Bitcoin may be on the decline right now, but a complete breakdown of the fundamentals shows Bitcoin is poised to return to $120,000. It’s just a matter of time.

According to extensive fundamental analysis shared by Mr. Wall Street on X, the stagnation and sudden decline in prices in recent months has been part of a larger accumulation phase Controlled by institutional investors. He argued that the overall situation clearly shows that Bitcoin will eventually rise above $120,000 again.

Bitcoin price range accumulated and managed by institutional investors

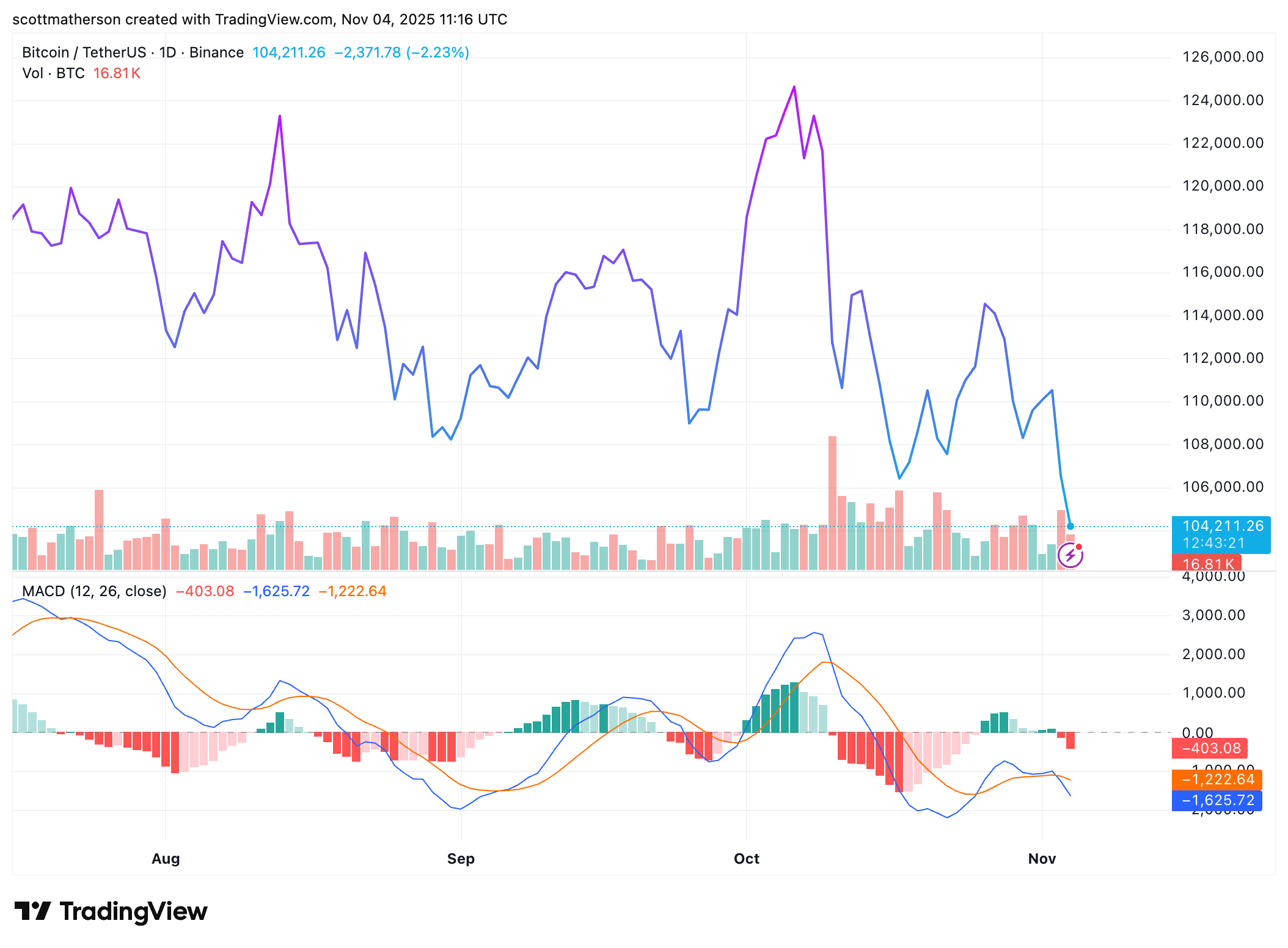

of The analyst’s first point is How Bitcoin trades within a 120-day range, fluctuating between $107,000 and $123,000 to form a controlled consolidation range by financial institutions aimed at driving out weak retail investors. Wall Street noted that despite the extended sideways movement, Bitcoin’s structure remains fundamentally bullish.

Any attempt to force the price above $120,000 or break below the $107,000 support failed, indicating that large financial institutions are actively controlling liquidity within this narrow range. All selloffs during this period, including those caused by the Binance sale and President Trump’s tariff war with China, were greeted by strong institutional bids around the $107,000 zone. When Bitcoin had a flash crash Up to $101,000.

Therefore, there are no technical or structural weaknesses that invalidate the bullish thesis. He added that the imbalance to the upside is enough to send Bitcoin trading at the high end of the value area, between $120,000 and $123,000.

Mr. Wall Street also linked Bitcoin’s upcoming surge to: change within Federal Reserve Policy. He pointed out that despite claims to end quantitative tightening, the Fed is quietly injecting billions of dollars into the banking system through repurchase operations and purchases of mortgage-backed securities. He highlighted that $50.35 billion entered the system in just one Friday.

According to him, this Liquidity will eventually find its way A pattern similar to the 2019 financial reaction that preceded the crypto bull market of 2020 and 2021 led to investments in risk assets, including Bitcoin. He warned that a fabricated crash could precede the next wave of liquidity, but this could only further strengthen Bitcoin’s long-term position and push it further to $120,000 or more.

Gold and Bitcoin in the battle over real store of value

Mr. Wall Street also called attention to the psychological aspects of the current cycle, which some have highlighted. Investors are attracted to gold. He argued that retail investors were being driven into gold by a manipulated narrative of stagflation and economic instability. Financial institutions quietly buy Bitcoin. “Ironically, the same logic that drives people to buy gold should also drive people to buy Bitcoin instead,” he said.

Gold Hype Continues is to distract the public Institutions, on the other hand, accumulate Bitcoin at discounted levels. If retail participants completely withdraw from the crypto market, there will be an upward movement that redefines Bitcoin’s price level.

As he concluded, the boring sideways phase is nearing an end, and it is only a matter of time before the next aggressive move that could take Bitcoin back above $120,000. At the time of this writing, Bitcoin is trading at $104,200.

Featured image from Pixabay, chart from Tradingview.com