Solana (SOL) outperformed Solana on key metrics amid the ongoing market meltdown. According to DeFiLlama data, Solana generated more app revenue than Solana in the past 24 hours and 30 days.

Solana tops in PP revenue

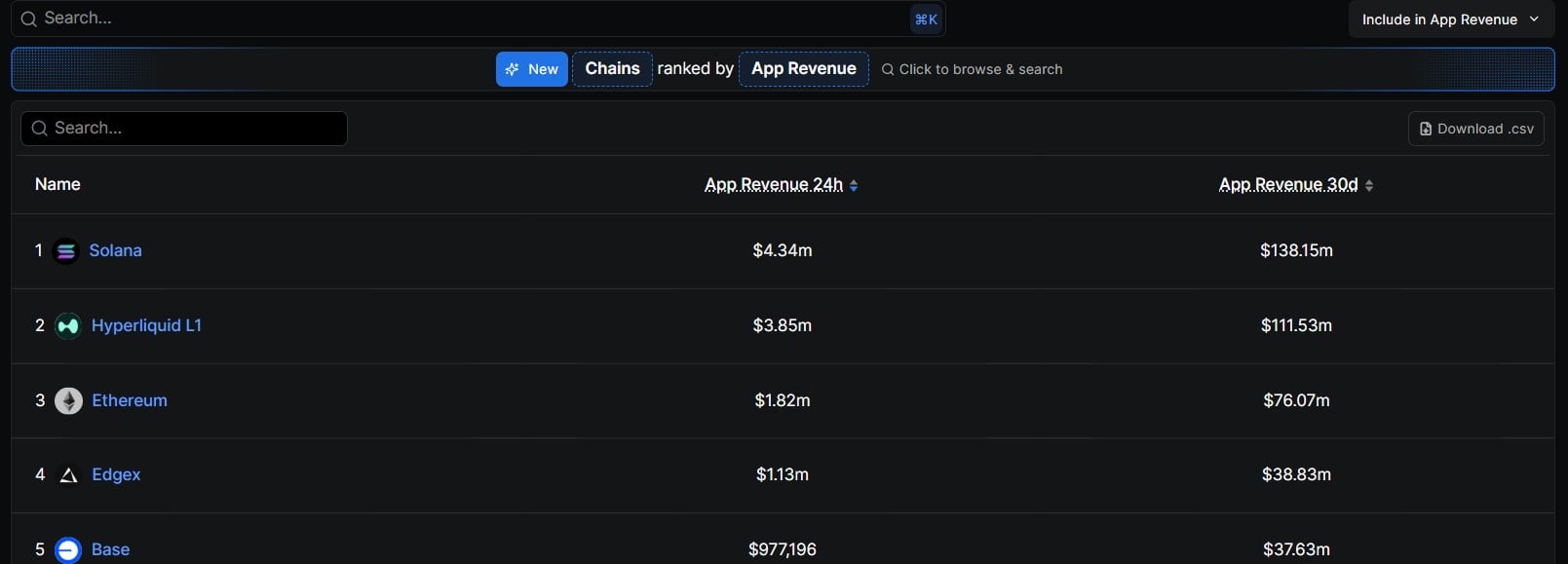

Solana has turned Ethereum on its head and become the leading blockchain with the highest app revenue. every Defilama According to the data, apps on Solana earned $4.33 million in one day, while apps on Ethereum only earned $1.82 million.

This is a big reversal that no one expected, as Ethereum has consistently been in the lead. For example, in the first quarter of 2024, Ethereum generated more app revenue Better than big public companies like Robinhood, Etsy, Yelp, Reddit, etc.

However, recent data shows that apps built on Solana have accumulated more than twice as much revenue as Ethereum. Additionally, Hyperliquid also outperformed Ethereum, recording $3.85 million in app revenue.

Ethereum surpassed blockchains such as Edgex, Coinbase’s Base, BSC, Polygon, Arbitrium, Aptos, and Avalanche in the top 10, with Edgex generating $1.13 million in app revenue, while Base collected $980,504 and BSC $767,788.

App revenue is represented as all fees across all dApps in the blockchain. This is real money paid by users and is the best evidence that people are actually using the chain.

The top Solana chains that contributed huge revenues are Pump.fun, Axiom Pro, and Jupiter.

Why is Ethereum falling behind?

The recent reversal in Solana’s app revenue Ethereum Prices plummet. In the past 24 hours, ETH price fell by 4.47% to $3,235. Major altcoins have also fallen by 15.94% and 27.7% over the past week and month, respectively.

Solana is also on a similar downward trend. SOL’s current price is $151.90, down 5.4% on the daily price chart. However, a surge in app revenue could increase optimism for the Solana network.

Revenue proves actual usage. Therefore, if the app continues to generate revenue, validators will become richer, leading to higher staking APYs and ultimately higher prices.

Overall, Solana has proven to be faster, cheaper, and more profitable than Ethereum despite falling prices.

of Solana Exchange Traded Fund (ETF) also appears to have sparked optimism within the ecosystem. SOL ETF has recorded inflows since its inception, indicating high demand from institutional investors.