Bitcoin (BTC) continues to navigate a complex market environment defined by shifting ETF flows, macro headwinds, and evolving investor sentiment. Despite gaining just 2% over the past week, the flagship cryptocurrency is down more than 8% month-on-month, briefly falling below $100,000 before stabilizing around $105,000.

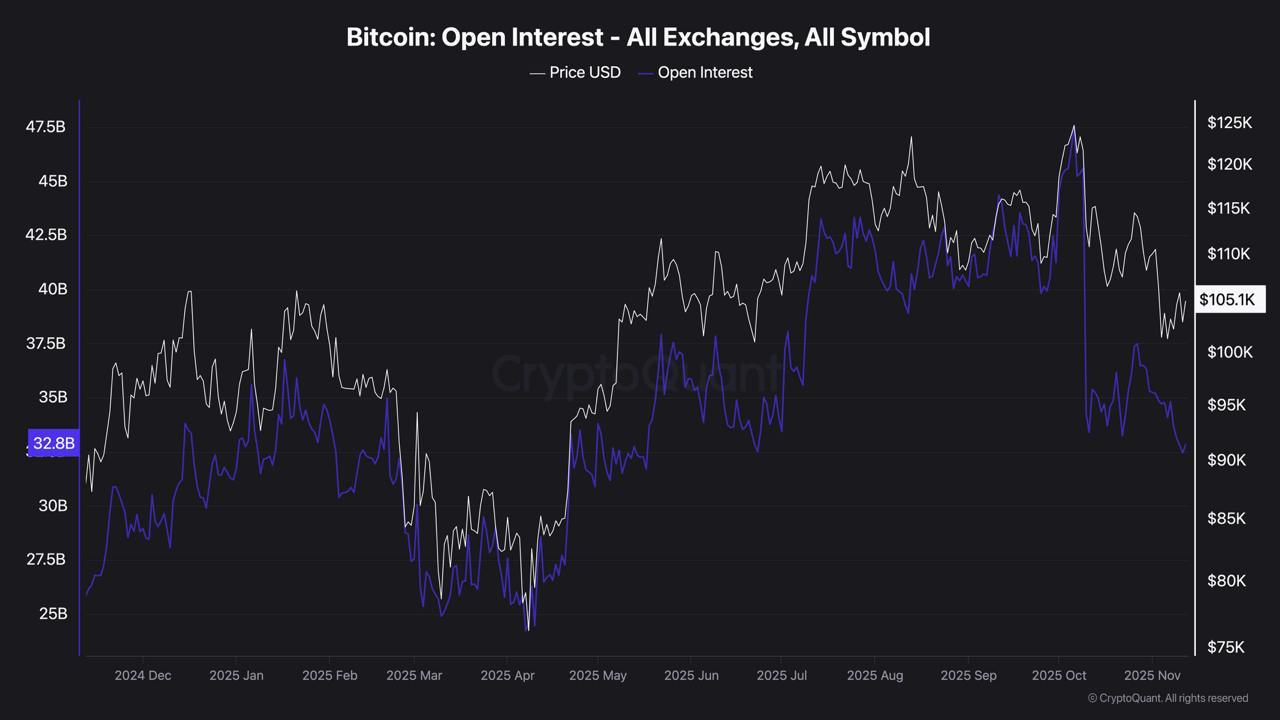

At the same time, certain indicators are showing alarm. Bitcoin open interest across exchanges has fallen to its lowest level in seven months and is currently hovering around $32.1 billion, according to data obtained from Finnvold’s analytics platform. cryptoquant November 12th.

This was notable at the time because open interest represents the total amount of futures contracts outstanding and serves as a barometer for speculative participation. A contraction typically indicates traders are unwinding leveraged positions and often reflects diminishing confidence or increased uncertainty.

Interestingly, this decline comes amid waning short-term enthusiasm for spot Bitcoin ETFs, which were a key driver of demand at the beginning of the year. After weeks of record inflows, ETF momentum has slowed, with some funds seeing modest outflows as investors reassess their risk exposure.

The softening in derivatives trading therefore reflects that pause, suggesting that institutional investors may be moving to the sidelines while waiting for clearer macro and regulatory signals.

Bitcoin on-chain data

However, behind the scenes, structural indicators continue to provide support. The correlation between the US 10-year Treasury yield and Bitcoin reversed to -0.88, highlighting Bitcoin’s growing appeal as a portfolio hedge against traditional markets. Meanwhile, on-chain data shows that long-term holders continue to accumulate, suggesting confidence in Bitcoin’s long-term store of value role despite waning speculative enthusiasm.

Looking ahead, analysts are eyeing a recovery in open interest and new inflows into ETFs, a combination that could reintroduce volatility and directional momentum. On the downside, the $100,000 to $104,000 zone remains a key support area. Failure to sustain this level could lead to further deleveraging, while a sustained close above $106,000 could reignite bullish sentiment.