down this path unless something gives way.

Either the price of Bitcoin would have to rise enough to compensate for the decline in profits, or on-chain activity would have to heat up significantly to provide more meaningful fees. If neither happens, the current squeeze will not last long and miners will be forced to rethink their operations, whether that means upgrading their fleets, moving more quickly to artificial intelligence (AI), consolidating, or pursuing other revenue streams.

Frequently asked questions ❓

- What is Bitcoin hash price? This is the estimated daily value of 1 PH/s of mining power based on price, difficulty, and fees.

- Why is mining revenue decreasing? Hashprice has fallen to record lows as on-chain fees shrink and subsidies make up the majority of payments.

- How will miners be affected? Despite the rise in Bitcoin prices, many companies are facing shrinking margins as the revenue per petahash decreases.

- What could change the outlook? Increased fees, significant price increases, and operational changes such as AI integration could ease the pressure.