Ethereum (ETH) derivatives traders are back in full swing, with open interest, volume, and options activity all showing signs of renewed energy across the futures and options markets.

ETH peaks near $3,300 as traders focus on key expiry levels

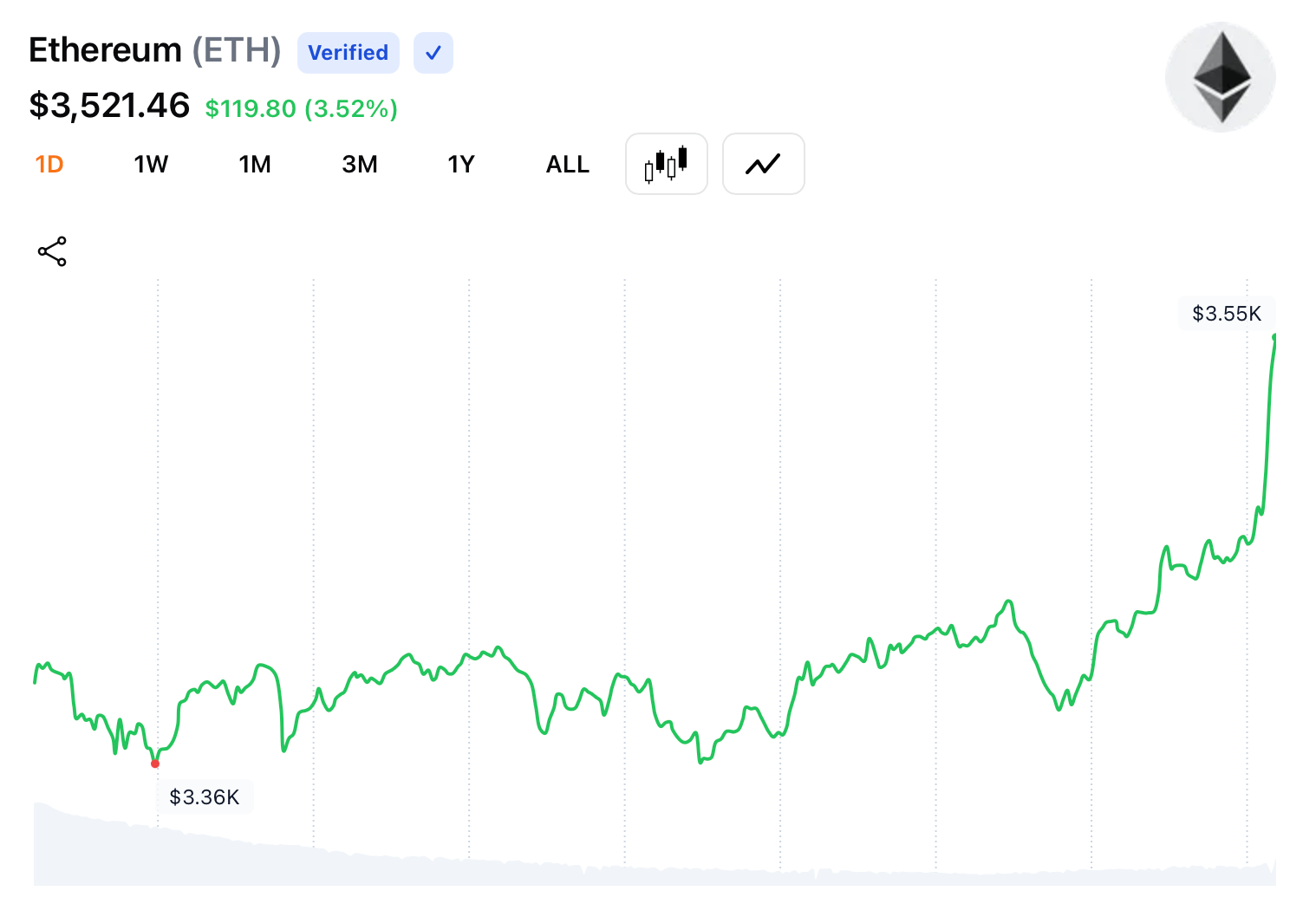

As of 10 a.m. ET on November 9, Ethereum (ETH) was trading at $3,521, up more than 3% on the day but still 28% below its all-time high of $4,946.

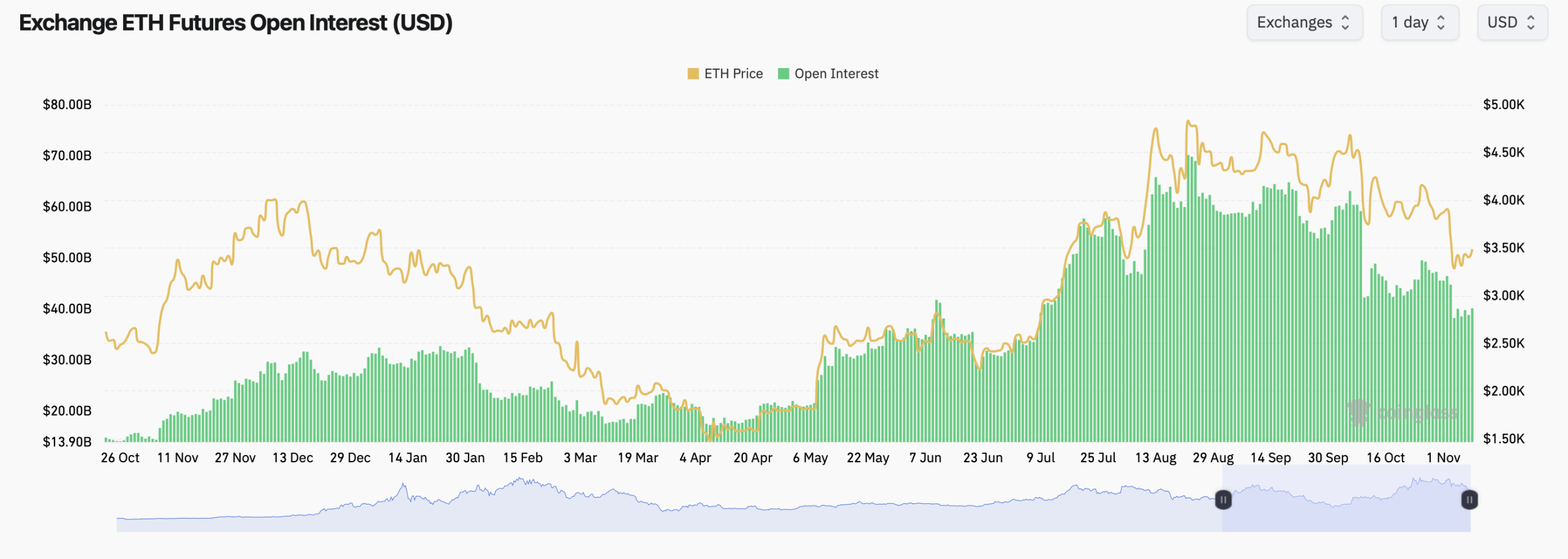

The second-largest crypto asset futures market tells a story of active participation, with total open interest in ETH futures hovering around $40.11 billion across exchanges, representing a total exposure of around 11.5 million ETH, according to Coinglass data.

Binance leads the pack with $8.15 billion in open interest, narrowly ahead of CME’s $7.57 billion, and continues to see inflows from institutional investors. OKX holds $2.35 billion, while Bybit and Gate round out the top five with $2.86 billion and $3.88 billion, respectively. Kucoin saw its open interest rise 20.2%, posting the steepest intraday increase, indicating a surge in retail activity.

Open interest across all exchanges rose 2.52% in 24 hours, with significant inflows to Binance and CME, with both exchanges posting gains of over 3%. Meanwhile, Gate rose 10.43% in daily OI, while Bigget added 8%, highlighting a combination of aggressive short-term positioning. MEXC and BingX showed outflows, decreasing by 16.5% and 20.5%, respectively.

The steady increase in open interest reflects a broader recovery in market sentiment. Over the past three months, ETH futures open interest has recovered from its late September lows and has tracked spot price movements above $3,000. The correlation between ETH price and derivatives exposure remains tight, showing how traders are leaning towards leveraged positions as volatility gradually returns.

The options market remains decidedly tilted in the bullish favor. Across major venues, calls account for 65.05% of total open interest and puts account for 34.95%. Total open interest on ETH options exceeds the 1.13 million ETH put versus the 2.1 million ETH call, suggesting traders are targeting a breakout or possible continuation above $3,500.

Daily options volume reflected a bullish trend, with calls accounting for 58.15% and puts 41.85%, for a total of 184,321 ETH in calls and 60,675 ETH in puts. This combination suggests that, at least for now, traders are leaning more toward upside exposure than hedging downside risk. At Deribit, the largest crypto options exchange, traders are piling up long-term bets that Ethereum can rise significantly above its current price.

The most popular contracts are December 2025 call options with strike prices of $6,000, $5,000, and $4,000, demonstrating confidence in future value increases. In the past 24 hours, the ETH-28NOV25-4600-C contract saw the most activity with 7,008 ETH traded, while Bybit’s ETH-27MAR26-500-P-USDT (put option) recorded a volume of 3,824 ETH. This shows that while many traders are betting on profits, some are still hedging against the decline.

Across major options exchanges such as Deribit, Binance, and OKX, the maximum pain point (the strike price at which most options become worthless) is concentrated between $3,300 and $3,600. This suggests that option sellers would benefit the most if ETH gravitates toward that range by expiration. Deribit’s curve shows a sharp rise in notional value at the $3,900-$4,200 level, indicating a bullish bias, while the Binance and OKX charts reflect lighter exposure and smoother curves around $3,400.

Bottom line: Traders expect ETH to consolidate in the mid-$3,000s in the short term, but the direction could get even tougher once the December expiry arrives.

While futures traders are steadily increasing their exposure, options desks are leaning toward optimism. The combination of high call OI and stable futures growth indicates that institutional investors and retail traders alike are betting that Ethereum’s next trade will be even higher, especially if the overall market remains liquid and Bitcoin crosses six digits.

Frequently asked questions ❓

- What is the current price of Ethereum?Ethereum is trading at $3,484 per coin as of November 9, 2025, up over 3% today.

- Which exchange has the most open interest in ETH futures?In terms of ETH open interest, Binance is at the top with $8.15 billion, followed by CME with $7.57 billion.

- What is Ethereum options market bias?Calls dominate with 65% of open interest, indicating bullish positioning.

- What is the biggest problem with ETH right now?The biggest pain is around $3,300-$3,600 on major exchanges like Deribit, Binance, and OKX.