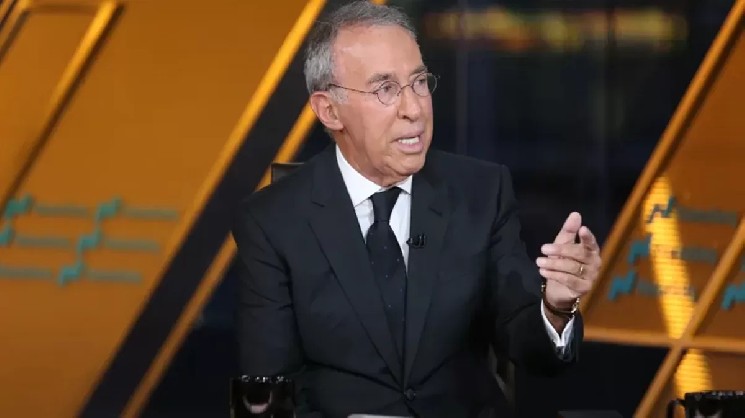

Billionaire investor Ron Baron, chairman and CEO of Baron Capital, made important comments in an interview with CNBC about the latest market trends, long-term investment strategy, and the future of Tesla.

Baron argued that investors should look at the big picture and seize opportunities, rather than focusing on short-term declines.

Ron Baron pointed out that the market has been mainly focused on technology and artificial intelligence stocks recently. He pointed out that companies outside these sectors, especially small and medium-sized enterprises, have performed relatively poorly this year. Baron noted that the largest stocks in the market account for most of the returns, and excluding them makes the overall market return look lower.

Explaining the basics of his investment philosophy, Barron pointed out that inflation continues to erode the value of money. He said people will need to earn twice as much as they do now within 15 years to maintain their purchasing power.

But Barron’s main theory hinges on the fact that the stock market and economy double every 10 to 12 years, as they have throughout his lifetime. Therefore, he argued, the way to protect and increase the value of money in the face of inflation is through stock investment, rather than by putting it in banks or bonds.

Ron Baron also briefly mentioned cryptocurrencies when evaluating the performance of various asset classes. When discussing the potential of the stock market, Baron briefly commented, “Bitcoin has obviously been great.”

*This is not investment advice.