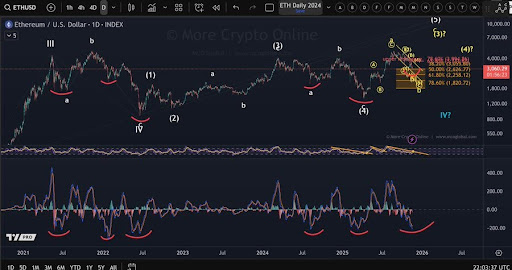

Ethereum (ETH) is flashing a rare technical warning sign for the bears. According to our analysis, the daily chart has reached a historically oversold MACD reading not seen in years, coinciding with a significantly oversold RSI. This confluence of extreme momentum signals suggests that price has entered a major demand zone, dramatically increasing the likelihood of a strong bailout rebound and setting the stage for a significant short-term rebound.

MACD hits rare historic low — zone linked to major ETH bottoms

According to recent information, post From More Crypto Online Ethereum is currently flashing one of the most extreme MACD readings in years on the daily time frame. While MACD technically does not have a fixed oversold threshold, comparing past cycles can provide valuable context. Historically, ETH has often undergone significant formations. market Every time the MACD enters the -210 to -220 area, it hits a new low and has fallen below this zone several times, but not often.

Related article: Ethereum drops to $3,000, highlighting weakness after recent failed rally

This places the current MACD position in what can be considered a historically oversold zone, indicating an increasing likelihood of a rescue rebound. In addition to this confluence, the RSI has slipped deeper into oversold territory, reinforcing the idea that selling pressure may be nearing exhaustion. When we put both metrics together we find: momentum You may be able to move away from the bear quickly.

However, analysts caution that these signals alone do not confirm a major trend reversal. Especially in strong downtrends, oversold conditions can last longer than expected. Still, such extreme readings are often early clues to temporary problems. recovery Alternatively, a corrective move to the upside may be on the horizon. Overall, the current market structure gives bears something to think about.

Early signs of relief: Ethereum finds stability in key demand zone

In the 3D market updateCryptoPulse reported that Ethereum had completely eavesdropped on what was identified. demand zoneshowing early signs that the aggressive downside may ease. This reaction suggests that sellers are losing momentum, creating a situation where a short-term rebound is possible if buyers pull back. If bullish strength returns, the $3,500 area is likely to be retested in the coming sessions.

Related article: Ethereum approaches significant resistance — bullish breakout or trap?

However, CryptoPulse emphasized that confirmation is required before making any meaningful reversal. A strong rebound combined with a recovery in key short-term levels would be the first signal that buyers are regaining control.

On the other hand, if the bearish pressure continues, Ethereum could drift deeper into the chart structure and the next significant demand could be located between $2,400 and $2,600. Given the current situation, this zone could act as a major support zone for ETH. support Unable to hold.

Featured image from iStock, chart from Tradingview.com