Miners have been actively depositing BTC on Binance, joining inflows from newly created whale wallets. Although mine reserves remain high, they could still cause short-term selling pressure.

While securing short-term profits from BTC, miners maintain a balance of 1.89 million coins, including old wallets where they never transfer assets. Binance has become the main place for BTC deposits in the short term, as miners are currently producing coins for profit.

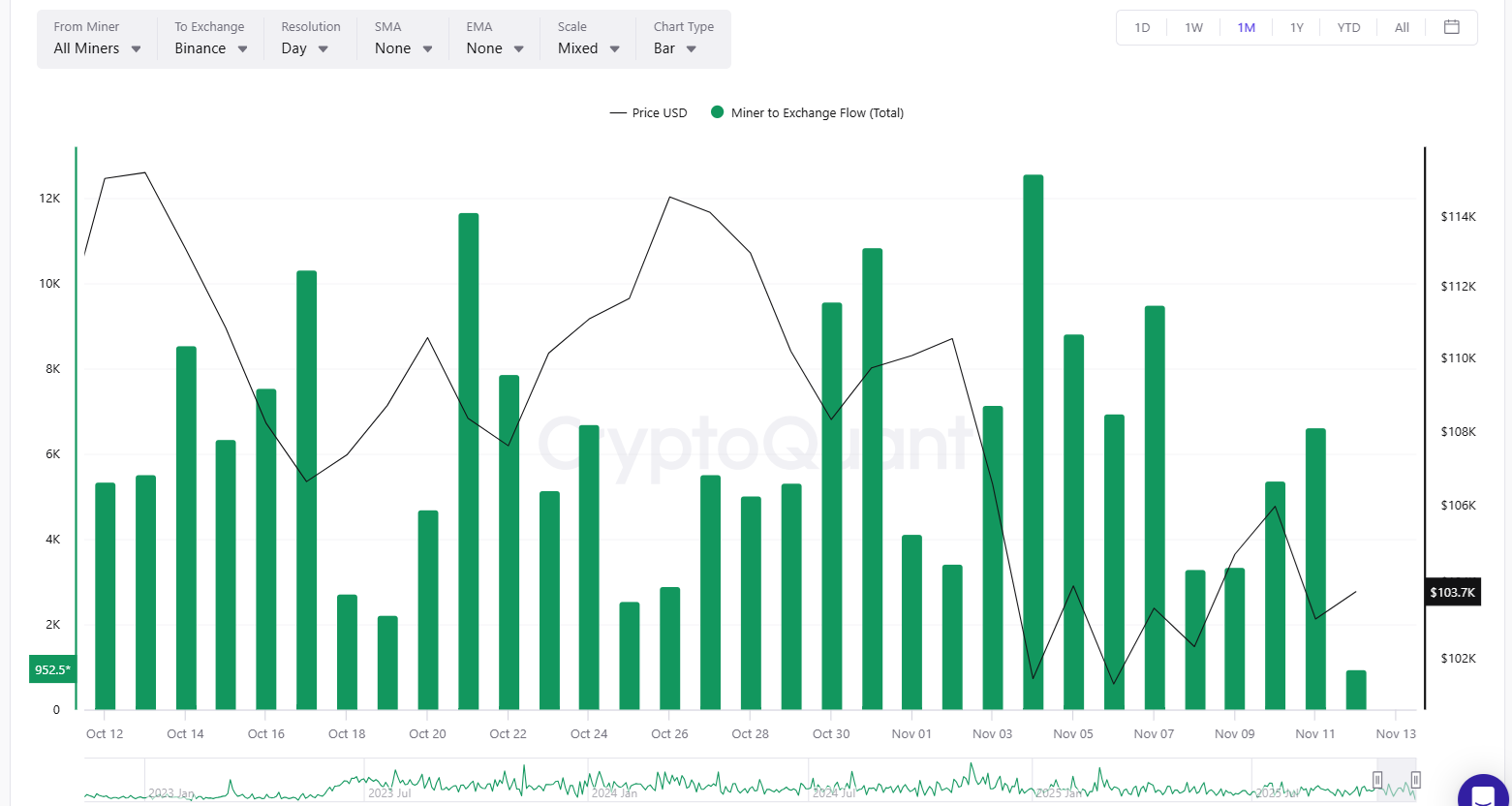

Miner inflows to Binance remained high in November, with over 71,000 BTC month-to-date. |Source: CryptoQuant.

Although miners are operating under the most competitive conditions in history, BTC remains relatively stagnant, trading at $104,115.

In early November, daily deposits flowing into Binance reached a peak of 12,564 BTC. Miner deposits also far exceed recent purchases from finance companies. Previously, all the newly mined BTC was not enough to meet demand.

Block production is currently profitable, so miners may be looking to lock in profits. Despite the lower block reward, miners are using more efficient machines and are able to sell more coins for profit. The market still has the capacity to absorb BTC even at prices above $100,000.

Miner production capacity falls below all-time high

Miners achieved a new activity record in October, making BTC even more competitive. Most of the coins produced went to the largest pool. At the same time, after the establishment of new mining data centers, mining has mainly become an activity that involves large investments.

BTC difficulty is at an all-time high and has been increasing for most of the recent revaluation period. Mining is highly competitive, so there are few attempts to shut down capacity to reduce difficulty. New capacity is coming online after miners modernized their fleets with the latest ASICs.

BTC miners are not seeing anything dire situation This is because mining costs have also fallen since July. More efficient machinery made block production competitive again, and miners were able to take advantage of cheaper power contracts. For miners, the past few months have been one of the longest periods of the year with no signs of distress or mining BTC at a higher cost than the market price.

BTC exchange reserves remain low

Overall, BTC foreign exchange reserves remain low despite recent deposits. Spot sales are meeting demand as BTC transitions to new whale wallets.

Binance holds over 566,000 BTC in reserves, a net increase of over 10,000 coins in a few weeks. However, even Binance’s reserves have decreased compared to previous cycles.

The reasons why miners sell are diverse. Some companies may be looking to sell old coins and pivot and fund new AI data centers.

Overall, the cost of producing coins varies widely between miners. Older mining operations can cost at least $45,000 to produce a coin. New investments have produced up to $117,000 of BTC. recent analysis This disparity suggests that it could lead to further consolidation in the mining space.