Crypto analyst Colin raised the following possibility: bitcoin price It reflects the parabolic movement of gold. The analyst further revealed what impact this could have on BTC if it ultimately happens.

What would happen if the price of Bitcoin reflected that of gold?

in ×postColin suggested that if Bitcoin prices follow the movement of gold, it could record a further uptrend as early as next week. He expressed the opinion that, considering the following, it is unlikely that the main virtual currency will experience a major upward trend again. gold and stocks In recent months, there has been a rapid rise to the point where the stock price has reached a new all-time high (ATH).

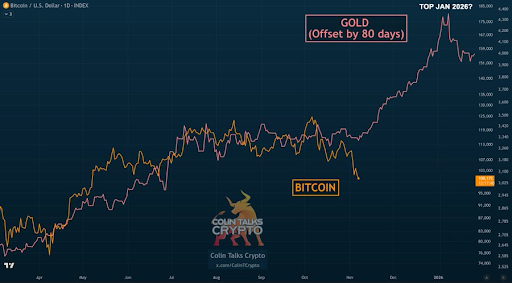

Koilin further said that funds will still go to cryptocurrencies, but there will be delays, as highlighted in the gold and Bitcoin charts. He added that he predicts a Bitcoin price peak in January 2026 if gold’s peak price is brought forward by 80 days. His attached chart showed that BTC could still rise to $175,000. that bull market It will be extended until January next year.

Colin admitted that this could be wrong for Bitcoin price, but pointed out that many other indicators point to further increases in Bitcoin price. However, he also emphasized the fact that market sentiment is becoming bearish. cryptocurrency market. The market is currently trending lower, with BTC falling below $100,000 several times this week.

This has raised concerns that Bitcoin prices are already in a state of collapse. bear market. However, Colin suggested that BTC could reach new all-time highs before this cycle ends. His predictions match those of people such as: standard charteredpredicts that BTC could reach $150,000 to $20,000 by the end of the year.

Reasons why BTC top does not enter

somewhere else ×postColin also explained why the top may not participate in the Bitcoin price in this bull market. He pointed out that the intersection of the 1150-day SMA and the previous bull market peak is the time when the next peak crests. This happened in both the 2017 and 2021 bull markets, BTC top at that time.

Now, the analyst said, this moving average is not quite in line with the initial $65,000 high. previous cycleindicating that BTC still has room to rise in this market cycle. Colin added that if this 1,150-day SMA is predicted, it will mark the highest price for Bitcoin around late December of this year or January of next year. He reiterated that all indicators collectively point to a peak around late December or January next year.

As of this writing, the price of Bitcoin has risen over the past 24 hours and is trading at around $102,400. data From CoinMarketCap.

Featured image from Pixabay, chart from Tradingview.com