Overnight crypto gains evaporated again by morning in US as Bitcoin BTC$101.727,63 It fell below $102,000 on Wednesday.

It briefly topped $105,000 earlier today, but the largest cryptocurrency plummeted 3% in just a few hours when traditional markets opened in the United States. It wasn’t just Bitcoin. ether Ethereum$3.431,64 Although it fell almost 5% below $3,400 during the same period, Solana sol$153,62, XRP$2,3488 And other altcoin majors suffered similar declines.

U.S. stocks related to cryptocurrencies also rose in the early stages. USDC stablecoin issuer Circle (CRCL) fell 9.5% following Q3 results, but crypto miners with data center ambitions continued to sell, including Bitfarm (BITF), BitDeer (BTDR), Cipher Mining (CIFR), Hive Digital (HIVE), Hut8 (HUT), and IREN, which fell 5-10%.

Decreasing US appetite for Bitcoin

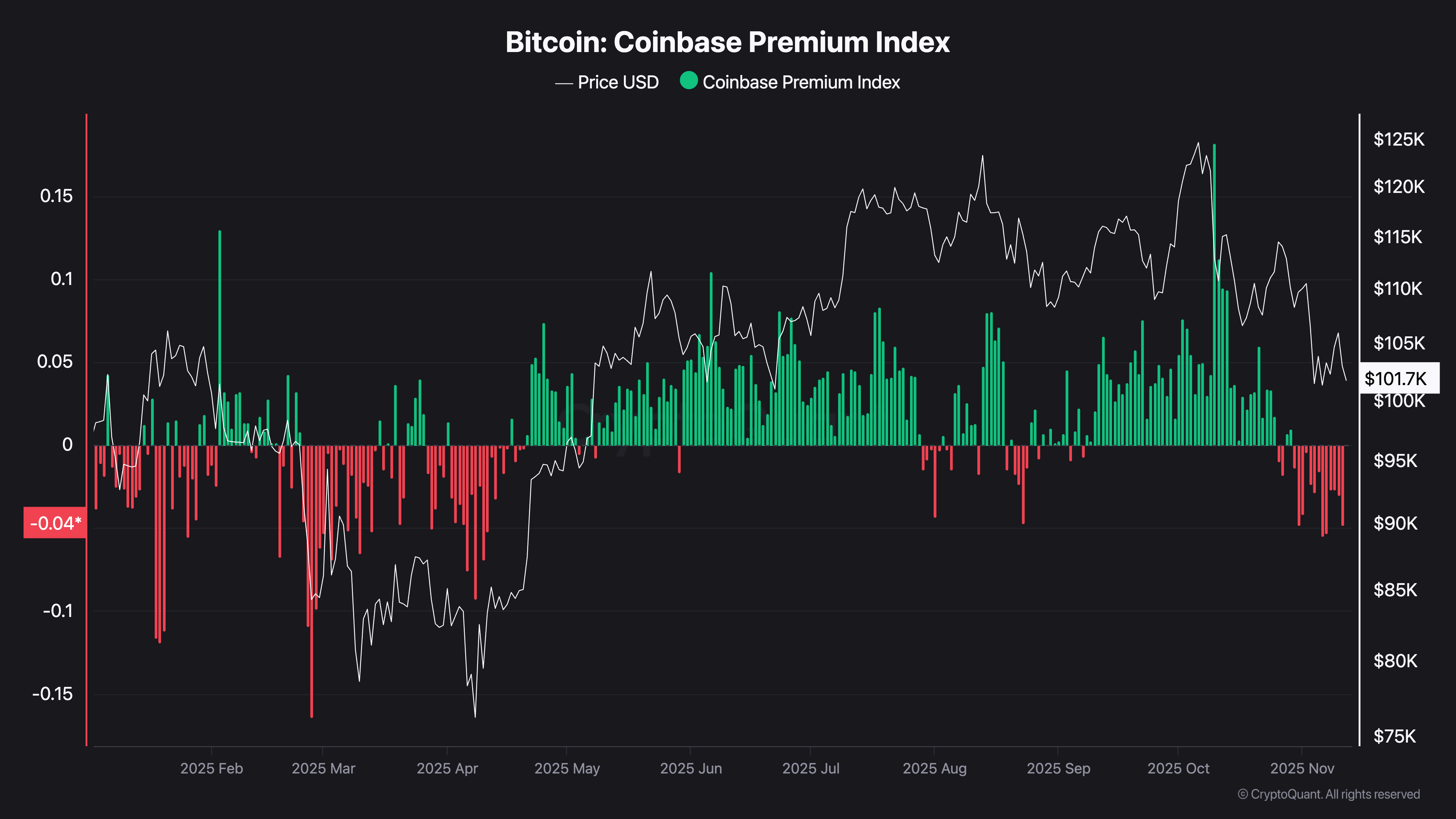

Lackluster price action during US trading hours has been a fixture of the crypto market in recent weeks. An indication of the weakness in U.S. investor demand is the so-called Coinbase premium, a popular measure of U.S. investor demand, which has been negative since late October.

Bitcoin’s Coinbase Premium Index is in its weakest streak since the April correction. (CryptoQuant)

Coinbase Premium measures the price difference between the price of Spot BTC on Coinbase, a cryptocurrency exchange widely used by US customers and many institutional market participants, and the price on Binance, a popular exchange among offshore retail users and the top exchange by trading volume.

This is the indicator’s longest negative streak since March-April, when a market-wide correction saw BTC rise above $100,000 before falling to $75,000.

Fed is divided on interest rate cuts

The shift in U.S. sentiment coincides with growing uncertainty over the Fed’s next action since its October central bank meeting. What was widely expected to be an easy path to another rate cut in December before the meeting has now turned into an internal battle between policymakers.

The Wall Street Journal recently reported that central banks are facing internal divisions, with policymakers divided over whether the greater risk now is sustained inflation or a softening labor market. The split makes the path to a December rate cut much more uncertain than expected a few weeks ago.

The recent government shutdown, which temporarily froze the release of key jobs and inflation data, has widened the gulf as policymakers have had to rely on private data and anecdotes, the report said.

The report said that the December rate cut is currently a “toss-up” and that even if a decision is made to cut rates, the hurdles for further rate cuts may be high.

Since the Fed’s October meeting, US-listed spot Bitcoin ETFs have seen net outflows of more than $1.8 billion, indicating that the uncertainty surrounding the Fed’s actions and the lack of clear positive catalysts is keeping BTC on edge.